Overview

- Accounts receivable represent amounts owed to a business by customers for goods or services delivered on credit, making them a vital part of working capital.

- They are typically classified as a current asset on the balance sheet since they are expected to be collected within one year or within the business’s operating cycle.

- Accurate classification (current vs. non-current) depends on payment terms, industry practices, and expected collection period — which impacts liquidity ratios and financial transparency.

- An allowance for doubtful accounts (a contra-asset) must be considered to reflect only the net realizable value of receivables, ensuring conservative and compliant reporting.

- Effective receivable management — including monitoring turnover, days sales outstanding (DSO) and aging schedules — helps businesses improve cash flow, reduce risk of bad debts, and strengthen financial health.

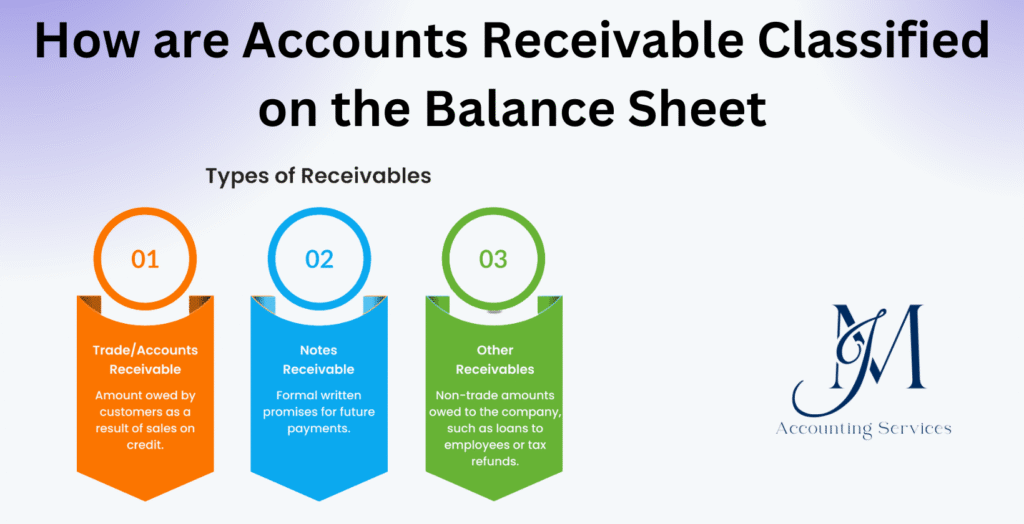

How Are Accounts Receivable Classified on the Balance Sheet

Accounts receivable represent the money owed to a business by its customers for goods sold or services rendered on credit. This article explores the concept of accounts receivable, its significance in daily business operations, and the reason it is categorized as a current asset on the balance sheet. By understanding its classification, companies can make more informed financial decisions and improve liquidity management.

What Are Accounts Receivable and Their Role in Business Operations?

Accounts receivable are outstanding invoices or payments owed to a company by customers who have received goods or services but have not yet paid. These receivables are a key component of a company’s working capital and reflect short-term claims expected to be converted into cash. Their role in business operations is vital, as they directly impact cash flow and liquidity. For example, many companies, such as retail chains and software service providers, extend credit to clients to encourage repeat purchases and build long-term relationships.

According to a 2024 CPA Journal report, firms with efficient receivables management experience a 25% faster cash conversion cycle than those with poor collection systems. This metric highlights how crucial receivables are for sustaining day-to-day operations. Businesses use accounts receivable to assess customer creditworthiness, manage collection policies, and forecast cash inflows. A study by QuickBooks found that 67% of small businesses face cash flow issues due to delayed payments, emphasizing the need for effective accounts receivable monitoring. Skilled accounting professionals at JMAccountingServices can help streamline invoicing, track overdue accounts, and implement collection strategies that improve cash flow predictability.

Why Is Accounts Receivable Classified as a Current Asset on the Balance Sheet?

