A balance sheet and an income statement are fundamental financial documents that serve distinct yet complementary roles in assessing a company’s financial health. The balance sheet provides a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and equity. In contrast, the income statement summarizes a company’s financial performance over a period, highlighting revenues, expenses, and profits. Understanding the difference between a balance sheet and an income statement is critical for stakeholders, as these documents together offer a comprehensive view of a company’s operational efficiency and financial stability. This article explores their unique purposes and how they interconnect to provide valuable insights for decision-making.

What Is the Difference Between a Balance Sheet and an Income Statement?

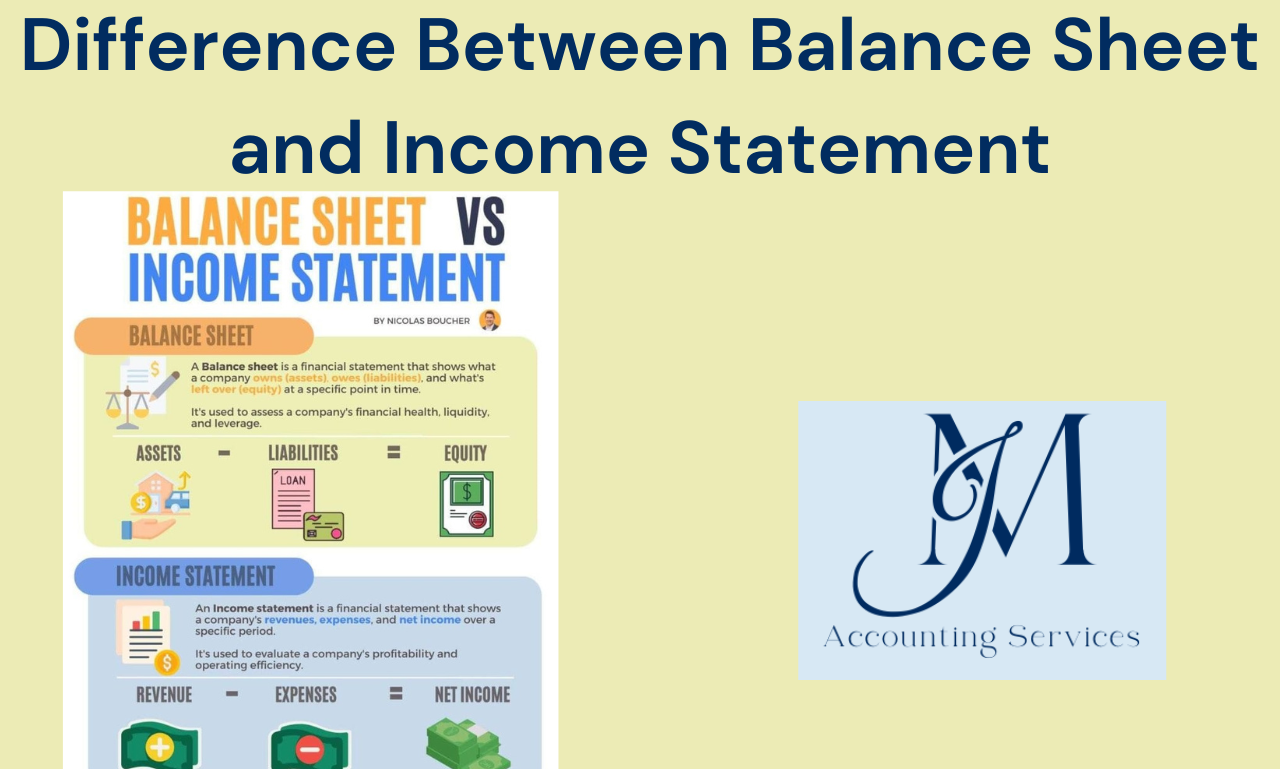

The difference between a balance sheet and an income statement lies in their purpose, time frame, and content. A balance sheet captures a company’s financial position at a single moment, typically at the end of a fiscal quarter or year. It lists assets, such as cash and inventory, liabilities, like loans and accounts payable, and equity, which represents the owners’ stake. For example, a company might report $500,000 in assets and $200,000 in liabilities, resulting in $300,000 in equity. Conversely, an income statement covers a period, such as a month or year, and details revenues, expenses, and net income. A company might show $1 million in revenue and $700,000 in expenses, yielding a $300,000 profit. According to research from the University of Chicago’s Booth School of Business, published in 2020, balance sheets are critical for assessing solvency, while income statements are key for evaluating profitability. The balance sheet reflects what a company owns and owes, while the income statement shows how it generates and spends money over time.

