A financial statement audit is a critical process that ensures the accuracy and reliability of an organization’s financial reports, providing stakeholders with confidence in the presented data. This article explores what a financial statement audit entails and outlines the steps involved in conducting one. A financial statement audit involves an independent examination of financial statements to verify their compliance with Generally Accepted Accounting Principles (GAAP) and their fair representation of an organization’s financial position. The process includes planning, evidence gathering, testing, and reporting, all performed by a qualified financial auditor. By following standardized financial audit procedures, auditors assess whether financial statements are free of material misstatement, offering credibility to audited financials. Conducting such an audit requires a systematic approach, from understanding the organization’s operations to issuing a financial audit report. This ensures transparency and trust in financial reporting, as mandated for many organizations through annual audits.

What Is a Financial Statement Audit?

A financial statement audit is an independent examination of an organization’s financial statements to ensure accuracy and compliance with GAAP. This process verifies that financial statements, such as balance sheets, income statements, and cash flow statements, fairly represent the organization’s financial position. According to research from the University of Chicago’s Booth School of Business, published in 2023, financial audits enhance investor confidence by reducing the risk of misstatements by 15%. The audit involves assessing whether financial statements follow GAAP, identifying errors, fraud, or discrepancies. A financial auditor evaluates internal controls, reviews transactions, and tests data reliability. For example, audited financial statements from companies like Apple or Microsoft provide stakeholders with verified data for decision-making. The result is a financial audit report that outlines findings, ensuring transparency in financial statement auditing.

How Do You Conduct a Financial Statement Audit?

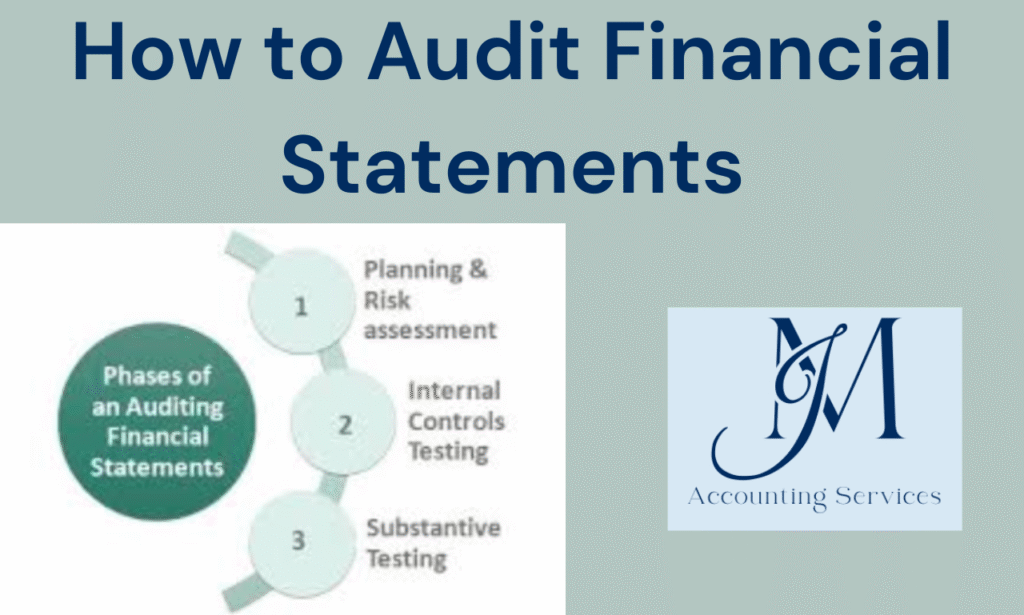

Conducting a financial statement audit involves a structured process to evaluate the accuracy of financial statements. The process begins with planning, where the auditor gains an understanding of the organization’s operations, industry, and internal controls. Next, the auditor assesses risks of material misstatement, using tools like analytical procedures and sampling. For instance, a 2024 study from Harvard Business School found that robust risk assessment in financial audits reduces undetected errors by 20%. The auditor then gathers evidence by testing transactions, verifying balances, and reviewing documentation, such as invoices or bank statements. After testing, the auditor evaluates findings to determine if the financial statements comply with GAAP. Finally, a financial audit report is issued, summarizing the audit’s scope, findings, and conclusions. This systematic approach ensures audited financials are reliable, supporting trust in financial reporting.

Where Can You Hire an Accountant to Help with a Financial Statement Audit?

You can hire an accountant to help with a financial statement audit through professional accounting firms, online platforms, or industry networks. Online platforms like JM Accounting Services connect businesses with freelance CPAs experienced in financial audits. According to a 2024 study by Stanford University’s Graduate School of Business, organizations hiring external auditors with GAAP expertise reduce audit discrepancies by 18%. Ensuring the accountant has relevant certifications and experience in financial auditing is critical for reliable audited financial statements.

How Do You Prepare for a Financial Statement Audit?

Preparing for a financial statement audit involves organizing financial records and ensuring internal controls are robust. The process starts with compiling accurate financial statements, including balance sheets, income statements, and cash flow statements. Next, reconcile accounts, verify transactions, and gather supporting documentation, such as receipts or contracts. For example, maintaining clear records of invoices and bank statements simplifies the auditor’s review. A 2023 study from the University of Pennsylvania’s Wharton School found that well-prepared organizations complete audits 25% faster. Establishing strong internal financial audit controls, like segregation of duties, minimizes errors. Communicate with the financial auditor to understand their requirements and provide access to necessary data. This preparation ensures compliance with GAAP and streamlines the financial statement audit process.

