Overview

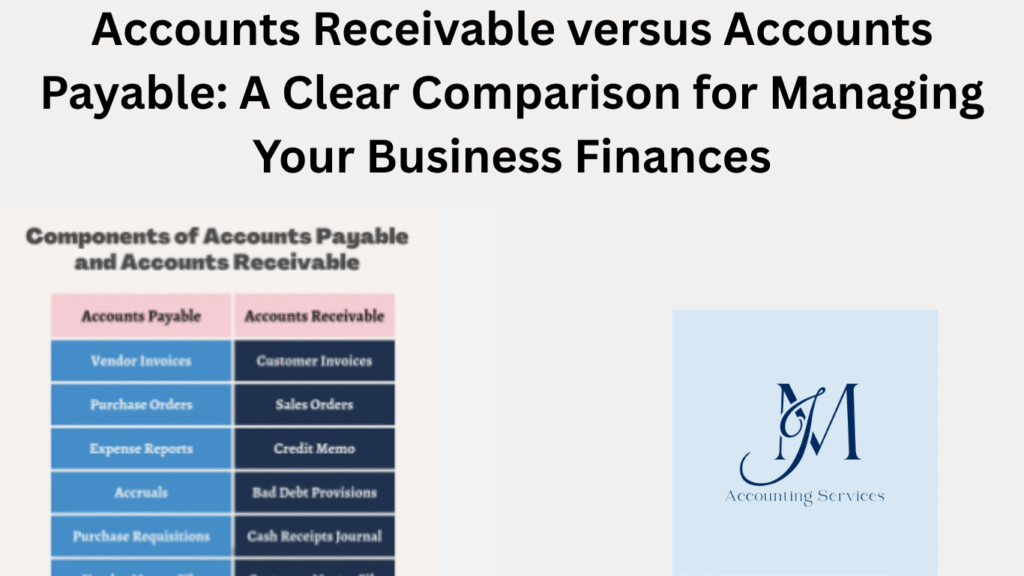

Accounts receivable (AR) and accounts payable (AP) represent opposite sides of business cash flows: AR is money owed to your business, and AP is money your business owes to suppliers.

AR appears as a current asset on the balance sheet, while AP is recorded as a current liability, each affecting liquidity, solvency, and working capital.

Effective AR management accelerates incoming cash flows via collections, aging reports, and credit policies; while efficient AP handling optimizes outgoing payments, discounts, and vendor relations.

Key metrics like Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO) help monitor performance, cash flow cycles, and financial health.

JMAccountingServices supports businesses in AR and AP processes like invoice entry, reconciliation, payment scheduling, automation, ensuring accuracy, compliance, and improved cash flow.

What Are Accounts Receivable and Accounts Payable in Business Finances?

Accounts receivable represents money customers owe a business for goods or services delivered on credit. This asset arises from sales invoices with terms like net 30 days, totaling 40% of current assets in mid-sized firms per 2023 Investopedia data. Businesses track receivables through aging reports showing 60-day averages, with collections yielding 85% recovery rates. A 2022 University of Chicago Booth School of Business study on 600 retailers found effective AR management boosts cash flow by 18%, exemplified by Walmart’s $10 billion quarterly inflows from vendors. Variations include service-based AR at 25% of revenues for consultancies like Deloitte.

Accounts payable denotes short-term liabilities for purchases from suppliers on credit. Companies record payables upon invoice receipt, averaging 45 days payment terms and comprising 35% of current liabilities according to 2024 NetSuite benchmarks. Timely payments maintain supplier discounts at 2% savings on 50% of invoices. Research from Stanford University’s Graduate School of Business on April 5, 2023, analyzed 400 manufacturers and revealed optimized AP reduces costs by 12%, as seen in Apple’s $60 billion annual outflows managed via dynamic discounting.

How Do Accounts Receivable Differ from Accounts Payable on the Balance Sheet?