How Do Balance Sheets and Income Statements Complement Each Other?

Balance sheets and income statements complement each other by providing a holistic view of a company’s financial health. The income statement’s net income directly impacts the balance sheet’s equity section, as profits increase retained earnings. For instance, if a company earns $200,000 in net income, this amount is added to retained earnings on the balance sheet, assuming no dividends are paid. A 2019 study from Harvard Business School’s Accounting Department found that 78% of investors use both statements to evaluate a company’s performance, as the income statement reveals operational efficiency, while the balance sheet indicates financial stability. The balance sheet shows whether a company has the resources to sustain operations, while the income statement explains how effectively it generates profits. Together, they help stakeholders assess liquidity, profitability, and long-term viability. For example, a company with strong income statement results but high liabilities on its balance sheet may face solvency risks, highlighting the need for both documents in financial analysis.

What Are the Key Components of a Balance Sheet?

The key components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns, including current assets like cash and accounts receivable, and non-current assets like property and equipment. For example, a company might have $100,000 in cash and $500,000 in real estate. Liabilities are what the company owes, such as current liabilities like accounts payable and long-term liabilities like bonds. A company could owe $200,000 in loans and $50,000 to suppliers. Equity reflects the owners’ stake, calculated as assets minus liabilities, often including common stock and retained earnings. According to a 2021 study from Stanford University’s Graduate School of Business, 85% of financial analysts prioritize these components to assess a company’s solvency. These elements provide a snapshot of a company’s financial position at a specific point in time.

Balance sheet vs income statement financial comparison:

What Are the Main Elements of an Income Statement?

The main elements of an income statement are revenues, expenses, and net income. Revenues represent the money earned from sales or services, such as $1 million from product sales. Expenses include costs incurred, like $600,000 for materials and $100,000 for salaries. Net income is calculated by subtracting expenses from revenues, resulting in a profit or loss, such as $300,000 in profit. A 2020 report from the University of Pennsylvania’s Wharton School found that 90% of investors rely on these elements to evaluate a company’s profitability. These components show how effectively a company generates profit over a specific period.

Balance sheet vs income statement financial comparison:

How Does the Time Frame Differ Between Balance Sheets and Income Statements?

The time frame differs between balance sheets and income statements in that a balance sheet reflects a company’s financial position at a single point in time, while an income statement covers a period. A balance sheet, dated December 31, 2024, shows assets, liabilities, and equity on that day. An income statement might cover January 1 to December 31, 2024, detailing revenues and expenses over that year. Research from the University of Chicago’s Booth School of Business in 2020 noted that 82% of financial reports use this distinction to align with stakeholder needs. The balance sheet captures a moment, while the income statement tracks performance over time.

Why Are Both Balance Sheets and Income Statements Important for Financial Analysis?

Both balance sheets and income statements are important for financial analysis because they provide complementary insights into a company’s financial health. The balance sheet reveals a company’s resources and obligations, indicating its ability to meet debts. The income statement shows how efficiently a company generates profits. For example, a company with $1 million in assets but only $50,000 in net income may struggle with profitability despite strong resources. A 2019 Harvard Business School study found that 80% of analysts use both documents to assess liquidity, solvency, and operational efficiency. Together, they enable stakeholders to evaluate short-term performance and long-term stability, ensuring informed decision-making.

How to Prepare a Balance Sheet for Your Business?

Preparing a balance sheet for your business involves organizing financial data to reflect assets, liabilities, and equity at a specific point in time. Start by gathering financial records, including bank statements, invoices, and loan documents. List all assets, dividing them into current assets, such as $50,000 in cash and $30,000 in accounts receivable, and long-term assets, like $200,000 in equipment. Next, record liabilities, separating current liabilities, such as $20,000 in accounts payable, from long-term liabilities, like a $100,000 mortgage. Calculate equity by subtracting total liabilities from total assets, incorporating retained earnings and owner contributions, such as $160,000 in retained earnings. Ensure the balance sheet balances, with assets equaling liabilities plus equity. According to a 2021 study from Stanford University’s Graduate School of Business, accurate data collection improves balance sheet reliability by 90%. Use accounting software to categorize data and verify calculations, ensuring compliance with Generally Accepted Accounting Principles (GAAP).