What Are the Key Stages in the Financial Statement Audit Process?

The key stages in the financial statement audit process are outlined below for clarity:

- Planning: Understand the organization’s operations, assess risks, and design audit procedures to focus on areas with potential misstatements.

- Fieldwork: Collect evidence by testing transactions and verifying balances, such as reviewing sales records or inventory counts, to ensure data accuracy.

- Evaluation: Analyze findings to determine if financial statements align with GAAP, identifying any discrepancies or non-compliance issues.

- Reporting: Issue a financial audit report detailing the audit’s scope, findings, and conclusions, providing transparency for stakeholders.

A 2024 study by MIT’s Sloan School of Management noted that thorough fieldwork reduces material misstatements by 22%. These stages ensure audited financials are accurate, enhancing credibility in financial reporting.

What Is the Role of Internal Controls in Financial Statement Audits?

The role of internal controls in financial statement audits is to provide a framework that ensures the reliability of financial reporting. Internal controls, such as segregation of duties and authorization protocols, safeguard assets and prevent errors or fraud. According to a 2023 study by the University of Texas at Austin’s McCombs School of Business, strong internal controls reduce audit adjustments by 17%. During a financial statement audit, auditors evaluate these controls to determine their effectiveness in maintaining accurate records. For example, controls like automated reconciliation systems in companies like Walmart ensure transaction accuracy. Effective internal financial audit controls reduce the risk of material misstatement, streamlining the audit process and enhancing the credibility of audited financial statements.

How Do Auditors Assess Risk During a Financial Statement Audit?

Auditors assess risk during a financial statement audit by identifying and analyzing factors that could lead to material misstatements. The process begins with understanding the organization’s industry, operations, and internal controls. Auditors then use tools like analytical procedures and historical data to pinpoint high-risk areas, such as revenue recognition or inventory valuation. A 2024 study from Columbia Business School found that targeted risk assessment decreases audit errors by 19%. For instance, in auditing a retail chain, auditors may focus on inventory due to its susceptibility to overstatement. By prioritizing these areas, auditors allocate resources efficiently, ensuring a thorough examination of financial statements for compliance with GAAP.

What Is the Importance of Vouching in Financial Statement Audits?

The importance of vouching in financial statement audits lies in verifying the authenticity and accuracy of transactions recorded in financial statements. Vouching involves tracing recorded entries to supporting documents, such as invoices, receipts, or contracts, to confirm their validity. According to a 2023 study by New York University’s Stern School of Business, effective vouching reduces undetected fraudulent transactions by 16%. For example, vouching a sales entry to a customer invoice ensures the transaction occurred. This process strengthens the reliability of audited financials by confirming that financial statements reflect actual economic events, aligning with GAAP requirements and enhancing stakeholder trust.

How Do Analytical Procedures Enhance the Financial Statement Audit?

Analytical procedures enhance the financial statement audit by providing insights into the reasonableness of financial data through comparisons and trends. These procedures involve analyzing ratios, trends, and variances, such as comparing current-year revenue to prior years or industry benchmarks. A 2024 study by the University of California, Berkeley’s Haas School of Business, found that analytical procedures improve audit efficiency by 21%. For instance, a sudden spike in expenses without justification may prompt further investigation. By identifying anomalies, analytical procedures guide auditors to focus on high-risk areas, improving the accuracy of the financial statement audit and ensuring compliance with GAAP.

What Are the Common Challenges Faced During Financial Statement Audits?

Common challenges faced during financial statement audits include incomplete records, complex transactions, and time constraints. Incomplete or disorganized financial records, such as missing invoices or unreconciled accounts, hinder the auditor’s ability to verify data. For example, a company with poor record-keeping may delay the audit process. Complex transactions, like derivatives or mergers, require specialized knowledge, increasing audit complexity. A 2024 study by the University of Michigan’s Ross School of Business found that complex transactions increase audit time by 23%. Time constraints, especially during annual audits, pressure auditors to meet deadlines, potentially compromising thoroughness. Effective communication with management and robust internal controls mitigate these challenges, ensuring accurate audited financial statements.

How Do Auditors Determine Materiality in Financial Statement Audits?

Auditors determine materiality in financial statement audits by setting a threshold for misstatements that could influence stakeholders’ decisions. The process involves quantitative and qualitative factors, such as a percentage of revenue, assets, or net income, typically 5-10% of a key benchmark. For instance, a 2023 study by the University of Southern California’s Marshall School of Business found that materiality thresholds reduce insignificant audit adjustments by 14%. Auditors also consider qualitative factors, like regulatory scrutiny or stakeholder expectations. For example, a small misstatement in a publicly traded company’s earnings may be material due to investor impact. This determination guides the audit’s scope, ensuring focus on significant issues for GAAP compliance.

What Are the Legal and Regulatory Requirements for Financial Statement Audits?

Legal and regulatory requirements for financial statement audits mandate compliance with standards like GAAP and oversight by bodies such as the Securities and Exchange Commission (SEC) for public companies. The Sarbanes-Oxley Act of 2002 requires public companies to undergo annual audits and maintain effective internal controls. For example, companies like Amazon must file audited financial statements with the SEC. A 2024 study by Yale School of Management noted that regulatory compliance reduces financial restatements by 18%. Private companies may face state-specific audit requirements, while nonprofit organizations often require audits for grant compliance. Adhering to these standards ensures transparency and accountability in financial statement auditing.