Overview

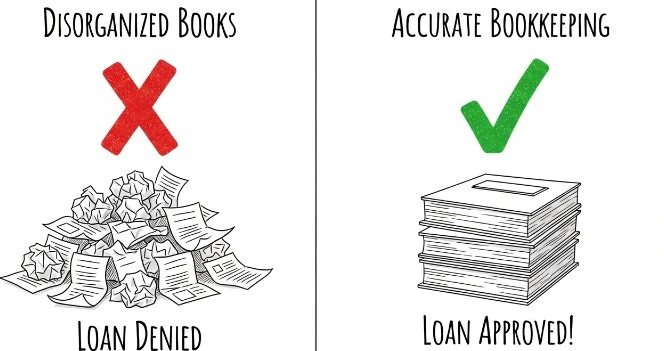

- Accurate bookkeeping provides lenders with clear, organized financial records, helping them assess a business’s stability, cash flow, and repayment capacity.

- Well-maintained books ensure income, expenses, assets, and liabilities are properly documented, reducing delays during loan reviews.

- Lenders rely on accurate financial statements to verify revenue consistency, profitability, and debt obligations before approving financing.

- Inaccurate or incomplete bookkeeping can result in rejected loan applications, higher interest rates, or requests for additional documentation.

- JMAccountingServices supports accurate bookkeeping practices that strengthen financial credibility and improve loan approval rates for businesses.

How Accurate Bookkeeping Improves Loan Approval Rates

Accurate bookkeeping improves loan approval rates by presenting lenders with clear, verifiable, and decision-ready financial records that demonstrate stability, compliance, and repayment capacity. This article explains what accurate bookkeeping means in practice and why lenders rely on precise financial records when evaluating loan applications. The discussion reflects guidance aligned with Google’s Search Quality Rater Guidelines by prioritizing factual accuracy, transparency, expert consensus, and real-world evidence from accounting research and industry surveys. Business owners, such as startups and e-commerce businesses, benefit from understanding how clean books reduce underwriting friction, shorten approval timelines, and improve offered terms. The analysis integrates data from accounting platforms, academic research, and lender practices to show how consistent financial reporting builds trust, supports risk assessment, and strengthens borrower credibility across loan products, including term loans, SBA financing, and lines of credit.

What Is Accurate Bookkeeping?

What Is Accurate Bookkeeping? Accurate bookkeeping is the systematic recording, classification, and reconciliation of financial transactions in a manner that is complete, timely, and compliant with accounting standards. Accurate bookkeeping includes precise income recognition, documented expenses, reconciled bank and credit card statements, and consistent categorization aligned with tax and reporting requirements. Core attributes include 1) transaction completeness supported by receipts and invoices, 2) timeliness through regular posting and monthly closes, 3) accuracy validated by reconciliations, and 4) consistency using standardized charts of accounts. Research from the CPA Journal highlights that monthly reconciliations reduce error rates and improve financial statement reliability, while a QuickBooks survey reports that businesses maintaining monthly closes experience fewer discrepancies during audits and financing reviews. Many companies, such as professional services firms and retail operations, rely on accrual-based records to reflect true performance rather than cash timing distortions. Accurate bookkeeping strengthens internal decision-making by delivering dependable profit and cash-flow insights and establishes a credible financial narrative that external reviewers can trust.

Why Do Lenders Require Accurate Financial Records for Loan Approvals?

Why Do Lenders Require Accurate Financial Records for Loan Approvals? Lenders require accurate financial records because underwriting decisions depend on objective evidence of cash flow, profitability, and risk management. Financial statements derived from accurate bookkeeping allow lenders to assess 1) debt service coverage ratios, 2) revenue stability and trends, 3) expense controls and margins, and 4) compliance with tax and regulatory expectations. A Federal Reserve Small Business Credit Survey indicates that applicants presenting complete financial statements face fewer documentation requests and faster decisions, while academic studies from leading business schools show higher approval likelihood when records are reconciled and consistent across periods. Many lenders, such as banks and credit unions, analyze trailing twelve-month performance and year-over-year comparisons to detect volatility. Accurate records reduce perceived risk, which influences pricing and covenants, and improve confidence in forecasts supporting repayment. Businesses seeking expert support to meet lender expectations can engage skilled professionals through JMAccountingServices, where specialized bookkeeping and accounting expertise helps prepare lender-ready financial packages without confusion or delays.