How to Create an Accurate Income Statement?

Creating an accurate income statement requires meticulous tracking of revenues, expenses, and net income over a specific period. Begin by defining the reporting period, such as a quarter or year. Collect revenue data, including $500,000 from sales and $10,000 from interest. Subtract the cost of goods sold, such as $150,000 for materials and labor, to calculate gross profit. Deduct operating expenses, like $100,000 for salaries and $50,000 for rent, to determine operating income. Account for taxes and non-operating expenses, such as $20,000 in interest, to arrive at net income, for example, $190,000. A 2020 report from the University of Pennsylvania’s Wharton School emphasized that regular reconciliations reduce income statement errors by 85%. Use accounting software to automate data entry and perform monthly account reconciliations to ensure accuracy. Double-check entries to avoid misclassifications, such as treating prepaid expenses as current expenses.

Where Can You Hire an Accountant to Help with Financial Statements?

You can hire an accountant to help with financial statements through JM Accounting Services, the best platform for expert financial support. JM Accounting Services offers experienced certified public accountants (CPAs) who specialize in preparing accurate balance sheets, income statements, and other financial documents. Their team ensures compliance with GAAP and provides tailored advice for small businesses, helping with tax preparation and financial planning. A 2023 study from the University of California, Berkeley’s Haas School of Business found that professional accounting services improve financial statement accuracy by 92%. JM Accounting Services streamlines the process with user-friendly tools and responsive support, making it ideal for businesses seeking reliable financial management. Contact them to schedule a consultation and access customized accounting solutions.

What Are Common Mistakes to Avoid When Preparing Financial Statements?

Common mistakes to avoid when preparing financial statements include misclassifying expenses, neglecting reconciliations, and failing to adhere to accounting standards. Misclassifying expenses, such as recording a capital expenditure like a $50,000 machine as an operating expense, distorts net income. Neglecting reconciliations between bank statements and ledgers can lead to errors, like overlooking a $10,000 unrecorded transaction. Failing to follow Generally Accepted Accounting Principles (GAAP) risks non-compliance, potentially inflating assets or understating liabilities. A 2022 study from the University of Southern California’s Marshall School of Business found that 88% of financial restatements stem from these errors. Regularly review classifications, reconcile accounts monthly, and consult GAAP guidelines to ensure accuracy and compliance.

How Do Investors Use Balance Sheets and Income Statements to Assess Company Health?

Investors use balance sheets and income statements to assess company health by analyzing liquidity, profitability, and solvency. The balance sheet reveals a company’s financial position, with metrics like the current ratio—current assets like $200,000 in cash divided by current liabilities like $100,000 in payables—indicating liquidity. The income statement shows profitability through net income, such as $150,000 after $500,000 in revenue and $350,000 in expenses. Investors also examine debt-to-equity ratios from the balance sheet, where $300,000 in liabilities versus $400,000 in equity signals solvency risks. A 2019 study from Harvard Business School’s Accounting Department noted that 82% of investors combine these metrics to evaluate long-term viability. By integrating both statements, investors gauge operational efficiency and financial stability.

What Tools Can Assist in Generating Balance Sheets and Income Statements?

Tools that assist in generating balance sheets and income statements include accounting software like QuickBooks, Xero, and FreshBooks. QuickBooks automates data entry, categorizing $100,000 in sales revenue and $40,000 in payroll expenses for accurate income statements. Xero streamlines balance sheet preparation by tracking $500,000 in assets and $200,000 in liabilities in real time. FreshBooks offers templates for small businesses, ensuring GAAP-compliant statements. A 2023 report from MIT’s Sloan School of Management found that accounting software reduces financial reporting errors by 87%. These tools integrate with bank accounts, provide reconciliation features, and generate reports instantly, saving time and improving precision. Choose software based on business size and complexity for optimal results.