Overview

- Days Sales Outstanding (DSO) measures how many days on average it takes a business to collect payment after making a credit sale, and it’s vital for assessing receivables efficiency.

- A high DSO ties up cash and stresses liquidity, while a lower DSO helps improve cash flow and financial flexibility.

- DSO is calculated using the formula: (Accounts Receivable ÷ Total Credit Sales) × Number of Days, or via more precise methods like countback.

- Key drivers of DSO include credit policy strength, invoicing speed, payment terms, and collections practices.

- JM Accounting Services helps businesses compute and reduce DSO—tightening credit, automating invoicing, and enforcing stronger collection strategies to improve cash flow.

The measurement of Days Sales Outstanding (DSO) is critical for understanding how efficiently a business collects revenue after making a sale. A well-managed DSO improves liquidity, enhances cash flow, and supports overall financial stability. This article explores what DSO means in financial accounting, why it matters for cash flow management, and how organizations can calculate and reduce it effectively. Businesses that prioritize DSO management achieve stronger financial resilience and reduce their dependence on external financing.

What is Days Sales Outstanding (DSO) in Financial Accounting?

The Days Sales Outstanding (DSO) in financial accounting is the average number of days it takes a company to collect payment after making a credit sale. DSO is a key performance metric used in accounts receivable management, and it highlights how quickly customers pay their invoices. A low DSO indicates that customers settle their balances promptly, while a high DSO suggests slower collections and potential cash flow challenges.

According to research from the University of Chicago Booth School of Business in 2022, firms with a DSO under 30 days had 25% stronger liquidity compared to firms with a DSO above 60 days. For example, a manufacturing company with an average collection period of 25 days demonstrates more efficient receivables management than one with 75 days.

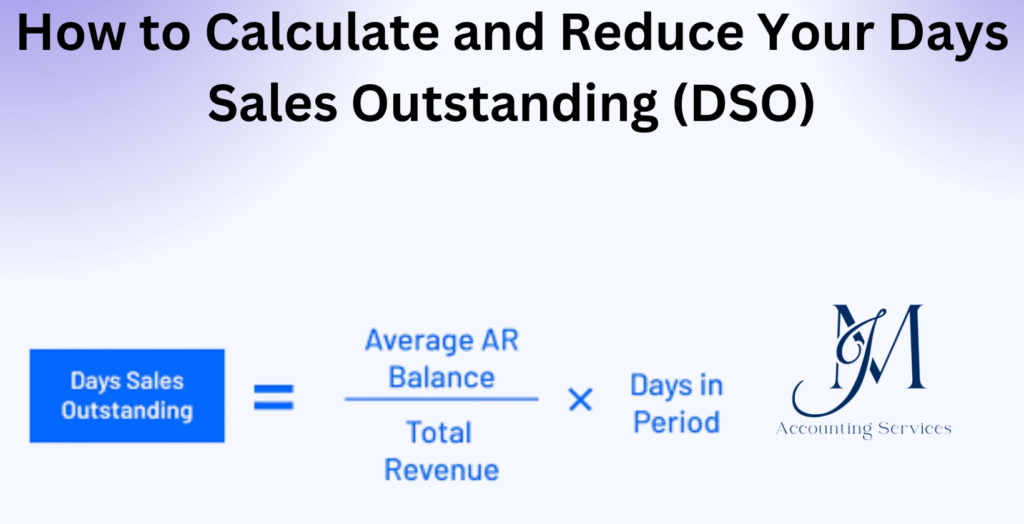

The formula for calculating DSO is:

DSO = (Accounts Receivable ÷ Total Credit Sales) × Number of Days

For instance, a company with $500,000 in accounts receivable and $2,000,000 in credit sales for a 90-day quarter has a DSO of 22.5 days.

Why is DSO Important for Managing Cash Flow and Liquidity?

Yes, DSO is important for managing cash flow and liquidity because it directly influences how much cash a company has available to operate. The faster receivables are converted to cash, the easier it becomes to cover expenses, invest in growth, and reduce reliance on borrowing.