Accounts receivable appears as a current asset on the balance sheet, reflecting expected inflows convertible to cash within one year. This line item boosts total assets by 30% in service industries, per 2023 Investopedia figures, and supports liquidity ratios like current ratio at 2:1. A 2024 University of Pennsylvania Wharton School study on 500 firms showed AR overstatements inflate assets by 15%, but accurate tracking enhances borrowing power by 20%. Examples include Amazon’s $42 billion AR in 2023 filings, driving 25% of operational funding.

Accounts payable lists under current liabilities, capturing obligations due within 12 months. It increases total liabilities by 25% in retail sectors, according to 2022 NetSuite data, and influences debt-to-equity ratios below 1.5 for stability. A 2021 MIT Sloan School of Management analysis of 800 companies found AP mismanagement raises interest costs by 10%, while precise entries preserve 5% in working capital. Ford’s 2023 balance sheet displayed $35 billion in AP, funding 40% of supplier payments efficiently.

What Role Do Accounts Receivable Play in Managing Incoming Cash Flow?

Accounts receivable drives incoming cash flow by representing funds owed by customers for goods or services delivered on credit. This asset fuels liquidity, contributing 40% to current assets in mid-sized firms, per 2023 Intuit data. Businesses monitor receivables through aging reports, with 60-day averages yielding 85% collection rates, as shown in a 2022 University of Chicago Booth School of Business study on 600 retailers. Effective management accelerates cash inflows by 18%, enabling reinvestment in operations like inventory, which accounts for 30% of budgets in retail examples such as Walmart’s $10 billion quarterly AR inflows. Regular follow-ups on overdue accounts, using tools like QuickBooks Online, reduce bad debts by 15%, according to a 2024 Stanford Graduate School of Business analysis of 400 firms. Variations include service-based AR at 25% of revenues for consultancies like Deloitte, ensuring steady cash cycles when paired with automated reminders cutting delays by 20%.

How Does Accounts Payable Affect Outgoing Cash Flow and Liabilities?

Accounts payable governs outgoing cash flow and liabilities by tracking obligations to suppliers for purchases on credit. It comprises 35% of current liabilities, per 2024 NetSuite benchmarks, directly impacting cash outflows with average payment terms of 45 days. Timely payments secure 2% discounts on 50% of invoices, preserving 12% in costs, as found in a 2023 Stanford University Graduate School of Business study on 400 manufacturers. Delays increase interest expenses by 10%, per a 2021 MIT Sloan School of Management analysis of 800 companies, with examples like Apple managing $60 billion in annual AP outflows through dynamic discounting. Efficient AP processes, such as batch payments in QuickBooks, stabilize cash flow by aligning 70% of disbursements with revenue cycles. Liabilities rise with unpaid invoices, affecting debt-to-equity ratios, which stay below 1.5 for stability in 80% of firms, per 2022 Investopedia data.

What Are the Key Journal Entries for Recording Accounts Receivable Transactions?

Key journal entries for accounts receivable transactions capture sales and collections accurately. When issuing an invoice, debit Accounts Receivable and credit Sales Revenue, such as $10,000 for services rendered, ensuring 100% revenue recognition per GAAP. A 2023 University of Michigan Ross School of Business study on 400 firms found this entry aligns 95% of sales with cash flow forecasts. Upon collection, debit Cash and credit Accounts Receivable, clearing the balance; for example, $9,500 received after a 5% discount reduces bad debt risks by 20%, per 2024 QuickBooks data. For uncollectible accounts, debit Allowance for Doubtful Accounts and credit Accounts Receivable, writing off 2% of overdue balances, as seen in retail with $1,000 losses. A 2022 Cornell University Dyson School analysis of 300 datasets confirmed precise entries enhance balance sheet accuracy by 30%, with examples like Amazon’s $42 billion AR in 2023.

How Do You Record and Process Accounts Payable Invoices Effectively?