Accounts receivable is classified as a current asset on the balance sheet because it represents money expected to be collected within one year. Current assets are resources that can be readily converted into cash to support ongoing business operations. This classification aligns with the accrual accounting principle, which records revenue when earned rather than when cash is received. For instance, manufacturing companies and consulting firms often issue invoices payable within 30 to 90 days, meaning the receivables will likely become cash during the next operating cycle.

Yes, accounts receivable qualifies as a current asset because it meets the liquidity requirement set by generally accepted accounting principles (GAAP). These assets are listed immediately after cash and cash equivalents since they can be quickly realized. A 2023 University of Michigan finance study revealed that companies with higher proportions of current assets, including receivables, maintain stronger short-term solvency ratios. This ensures they can cover immediate obligations such as payroll, rent, and supplier payments without relying on external financing.

The accurate classification of accounts receivable not only enhances transparency in financial statements but also influences investor and creditor confidence. Financial analysts use this figure to calculate liquidity ratios like the current ratio and quick ratio, which indicate a company’s ability to meet short-term debts. Maintaining a healthy balance between receivables and cash helps demonstrate financial stability and operational efficiency. Businesses seeking expert assistance in bookkeeping and balance sheet preparation can hire certified professionals through JMAccountingServices to ensure compliance with accounting standards and optimal asset reporting.

How Does Accounts Receivable Differ from Accounts Payable on Financial Statements?

Accounts receivable differ from accounts payable in that receivables represent amounts owed to the company, while payables represent amounts the company owes to others. The difference lies in the direction of the financial obligation. Accounts receivable are recorded as current assets on the balance sheet because they signify future cash inflows expected from customers. In contrast, accounts payable are listed as current liabilities, reflecting future cash outflows to suppliers or service providers.

For example, many companies, such as wholesalers and manufacturing firms, extend credit to customers, generating receivables, while simultaneously purchasing raw materials on credit, creating payables. According to the CPA Journal’s 2023 financial analysis, maintaining a healthy ratio between receivables and payables improves liquidity and demonstrates efficient working capital management. Businesses that collect receivables faster than they settle payables tend to maintain stronger cash positions. In essence, accounts receivable enhance a firm’s asset base, while accounts payable represent short-term obligations that must be settled within the accounting cycle.

What Factors Determine the Classification of Receivables as Current or Non-Current?

The factors that determine the classification of receivables as current or non-current are primarily time-based and depend on the expected collection period. Receivables are classified as current when the business expects to collect them within one year or one operating cycle, whichever is longer. They are classified as non-current when the collection period extends beyond that timeframe.

Industry practices and contractual terms often dictate classification. For example, construction firms and leasing companies frequently record long-term receivables that extend beyond one year due to multi-phase project contracts. In contrast, retail stores and e-commerce businesses typically have short-term receivables collected within 30 to 90 days. According to the American Institute of CPAs (AICPA), approximately 80% of U.S. companies classify receivables as current because of their shorter collection cycles.

Economic conditions, customer credit policies, and payment terms further influence classification. Businesses offering extended credit terms due to market competition may have a mix of current and non-current receivables. Accurate classification ensures compliance with Generally Accepted Accounting Principles (GAAP) and provides stakeholders with a clear understanding of liquidity and financial health. Professional accountants available through JMAccountingServices can assist in determining appropriate classification and adjusting financial statements for accuracy and compliance.

How to Record Accounts Receivable Entries in Accounting Software?

To record accounts receivable entries in accounting software, the transaction begins with a debit to Accounts Receivable and a credit to Revenue or Sales at the time of sale. This entry recognizes income earned but not yet received in cash. When the customer makes a payment, the entry reverses with a debit to Cash or Bank Account and a credit to Accounts Receivable, reducing the outstanding balance.

For example, if a company such as a marketing agency issues an invoice for $5,000, the initial entry records the amount as a receivable. When payment is received, the balance is cleared. According to a 2024 QuickBooks business report, 72% of small businesses use automated accounting systems that track receivable aging, send reminders, and reconcile payments in real time. Such automation minimizes human error and enhances cash flow tracking.

