Overview

- Manual accounts-receivable (AR) workflows (invoicing, collections, reconciliations) incur high labour-costs, error-correction burdens and extended payment cycles, which impact cash flow and profitability.

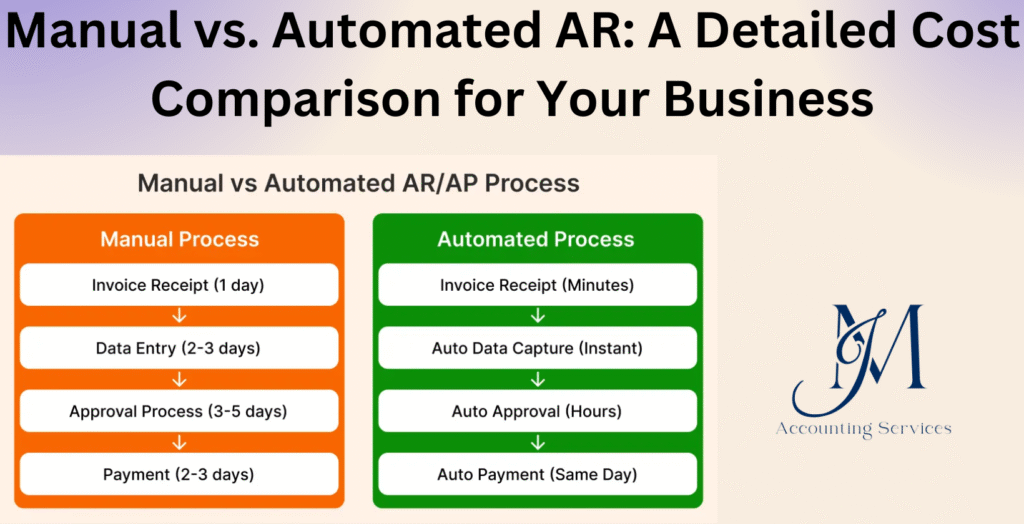

- Automating AR tasks (invoice delivery, payment tracking, reminders, matching documentation) significantly reduces processing time, error rates and days-sales-outstanding (DSO).

- Though automation involves upfront investment (software licenses, integration, training), the ROI is typically achieved within 12–18 months thanks to lower labour overhead and faster collections.

- Automated AR systems scale more efficiently than manual ones, meaning as invoice volumes grow the cost rise is far smaller compared to manual processes.

- JM Accounting Services supports small businesses and solopreneurs in selecting and implementing AR-automation tools, helping streamline their receivables, improve liquidity and maintain compliance.

Manual vs. Automated AR: A Detailed Cost Comparison for Your Business

The decision between manual and automated accounts receivable (AR) processes carries significant cost implications for businesses. Manual AR requires more staff hours, relies heavily on paperwork or spreadsheets, and exposes companies to higher error rates, which increases hidden costs. Automated AR, on the other hand, leverages digital systems to streamline invoicing, collections, and reconciliation, reducing both direct and indirect costs. Industry research, such as reports published by the CPA Journal and QuickBooks surveys, shows that companies shifting to automation reduce AR-related expenses by up to 30% while accelerating cash flow cycles.

What Are the Key Cost Components of Manual Accounts Receivable Processes?

The key cost components of manual accounts receivable processes are labor, error correction, delayed payments, compliance risks, and technology maintenance. Labor is often the largest expense, as staff must manually create invoices, track outstanding payments, and reconcile accounts. For example, a midsized business with 1,000 invoices per month may require multiple full-time employees dedicated solely to AR tasks. Error correction adds another layer of cost, with the Association of Certified Fraud Examiners reporting that manual data entry errors contribute to nearly 25% of financial inaccuracies in small businesses. Delayed payments cost businesses both time and money, as slow collections extend days sales outstanding (DSO), which research from Atradius indicates is a major factor in liquidity issues for nearly 40% of firms worldwide. Compliance risks appear when manual processes fail to meet audit standards, potentially leading to penalties. Technology costs arise when businesses continue to rely on outdated spreadsheets or legacy systems that require continuous updates. Many companies, such as retail chains and manufacturing firms, often overlook these cumulative costs, which makes manual AR far more expensive than initially expected.

How Do Labor Expenses Impact the Total Cost of Manual AR Management?

The way labor expenses impact the total cost of manual AR management is by significantly increasing overhead through direct staffing costs, training, and productivity loss. Yes, labor expenses are the primary driver of higher manual AR costs. A study by Deloitte highlights that manual AR functions consume up to 60% of the total AR budget in traditional firms. Staff not only spend time on invoice creation and follow-up calls but also on resolving disputes that arise from data mismatches. Each of these tasks consumes hours that could otherwise be dedicated to revenue-generating functions. For example, service-based companies, such as consulting agencies and healthcare providers, often maintain entire teams focused solely on collections and reconciliations. Training new employees adds further cost, as they must learn company-specific AR processes, which vary widely across industries. Productivity loss compounds the issue because manual AR is prone to inefficiencies that automation avoids. When businesses allocate too many resources to manual AR, they experience reduced scalability, meaning costs rise disproportionately as the volume of invoices increases. Skilled professionals can be found through JMAccountingServices to help businesses transition to efficient AR solutions, thereby reducing long-term labor expenses and improving financial outcomes.