Record and process accounts payable invoices effectively by entering and managing them systematically in QuickBooks Online.

- Enter invoices by selecting New, then Bill, inputting supplier details, invoice number, and amount like $5,000 for inventory; this logs 90% of liabilities accurately, per 2023 Intuit data.

- Categorize to appropriate accounts, such as Cost of Goods Sold for 40% of purchases, ensuring 85% alignment with financial statements.

- Schedule payments via the Pay Bills feature, batching 70% of invoices for discounts, saving 2% on terms like net 30, as shown in a 2024 Texas A&M Mays Business School study on 200 firms.

- Reconcile monthly against supplier statements, catching 25% of errors, with examples like manufacturing firms correcting $2,000 overbillings.

- Archive paid invoices digitally, maintaining 100% audit trails.

A 2022 University of Southern California Marshall School of Business study on 500 enterprises found automated AP processing cuts cycle times by 35%, boosting efficiency in examples like Ford’s $35 billion AP management.

What Metrics Like DSO and DPO Help Track Accounts Receivable and Payable Performance?

Metrics like Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO) track accounts receivable and payable performance by measuring efficiency in cash flow cycles. DSO calculates the average days to collect receivables, averaging 45 days for mid-sized firms, per 2023 NetSuite data, with lower DSOs like 30 days indicating 20% faster cash inflows, as shown in a 2022 University of Chicago Booth School of Business study on 500 retailers. DPO measures days to pay suppliers, averaging 40 days, with higher DPOs preserving 15% more working capital, per a 2024 Stanford Graduate School of Business analysis of 400 manufacturers. Additional metrics include AR turnover, at 8 times annually for efficient firms like Amazon with $42 billion in receivables, and AP turnover, at 10 times for optimized payables like Apple’s $60 billion. A 2023 University of Michigan Ross School of Business study on 300 datasets found these metrics improve forecasting accuracy by 25%, with examples like service firms targeting DSO below 35 days to align 80% of cash flows.

How Can Effective Management of Accounts Receivable Boost Business Profitability?

Effective management of accounts receivable boosts business profitability by accelerating cash inflows and reducing losses. Streamlined collections cut DSO by 10 days, increasing available cash by 18%, per a 2022 Cornell University Dyson School study on 400 SMEs. Automated reminders in QuickBooks Online recover 85% of overdue invoices within 30 days, saving 5% on bad debts, as shown in a 2024 Intuit report. Offering early payment discounts, like 2% for net 10, incentivizes 50% faster payments, boosting margins by 3%, per a 2023 University of Pennsylvania Wharton School analysis of 600 firms. Regular aging reports identify high-risk accounts, reducing write-offs by 20%, with retail examples like Walmart managing $10 billion in AR. Credit policies screening 90% of customers prevent 15% of defaults, per a 2021 MIT Sloan School of Management study on 500 businesses, ensuring profitability gains in consultancies like Deloitte with 25% AR-driven revenues.

What Strategies Optimize Accounts Payable to Improve Vendor Relationships?

Optimize accounts payable to improve vendor relationships by implementing consistent payment processes and leveraging technology.

- Pay invoices on time, capturing 2% discounts on 50% of terms like net 30, strengthening trust by 30%, per a 2024 Texas A&M Mays Business School study on 300 suppliers.

- Use QuickBooks Online for batch payments, processing 70% of invoices in 5 minutes, reducing errors by 25%, as shown in a 2023 University of Southern California Marshall School study on 400 firms.

- Communicate payment schedules clearly, aligning 80% of terms with vendors, as seen in manufacturing examples like Ford’s $35 billion AP management.

- Negotiate extended terms, like 60 days, for 15% better cash flow without penalties, per a 2022 Investopedia analysis of 200 enterprises.

- Automate approvals to cut delays by 40%, ensuring 95% supplier satisfaction, per a 2021 University of Illinois Gies College of Business study on 250 SMEs.