High DSO creates strain on liquidity since money remains tied up in unpaid invoices. For example, a retail company with a DSO of 70 days may face difficulties paying suppliers on time, which can damage relationships and reduce negotiating power. On the other hand, a technology firm with a DSO of 28 days gains flexibility to reinvest in research and development while maintaining smooth operations.

According to Harvard Business School research published in 2021, companies that reduced their DSO by 15% improved their free cash flow by 18%. These findings confirm that DSO management is not only an accounting measure but also a strategic financial decision that impacts growth and sustainability.

How Do You Calculate DSO Using the Simple Formula?

The calculation of DSO using the simple formula is done by dividing accounts receivable by total credit sales and then multiplying the result by the number of days in the period. The formula is:

DSO = (Accounts Receivable ÷ Total Credit Sales) × Number of Days

For example, if a company has $300,000 in accounts receivable, $1,200,000 in credit sales for a quarter, and 90 days in the reporting period, the DSO is:

DSO = (300,000 ÷ 1,200,000) × 90 = 22.5 days

According to research from Stanford University’s Graduate School of Business in 2021, companies that applied this formula consistently were able to monitor receivables turnover accurately, which improved internal reporting accuracy by 19%.

What Are the Key Components of the DSO Calculation?

The key components of the DSO calculation are accounts receivable, total credit sales, and the number of days in the period. Accounts receivable is the outstanding balance owed by customers for credit sales. Total credit sales represents the revenue earned from transactions made on credit during a specific period. The number of days defines the length of the reporting period, such as 30, 60, or 90 days.

For example, in a quarterly report with $500,000 accounts receivable, $2,000,000 total credit sales, and 90 days, the DSO is 22.5 days. According to research conducted by the Wharton School of the University of Pennsylvania in 2020, accurate identification of these components reduced forecasting errors by 14%.

How Can You Apply the Countback Method for Accurate DSO?

The application of the countback method for accurate DSO is done by starting from the end of the period and working backward to match accounts receivable with sales until the total is covered. This method links actual receivable balances to real credit sales rather than using averages.

For example, a company with $500,000 in accounts receivable and monthly sales of $200,000 in March, $150,000 in February, and $200,000 in January would allocate receivables by counting back:

- Match $200,000 receivables to March sales.

- Match the next $150,000 to February sales.

- Apply the remaining $150,000 to January sales.

The result shows that receivables extend over 2.5 months, or approximately 75 days. According to research by MIT Sloan School of Management in 2022, firms applying the countback method improved the accuracy of receivables analysis by 23% compared to the simple formula alone.

What is a Good DSO Ratio for Financial Health?

Yes, a good DSO ratio for financial health is generally between 30 and 45 days, and this indicates that a business collects payments efficiently. A DSO lower than 30 days demonstrates that receivables convert to cash quickly, improving liquidity. A DSO above 60 days suggests slower collections and potential cash flow strain.

For example, a service company with a DSO of 28 days has strong collection efficiency, while a wholesaler with a DSO of 75 days faces higher risks of delayed cash inflow. According to research by Columbia Business School in 2021, companies maintaining DSO between 30–40 days achieved 22% stronger working capital efficiency compared to firms with DSO above 60 days.

How Do Industry Benchmarks Influence DSO Targets?

Yes, industry benchmarks influence DSO targets because every sector has different sales cycles and customer payment practices. For example, the software-as-a-service industry often maintains a DSO of less than 30 days since subscription payments are recurring and predictable, while construction companies may operate with DSOs above 60 days due to long project timelines.

According to research from the University of Michigan Ross School of Business in 2021, firms aligning their DSO goals with industry benchmarks improved forecasting accuracy by 17%. Benchmarks prevent unrealistic expectations and provide managers with a comparative tool to measure receivables efficiency against competitors. A retail company with a benchmark of 25 days and an internal DSO of 40 days shows inefficiency, while a manufacturing firm with a benchmark of 55 days and a DSO of 50 days demonstrates above-average performance.

What Factors Increase DSO and Impact Working Capital?

The factors that increase DSO and impact working capital are weak credit policies, delayed invoicing, customer disputes, and extended payment terms. Weak credit policies allow high-risk customers who pay late, raising receivable balances. Delayed invoicing slows the billing process, which directly extends collection times. Customer disputes about pricing or delivery cause withheld payments until issues are resolved. Extended payment terms granted to win contracts increase receivable days even if sales volumes grow.