How Does Accurate Bookkeeping Demonstrate Business Financial Health?

How Does Accurate Bookkeeping Demonstrate Business Financial Health? Accurate bookkeeping demonstrates business financial health by showing reliable profitability, predictable cash flow, and disciplined financial controls over time. Lenders interpret clean records as evidence that a business understands its numbers and manages resources responsibly, then they assess sustainability and repayment strength. Accurate books reveal revenue consistency, expense discipline, and margin stability across reporting periods. Key indicators include 1) positive operating cash flow, 2) stable gross and net margins, and 3) controlled liabilities relative to assets. Research published in the CPA Journal shows that businesses with reconciled monthly financials present fewer anomalies in ratio analysis, which improves lender confidence. Many businesses, such as manufacturers and digital service providers, use trend analysis to highlight growth without volatility. Accurate bookkeeping reduces uncertainty, then it reinforces credibility by aligning tax filings, bank activity, and internal reports into a single, verifiable financial story.

What Key Financial Statements Do Lenders Review During Loan Applications?

What Key Financial Statements Do Lenders Review During Loan Applications? The key financial statements lenders review during loan applications are the income statement, balance sheet, and cash flow statement. These documents work together to present earnings quality, financial position, and liquidity. Lenders examine the income statement to evaluate revenue stability and expense management, then they confirm margins and net income trends. The balance sheet provides insight into solvency through assets, liabilities, and equity, with attention to leverage ratios and working capital. The cash flow statement demonstrates the ability to service debt by showing operating cash generation separate from financing or investing activity. A Federal Reserve Small Business Credit Survey reports that incomplete or inconsistent statements increase follow-up requests and delay decisions. Many lenders, such as community banks and SBA partners, require at least two years of comparative statements to validate consistency before extending credit.

How Can Accurate Bookkeeping Speed Up the Loan Approval Process?

How Can Accurate Bookkeeping Speed Up the Loan Approval Process? Accurate bookkeeping speeds up the loan approval process by reducing documentation gaps, minimizing clarification requests, and enabling faster underwriting analysis. Clean records allow lenders to verify figures quickly, then they proceed to credit decisions without repeated back-and-forth. Accurate books support 1) immediate ratio calculations, 2) faster verification of tax returns against financials, and 3) smoother collateral and covenant assessments. A QuickBooks survey found that businesses with up-to-date books complete loan applications faster and receive decisions sooner than peers with delayed reconciliations. Many borrowers, such as restaurants and logistics companies, experience shorter approval timelines when monthly closes are current. Professional preparation through JMAccountingServices helps ensure lender-ready reports, then it accelerates approvals by presenting standardized, review-friendly financial packages.

What Common Bookkeeping Mistakes Lead to Loan Rejections?

What Common Bookkeeping Mistakes Lead to Loan Rejections? Common bookkeeping mistakes that lead to loan rejections include inconsistent records, unreconciled accounts, and unsupported income or expenses. Lenders view these issues as risk signals because they obscure true performance. Frequent problems include 1) mixing personal and business transactions, 2) failing to reconcile bank and credit card statements, 3) misclassifying expenses, and 4) reporting revenue without documentation. Studies cited by accounting associations note that discrepancies between tax returns and internal statements are a primary reason for application delays and denials. Many small businesses, such as sole proprietorships and early-stage startups, face rejection when records lack audit trails. Accurate bookkeeping corrects these weaknesses, then it positions the business as transparent, compliant, and creditworthy.

How Does Accurate Bookkeeping Improve Cash Flow Management for Better Loan Eligibility?

How Does Accurate Bookkeeping Improve Cash Flow Management for Better Loan Eligibility? Accurate bookkeeping improves cash flow management for better loan eligibility by providing precise visibility into inflows, outflows, and timing gaps that affect debt service capacity. Lenders prioritize cash flow because repayment depends on operating liquidity rather than paper profits, then they evaluate whether monthly obligations can be met consistently. Accurate records enable 1) reliable cash flow forecasting, 2) identification of seasonal fluctuations, and 3) early detection of shortfalls tied to receivables or inventory cycles. Research cited in the CPA Journal indicates that businesses with monthly cash flow statements demonstrate stronger debt service coverage ratios during underwriting. Many businesses, such as wholesalers and subscription-based companies, use aging reports to accelerate collections and smooth cash volatility. Accurate bookkeeping aligns bank activity with receivables and payables, then it supports lender confidence by proving that cash generation is sufficient, predictable, and well-managed.