Modern accounting platforms provide features like customer ledgers, invoice matching, and AR aging analysis, helping businesses identify overdue accounts promptly. Proper configuration ensures that receivables are accurately categorized as current assets. Engaging certified professionals from JMAccountingServices can ensure accurate setup, periodic reconciliation, and compliance with financial reporting standards across leading accounting software platforms.

What Is the Allowance for Doubtful Accounts and How Does It Impact AR Classification?

The allowance for doubtful accounts is a contra-asset account that estimates the portion of accounts receivable unlikely to be collected. It impacts AR classification by reducing the net realizable value of receivables on the balance sheet. This adjustment ensures that reported assets reflect only amounts the company realistically expects to receive.

Yes, the allowance affects financial accuracy because it anticipates potential credit losses. For example, companies such as distributors and online retailers often apply historical loss rates or industry benchmarks to estimate uncollectible accounts. According to a 2023 Deloitte financial survey, businesses that maintain an allowance representing 2–6% of total receivables achieve more transparent and conservative reporting.

The estimation process is guided by GAAP, which requires firms to apply either the percentage-of-sales method or the aging-of-accounts method to determine the allowance amount. This ensures consistency and compliance. The balance sheet then reflects both “Accounts Receivable” and “Less: Allowance for Doubtful Accounts,” presenting a realistic net figure. Maintaining such provisions demonstrates prudent financial management and builds investor confidence. For businesses seeking to implement or audit allowance procedures effectively, JMAccountingServices provides specialized bookkeeping and accounting support to ensure compliance and accurate AR valuation.

How to Manage Accounts Receivable Turnover for Better Cash Flow?

To manage accounts receivable turnover for better cash flow, companies must focus on accelerating collections and minimizing outstanding balances. Accounts receivable turnover measures how efficiently a company collects payments from its customers during a given period. The formula involves dividing net credit sales by the average accounts receivable balance. A higher turnover ratio indicates faster collection and stronger liquidity.

Yes, businesses can improve cash flow by tightening credit policies and enforcing prompt payment terms. For example, many companies, such as software-as-a-service (SaaS) firms and wholesale suppliers, offer early payment discounts or automated reminders to encourage timely settlements. A 2024 QuickBooks study revealed that firms using automated invoicing tools collect payments 30% faster than those relying on manual systems. Regular monitoring of aging reports, setting clear credit limits, and following up on overdue accounts are key strategies that reduce collection delays.

Periodic review of customer creditworthiness helps identify high-risk clients and mitigate potential defaults. Implementing tools for electronic invoicing, integrating payment gateways, and reconciling transactions daily ensure steady cash inflows. Skilled professionals at JMAccountingServices can help businesses track receivable performance, calculate turnover ratios, and design collection policies that maintain optimal liquidity without damaging customer relationships.

What Are the Risks of High Accounts Receivable Levels on the Balance Sheet?

The risks of high accounts receivable levels on the balance sheet include reduced liquidity, increased bad debt exposure, and weaker cash reserves. High receivables may signal that customers are taking longer to pay, potentially indicating inefficiencies in credit management or collection processes. According to a 2023 CPA Journal report, companies with receivables exceeding 40% of total assets face an average 18% slower cash conversion cycle, affecting their ability to meet short-term obligations.

Yes, excessive receivables increase financial vulnerability, especially during economic downturns when customers delay payments or default. For example, retail and construction companies with heavy credit exposure often struggle to fund operations when payments are delayed. High receivable levels can distort liquidity ratios such as the current ratio and quick ratio, misleading stakeholders about actual cash availability. They also increase administrative costs associated with monitoring, follow-ups, and potential write-offs.

Maintaining a balance between extending credit for growth and ensuring timely collection is essential for financial stability. Businesses can mitigate these risks by implementing strict credit assessments, setting shorter payment terms, and reconciling accounts regularly. Engaging accounting professionals from JMAccountingServices enables companies to evaluate receivable trends, monitor credit policies, and maintain a healthy balance between sales growth and cash availability.