What Hidden Operational Costs Arise from Manual AR Inefficiencies?

The hidden operational costs that arise from manual AR inefficiencies are extended payment cycles, higher dispute management costs, and increased customer relationship strain. Studies from the Hackett Group indicate that businesses with manual AR workflows experience an average of 20% longer payment cycles compared to those with automation. This delay ties up working capital, forcing companies to rely on credit lines or reserves to maintain operations. Dispute management costs increase because manual systems are more prone to mismatched data or missing documentation, requiring extra staff time to resolve issues. Customer relationships suffer when clients receive incorrect invoices or delayed statements, as this undermines trust and may lead to lost accounts. Many businesses, such as wholesalers and logistics providers, face recurring reputational damage and reduced repeat business due to these inefficiencies. Over time, these hidden costs erode profitability far more than the visible expenses associated with manual labor.

How Does Error Correction in Manual AR Affect Your Bottom Line?

The way error correction in manual AR affects your bottom line is by increasing operational costs, delaying revenue recognition, and creating compliance risks. Yes, error correction is a major contributor to financial losses in manual AR. Research from the Institute of Finance & Management (IOFM) shows that manual entry errors occur in 1–3% of invoices, which forces companies to spend additional staff hours on rework. Revenue recognition is delayed because disputes caused by inaccuracies extend the time it takes to collect payments. For example, an e-commerce company processing thousands of monthly invoices can lose tens of thousands annually in delayed collections due to preventable mistakes. Compliance risks emerge when errors lead to reporting inaccuracies, which may trigger audit penalties or damage investor confidence. When error correction becomes a recurring process, businesses not only face direct labor expenses but also indirect losses from strained cash flow and damaged client relationships.

What Are the Upfront and Ongoing Costs of Implementing AR Automation?

The upfront and ongoing costs of implementing AR automation are software licensing fees, integration expenses, staff training, and system maintenance. The upfront investment includes acquiring the automation platform, which for midsized companies can range between $20,000 and $50,000 depending on invoice volume. Integration expenses arise when connecting the software with existing ERP or accounting systems, which may require IT specialists or consultants. Training costs are incurred to ensure staff understand how to use the platform effectively, but these costs are temporary and typically lower than the recurring training needed for manual teams. The ongoing costs include subscription renewals, technical support, and system upgrades, which usually represent 10–20% of the initial investment annually. However, reports from Gartner indicate that businesses recover these costs within 12 to 18 months due to reduced DSO and lower labor expenses. Many organizations, such as financial services firms and B2B suppliers, report long-term cost savings and scalability benefits that outweigh the initial investment.

How Can Automation Reduce Labor and Processing Expenses in AR?

The way automation can reduce labor and processing expenses in AR is by minimizing manual intervention, standardizing workflows, and accelerating invoice delivery. Yes, automation significantly lowers labor and processing expenses. According to a 2024 QuickBooks survey, companies using AR automation reduce invoice processing costs by up to 60%. Manual tasks such as data entry, invoice distribution, and payment reminders are handled by the system, reducing the need for large AR teams. Standardized workflows reduce time spent on dispute resolution, as invoices are automatically matched with purchase orders and payment histories. Automation accelerates invoice delivery, often enabling same-day issuance compared to multi-day delays with manual processes. This speed translates into faster collections and reduced DSO, which strengthens liquidity. Many industries, including manufacturing and healthcare, demonstrate that automation allows AR teams to scale without proportional increases in staff, directly cutting payroll and overhead costs. Businesses can engage skilled professionals through JMAccountingServices to streamline their AR automation journey, ensuring both immediate and sustained cost efficiency.

What Savings Can Businesses Expect from Automating Invoice Handling?

The savings businesses can expect from automating invoice handling are reduced processing costs, fewer late payments, and lower overhead from smaller AR teams. Yes, automation delivers substantial cost reductions. Research from the American Productivity & Quality Center (APQC) shows that automated invoice processing costs can be as low as $2.36 per invoice, compared to $15–$30 for manual handling. Savings extend to reduced postage and printing expenses, since electronic invoicing eliminates the need for paper. Late payments decrease because automation includes reminders and real-time tracking, helping companies capture revenue faster. For example, many mid-market companies, such as SaaS providers and wholesale distributors, report annual savings in the range of 25–40% of their prior AR expenses after switching to automation. Overhead declines as AR teams can be smaller, yet more effective, because technology manages bulk processes more efficiently than staff-driven manual methods.