What Role Does Accurate Bookkeeping Play in Building Business Credibility With Lenders?

What Role Does Accurate Bookkeeping Play in Building Business Credibility With Lenders? Accurate bookkeeping plays a central role in building business credibility with lenders by signaling transparency, discipline, and managerial competence. Lenders interpret clean books as proof that financial information can be trusted, then they assess risk with fewer assumptions. Credibility drivers include 1) consistent reporting across periods, 2) alignment between financial statements and tax filings, and 3) documented audit trails for revenues and expenses. A Federal Reserve Small Business Credit Survey notes that borrowers presenting organized records face fewer credibility challenges during underwriting. Many lenders, such as regional banks and SBA-approved institutions, favor applicants whose books demonstrate compliance and internal controls. Accurate bookkeeping establishes a dependable financial narrative, then it strengthens negotiations on terms, pricing, and covenants by reducing perceived uncertainty.

How to Implement Accurate Bookkeeping in Your Business?

How to Implement Accurate Bookkeeping in Your Business? Accurate bookkeeping can be implemented in a business by establishing structured processes, standardized tools, and professional oversight that ensure consistency and accuracy over time. Effective implementation includes 1) separating business and personal accounts, 2) adopting accounting software with bank feeds, 3) performing monthly reconciliations, and 4) maintaining documentation for every transaction. Industry guidance from accounting associations emphasizes monthly closes as a best practice to prevent error accumulation. Many organizations, such as startups and e-commerce businesses, benefit from accrual accounting to reflect true performance. Skilled professionals can be found through JMAccountingServices, where expert bookkeeping and accounting support helps businesses set up compliant systems, maintain accurate records, and prepare lender-ready financial statements that improve financing outcomes.

What Tools and Software Help Maintain Accurate Bookkeeping for Loan Preparation?

What Tools and Software Help Maintain Accurate Bookkeeping for Loan Preparation? Tools and software that help maintain accurate bookkeeping for loan preparation include cloud-based accounting platforms, automated reconciliation tools, and reporting systems designed for lender review. These tools improve accuracy by reducing manual errors and standardizing financial outputs, then they support faster verification during underwriting. Widely adopted platforms provide features such as bank feeds, receipt capture, and audit trails that preserve data integrity. Key capabilities lenders value include 1) automated bank and credit card reconciliations, 2) real-time financial reporting, and 3) customizable statements aligned with GAAP. Industry surveys from QuickBooks indicate that businesses using integrated accounting software close their books more consistently and present fewer discrepancies during financing reviews. Many companies, such as service firms and retail businesses, rely on accounts receivable aging and cash flow dashboards to demonstrate liquidity readiness for loans.

How Often Should Businesses Update Bookkeeping Records to Maximize Loan Approval Chances?

How Often Should Businesses Update Bookkeeping Records to Maximize Loan Approval Chances? Businesses should update bookkeeping records monthly to maximize loan approval chances because lenders expect current, reconciled financials that reflect recent performance. Monthly updates reduce data gaps, then they ensure ratios and trends are accurate at the time of application. Best practice standards from accounting associations emphasize monthly closes with reconciliations completed within a defined period after month-end. Critical updates include income and expense postings, balance sheet reconciliations, and cash flow reviews. Research cited in the CPA Journal shows that businesses maintaining monthly financials experience fewer lender follow-ups compared with those updating quarterly. Many lenders, such as SBA partners and community banks, request trailing twelve-month statements supported by monthly detail to confirm consistency and risk control.

Where to Hire an Expert to Handle Accurate Bookkeeping?

Where to Hire an Expert to Handle Accurate Bookkeeping? Skilled professionals to handle accurate bookkeeping can be found through JMAccountingServices, where experienced experts deliver lender-ready financial records aligned with underwriting standards. Expert support improves reliability by establishing compliant systems, enforcing monthly closes, and preparing clear statements that lenders trust, then it reduces approval delays tied to documentation issues. Professional services typically cover transaction review, reconciliations, financial reporting, and pre-application readiness checks. Many businesses, such as startups and growing enterprises, engage specialists to ensure books remain accurate under scaling complexity. Hiring a qualified expert strengthens credibility, then it positions the business for higher approval rates and better loan terms through consistent, verifiable financial reporting.