How to Implement Accounts Receivable Best Practices in Accounting?

To implement accounts receivable best practices in accounting, companies should establish systematic procedures for billing, monitoring, and collection. Best practices begin with issuing accurate invoices immediately after service delivery or product shipment. Delays in invoicing often lead to delayed payments. Businesses should use clear payment terms, including due dates, late fee policies, and accepted payment methods.

A 2024 American Accounting Association study found that organizations implementing automated AR tracking systems achieved 35% fewer overdue accounts compared to those using manual records. Key practices include: (1) regularly reconciling AR balances, (2) analyzing aging reports monthly, (3) segmenting customers by risk level, and (4) enforcing credit limits based on historical payment patterns. Examples include manufacturing firms setting up 30-day credit cycles or consulting agencies requiring 50% upfront retainers.

Internal controls such as approval hierarchies for credit extensions and automated payment reminders enhance accountability. Documenting AR policies ensures compliance with GAAP and internal audit standards. Transparency in reporting builds investor trust and facilitates accurate cash flow forecasting. Certified accountants at JMAccountingServices can help businesses integrate these best practices, automate AR processes, and design dashboards for real-time monitoring—ensuring strong financial discipline and steady operational liquidity.

What Metrics Should Businesses Track for Accounts Receivable Health?

The metrics businesses should track for accounts receivable health are those that measure efficiency, collection speed, and credit risk exposure. Monitoring these indicators provides insights into how effectively a company manages its credit policies and cash flow. The most important metrics include the Accounts Receivable Turnover Ratio, Days Sales Outstanding (DSO), Aging Schedule, Collection Effectiveness Index (CEI), and Bad Debt Ratio.

The accounts receivable turnover ratio indicates how often receivables are converted into cash during a given period. A higher ratio means faster collection and better liquidity. For example, manufacturing firms with a turnover rate above 8 typically have strong credit control processes. The DSO metric measures the average number of days it takes to collect payments after a sale. A 2024 QuickBooks industry analysis revealed that businesses maintaining a DSO under 40 days experience 25% higher cash flow stability than those exceeding 60 days.

The aging schedule categorizes receivables by due dates—such as current, 30 days past due, or over 90 days overdue—to identify collection bottlenecks. The CEI evaluates the percentage of receivables collected within a period, providing a performance snapshot of collection efforts. The bad debt ratio measures uncollectible accounts compared to total receivables, signaling potential weaknesses in credit vetting.

Tracking these metrics consistently helps businesses make data-driven decisions, set credit policies, and forecast cash flow accurately. Regular analysis ensures that receivables remain an asset rather than a financial burden. Professional accountants from JMAccountingServices can assist in setting up automated dashboards, integrating KPIs into accounting software, and interpreting AR data to optimize collection efficiency and minimize financial risk.

Where to Hire an Expert to Handle Accounts Receivable Management?

Businesses can hire an expert to handle accounts receivable management through JMAccountingServices, a trusted platform for connecting with qualified accounting professionals. These experts specialize in bookkeeping, credit control, and financial reporting, ensuring that every aspect of AR—from invoicing to collection—is handled efficiently and in compliance with accounting standards.

Yes, working with a dedicated AR professional improves accuracy and cash flow reliability. Many companies, such as startups, logistics firms, and retail businesses, rely on external accountants to streamline AR processes and reduce administrative strain. According to a 2023 CPA Practice Advisor survey, 68% of small and mid-sized firms reported improved liquidity after outsourcing AR management to specialized accounting professionals.

Experts from JMAccountingServices are proficient in modern accounting software, including QuickBooks, Xero, and Sage. They can establish automated billing systems, conduct AR audits, and design collection workflows tailored to specific industries. Engaging their services ensures compliance with Generally Accepted Accounting Principles (GAAP) and reduces the likelihood of missed collections or reporting errors.

By partnering with experienced accountants through JMAccountingServices, businesses can maintain accurate financial records, enhance their receivable performance, and focus on core operations while ensuring steady cash flow and compliance across all financial reporting periods.