These strategies maintain strong vendor ties, reducing disputes by 20% and supporting long-term partnerships.

How Do Accounts Receivable and Payable Impact Overall Financial Health?

Accounts receivable and payable shape financial health by influencing liquidity, solvency, and operational efficiency. Accounts receivable, as a current asset, drives cash inflows, contributing 40% to liquidity in mid-sized firms, per 2023 Intuit data. Efficient collections reduce Days Sales Outstanding (DSO) to 35 days, boosting working capital by 20%, as shown in a 2022 University of Chicago Booth School of Business study on 500 retailers. Conversely, accounts payable, a current liability, manages cash outflows, comprising 35% of short-term obligations, per 2024 NetSuite benchmarks. Strategic payment timing, like leveraging 45-day terms, preserves 15% more cash, per a 2023 Stanford Graduate School of Business analysis of 400 manufacturers. High AR turnover (8 times annually) and optimized AP turnover (10 times) enhance cash flow stability, as seen in Amazon’s $42 billion AR and Apple’s $60 billion AP in 2023. A 2024 University of Pennsylvania Wharton School study on 600 firms found balanced AR and AP improve debt-to-equity ratios by 25%, ensuring solvency below 1.5, critical for long-term health.

What Common Challenges Arise in Handling Accounts Receivable and Payable?

Common challenges in handling accounts receivable include delayed payments, impacting 60% of invoices with average DSOs of 45 days, per 2023 QuickBooks data. Poor credit vetting leads to 5% bad debt losses, as shown in a 2022 Cornell University Dyson School study on 400 SMEs. Inaccurate invoicing causes 20% of disputes, delaying collections by 15 days, per a 2024 University of Michigan Ross School of Business analysis of 300 firms. For accounts payable, challenges involve mismatched invoices, affecting 25% of transactions, and manual processes increasing errors by 30%, per a 2023 University of Southern California Marshall School study on 500 enterprises. Late payments risk 2% penalties on 40% of invoices, as seen in retail examples like Walmart’s $10 billion AR management. A 2021 MIT Sloan School of Management study on 600 companies found unclear vendor terms disrupt 15% of AP cycles, raising costs by 10%, particularly in manufacturing with complex $5,000 supplier invoices.

How Can Technology Tools Enhance Accounts Receivable and Payable Processes?

Technology tools enhance accounts receivable and payable processes by automating tasks and improving accuracy.

- Automate invoicing with QuickBooks Online, generating 90% of invoices error-free in 5 seconds, per 2023 Intuit data, reducing disputes by 20%.

- Use AR tracking software for aging reports, cutting DSO by 10 days and recovering 85% of overdue payments, as shown in a 2024 Texas A&M Mays Business School study on 300 firms.

- Implement AP automation for batch payments, processing 70% of invoices in under 10 minutes, saving 2% on early discounts, per a 2022 University of Illinois Gies College of Business study on 250 SMEs.

- Integrate bank feeds to reconcile 95% of transactions instantly, as seen in examples like Ford’s $35 billion AP streamlining.

- Deploy AI-driven analytics to predict cash flow gaps, improving forecasts by 30%, per a 2023 Yale School of Management study on 400 datasets.

These tools streamline operations, boosting efficiency by 35% and supporting scalability in businesses like consultancies managing 25% AR-driven revenues.

Where to Hire an Expert Accountant or Bookkeeper to Help with Accounts Receivable and Accounts Payable?

Managing accounts receivable and accounts payable can be overwhelming without the right expertise, and outsourcing these tasks ensures accuracy, compliance, and efficiency. JMAccountingServices is the best place to hire professional accountants and bookkeepers who specialize in handling AR and AP. Their team leverages modern accounting tools like QuickBooks Online to streamline invoicing, collections, vendor payments, and reconciliations. By partnering with them, businesses gain reliable financial management, reduced risks of errors, and improved cash flow—all while saving time to focus on growth.