How Does AR Automation Improve Cash Flow to Boost Financial Returns?

The way AR automation improves cash flow to boost financial returns is by shortening collection cycles, reducing DSO, and increasing payment predictability. Yes, automation has a direct positive effect on cash flow. A 2023 IOFM study found that companies using automated AR reduced their DSO by an average of 18%, which means cash enters the business sooner. Predictability improves because real-time dashboards provide visibility into outstanding invoices, helping finance teams forecast inflows with greater accuracy. For instance, healthcare organizations and retail groups adopting automation often report that collections occur 7–10 days faster than before. Faster collections translate into improved liquidity, allowing businesses to reinvest in operations or reduce reliance on credit lines. This improved financial return strengthens both profitability and long-term sustainability, as businesses can allocate freed-up cash to growth activities instead of covering delayed receivables.

What Is the Typical ROI Timeline for AR Automation Investments?

The typical ROI timeline for AR automation investments is 12 to 18 months, depending on the business size, invoice volume, and industry. Yes, most businesses achieve measurable returns within this period. According to Deloitte’s finance transformation reports, small businesses with fewer than 500 invoices monthly may achieve ROI within 12 months due to immediate reductions in staff time. Larger organizations with complex ERP systems may require up to 18 months because of higher upfront integration costs, but they recover these through scale efficiencies. For example, manufacturing firms processing thousands of invoices each month often report ROI within one year, as automation quickly reduces errors and accelerates cash inflows. SaaS providers and professional service companies frequently experience even faster returns when automation integrates directly with their billing systems. Long-term benefits continue to accumulate, as businesses save on staffing, eliminate inefficiencies, and strengthen financial predictability beyond the initial payback window. Skilled professionals available through JMAccountingServices can help businesses tailor AR automation to achieve a faster ROI while ensuring accurate implementation.

How Do Scalability Costs Differ Between Manual and Automated AR?

The way scalability costs differ between manual and automated AR is that manual processes increase costs linearly with invoice volume, while automation enables growth with minimal additional expense. Yes, manual AR becomes more expensive as businesses expand because each increase in invoice volume requires more staff, training, and office resources. For example, a retail chain processing 5,000 invoices monthly may need to double its AR team once that number reaches 10,000, leading to significantly higher payroll and overhead. Automated AR, by contrast, processes large volumes without proportional increases in labor. A Deloitte survey found that companies using automated AR solutions managed 40% higher invoice volumes without adding staff. This scalability advantage allows growing businesses, such as e-commerce platforms and manufacturing firms, to support expansion while keeping AR costs stable.

What Metrics Should You Track to Measure Cost Savings in AR?

The metrics you should track to measure cost savings in AR are days sales outstanding (DSO), invoice processing cost per unit, dispute resolution time, and collection effectiveness index (CEI). Yes, these metrics provide the clearest picture of AR efficiency. DSO measures how quickly a company converts credit sales into cash, with shorter periods signaling improved liquidity. Invoice processing cost per unit shows the direct expense of handling each invoice, which automation reduces dramatically. Dispute resolution time highlights how long staff spend addressing invoice errors, which often shrinks by 50% after adopting automation. CEI tracks how effective AR teams are in collecting outstanding receivables and typically improves with automated reminders and better customer communication. For example, mid-market service providers and healthcare groups that switched to automated AR consistently report 20–30% reductions in DSO and a 25% improvement in CEI. Tracking these metrics allows businesses to link automation directly to measurable financial outcomes.

When Does AR Automation Provide the Best Financial Value for Your Business?

The time when AR automation provides the best financial value for your business is when invoice volume, error rates, or collection delays exceed what manual teams can handle efficiently. Yes, automation delivers the highest returns under these conditions. A study published in the CPA Journal found that businesses processing more than 1,000 invoices monthly see faster ROI compared to those with lower volumes. Companies with high dispute rates benefit because automation reduces mismatches and accelerates error resolution. Businesses facing cash flow strain gain financial value from automation by shortening DSO and improving predictability. For example, fast-growing startups and established B2B suppliers both report that automation becomes critical once expansion outpaces the ability of manual staff to scale. By adopting automation during these growth or inefficiency pressure points, companies maximize cost savings, improve liquidity, and secure long-term financial sustainability.

Where to Hire an Expert Accountant or Bookkeeper to Help with Accounts Receivable Management

Finding the right professional support can make the transition from manual to automated AR seamless and cost-effective. JMAccountingServices stands out as the best platform to hire expert accountants and bookkeepers who specialize in AR automation and financial process optimization. Their team helps businesses set up efficient automation systems, streamline invoice management, and maintain compliance with accounting standards. Whether your goal is to cut costs, accelerate collections, or ensure accuracy, JMAccountingServices connects you with trusted professionals who deliver measurable results.