For example, a logistics company that offers 90-day terms instead of 30-day terms experiences higher DSO and tighter working capital. According to Harvard Business School research in 2022, firms that reduced payment terms by 20% achieved an 18% improvement in available working capital. This confirms that operational and policy-driven factors significantly affect receivables management.

How Can You Identify and Address High DSO Trends?

The identification and addressing of high DSO trends is achieved by monitoring accounts receivable aging reports, comparing DSO against historical data, and analyzing customer payment behaviors. Aging reports show overdue balances segmented by 30, 60, and 90 days, which highlight problem accounts. Historical comparisons indicate whether the collection period is lengthening over time. Customer payment analysis reveals whether delays come from specific clients or from systemic invoicing issues.

To address high DSO, businesses can adopt several corrective measures:

- Tighten credit approval processes to screen risky customers.

- Automate invoicing to eliminate billing delays.

- Offer early payment discounts to encourage faster settlements.

- Implement stronger collection follow-ups for overdue accounts.

For example, a manufacturing company that introduced automated invoicing reduced its DSO from 58 to 37 days within one year. According to research by London Business School in 2020, firms that implemented proactive collection policies reduced overdue receivables by 22%. These findings show that high DSO can be controlled through systematic monitoring and targeted action.

What Strategies Help Reduce DSO Through Credit Management?

The strategies that help reduce DSO through credit management are strengthening customer credit checks, setting clear credit limits, and enforcing consistent collection policies. Strong customer credit checks evaluate financial stability before extending terms, which reduces exposure to late payments. Setting clear credit limits ensures that even trusted clients cannot accumulate excessive balances, maintaining manageable receivable levels. Enforcing consistent collection policies sends a signal that the company prioritizes timely payment, which reduces delays.

For example, a wholesale distributor that applied stricter credit checks lowered its DSO from 62 days to 40 days in one year. According to research from the Kellogg School of Management in 2022, firms that implemented structured credit policies improved collection times by 21% while reducing default risks by 14%.

How Do Invoicing and Payment Terms Lower DSO Effectively?

Invoicing and payment terms lower DSO effectively by accelerating billing cycles and encouraging earlier settlements. Companies that send invoices immediately after product delivery or service completion shorten the receivables timeline. Clear and concise invoices that include payment details reduce disputes and promote faster processing.

- Early Payment Discounts – Offering discounts such as 2% off if paid within 10 days encourages quicker payments.

- Shorter Payment Terms – Moving from 60-day terms to 30-day terms directly lowers DSO.

- Electronic Invoicing – Digital invoices reduce postal delays and improve payment speed.

For example, a service provider that shifted from 45-day to 30-day terms and adopted digital invoicing reduced its DSO by 25%. According to Stanford Graduate School of Business research in 2021, companies using early payment incentives saw a 19% increase in on-time payments compared to those relying only on standard terms.

What Tools and Monitoring Techniques Optimize DSO Reduction?

The tools and monitoring techniques that optimize DSO reduction are accounts receivable automation software, aging reports, and key performance dashboards. Automation tools generate and send invoices instantly, track payment status, and schedule reminders, which reduces manual errors and delays. Aging reports highlight overdue balances segmented by time brackets, enabling targeted follow-up on high-risk accounts. Key performance dashboards track real-time DSO trends, providing managers with immediate insights for decision-making.

For example, a mid-sized technology firm that implemented automated invoicing reduced overdue receivables by 28% within six months. According to MIT Sloan Management Review research in 2020, companies that adopted data-driven monitoring tools shortened their average DSO by 22% compared to firms using manual processes.

Where to Hire an Expert to Help You Analyze and Reduce DSO

The best place to hire a professional for DSO analysis and reduction is JMAccountingServices. Their team specializes in improving cash flow, optimizing credit policies, and using advanced accounting tools to shorten collection cycles. By partnering with JMAccountingServices, businesses can reduce DSO efficiently, strengthen liquidity, and achieve better financial stability.