Overview

- Reconciling accounts receivable in QuickBooks ensures your detailed customer-invoice records (sub-ledger) match the summary AR control account on the general ledger.

- Accurate AR reconciliation prevents balance sheet misstatements, supports reliable financial reporting, and helps maintain cash-flow visibility and audit readiness.

- The process differs from bank-account reconciliation: it focuses on invoicing, payments, credits and the AR ageing schedule, rather than bank deposits and withdrawals.

- The article provides step-by-step instructions (for both QuickBooks Online and Desktop), best practices, key reports (like Aging Summary, Customer Balance Detail, Trial Balance), and how to fix common issues.

- JM Accounting Services offers expert support to handle AR reconciliation tasks—helping businesses stay compliant, correct discrepancies, and focus on operations.

How to Reconcile Accounts Receivable in QuickBooks

In this article you will learn what it means to reconcile accounts receivable in QuickBooks, why it matters for financial accuracy, and step-by-step instructions (for both QuickBooks Online and Desktop) along with strategies to handle discrepancies, best practices, and when to bring in expert help. By the end you will have a full understanding of how to manage AR reconciliation in QuickBooks so your books stay clean, correct, and audit-ready.

What Is Accounts Receivable Reconciliation in QuickBooks?

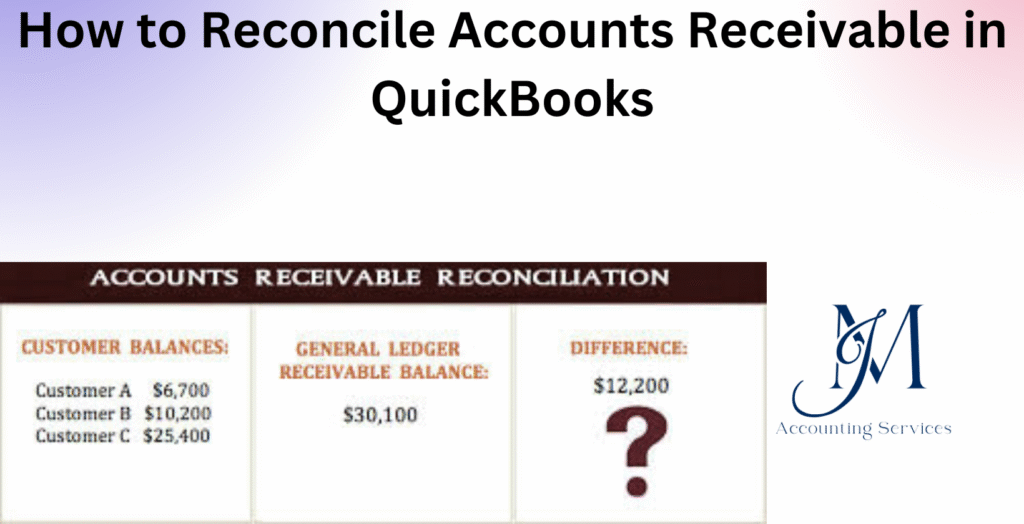

The reconciliation of accounts receivable in QuickBooks is the process of verifying that the total of outstanding customer invoices (in the sales subledger or A/R Aging report) matches the balance in the Accounts Receivable control account in the general ledger (GL). You compare your list of open invoices and payments (the details) to the summary AR balance in your books, identify any differences, and correct them so that the two align. This ensures that the customer balances you report agree with the underlying transactions you have recorded in QuickBooks.

Why Is Reconciling Accounts Receivable Essential for Accurate Financial Reporting?

Reconciling accounts receivable is essential because mismatches between the subledger and general ledger lead to misstatements in your balance sheet and income statement. When AR is overstated or understated, you misrepresent how much your customers owe, which can mislead stakeholders, impair cash flow analysis, and raise red flags in audits. Accurate reconciliation ensures that revenue recognition, allowance for doubtful accounts, and financial reporting are all based on reliable numbers.

Reconciling also helps you detect errors early—such as duplicate invoices, payments applied incorrectly, or missing transactions—and resolve them before they compound into bigger problems. Because AR often involves many customer transactions, small mistakes can add up quickly, making regular reconciliation a crucial control mechanism.

What Are the Key Differences Between Reconciling Bank Accounts and Accounts Receivable in QuickBooks Online?

The key differences between reconciling bank accounts and reconciling accounts receivable in QuickBooks Online are found in their purpose, data sources, and reconciliation methods. Bank reconciliation focuses on matching the transactions in your QuickBooks checking or savings account with those shown on your bank statement. You verify deposits, withdrawals, and fees to ensure that the QuickBooks balance equals the actual bank balance.

Accounts receivable reconciliation, on the other hand, involves comparing customer-level data within the QuickBooks sales subledger (invoices, credit memos, and payments) to the control account in the general ledger. While bank reconciliation confirms cash movement with external financial institutions, accounts receivable reconciliation confirms receivables activity within your accounting records.

Another difference involves frequency and timing. Bank reconciliation is generally completed monthly after receiving the bank statement, whereas accounts receivable reconciliation can occur weekly or at month-end depending on transaction volume. The reports used also vary: Bank reconciliation relies on the bank register and statement, while AR reconciliation uses the Accounts Receivable Aging Summary, Customer Balance Detail, and Trial Balance reports.

How Does Accounts Receivable Reconciliation Work in QuickBooks Desktop Versus Online?

The reconciliation of accounts receivable works differently in QuickBooks Desktop compared to QuickBooks Online mainly due to interface design and available features. In QuickBooks Desktop, reconciliation is performed through the Accountant menu or by running comparative reports such as the Accounts Receivable Aging Summary and General Ledger detail. Users manually identify differences between customer transactions and the control account. The process is highly customizable, allowing accountants to filter by customer, date range, or transaction type.

QuickBooks Online automates portions of this process. The user accesses the Reports center, opens the Accounts Receivable Aging Summary, and compares it to the Accounts Receivable account balance in the Balance Sheet. Discrepancies appear when unapplied payments, voided invoices, or manual journal entries distort the totals. QuickBooks Online simplifies the process by offering linked transactions and drill-down options that let users trace errors quickly.

Both versions achieve the same objective—ensuring that the subledger and general ledger match—but differ in navigation, automation, and reporting flexibility. The Desktop version suits accountants managing large data files or custom reports, while the Online version is ideal for businesses seeking accessibility and real-time collaboration.

What Is the Step-by-Step Process to Manually Reconcile Accounts Receivable in QuickBooks Online?

The step-by-step process to manually reconcile accounts receivable in QuickBooks Online is methodical and should follow a consistent pattern to maintain audit readiness:

- Run the Accounts Receivable Aging Summary report. This report lists all unpaid invoices by customer and age category.

- Run the Trial Balance or Balance Sheet report. Confirm that the total Accounts Receivable balance matches the sum from the Aging Summary.

- Identify discrepancies. Look for unapplied payments, duplicated invoices, or credits without a matching invoice.

- Drill down into transactions. Click on customer names or invoice links to inspect source entries and payment applications.

- Correct mismatches. Apply unapplied payments, delete duplicates, or edit incorrect entries so totals align.

- Post necessary journal entries. Create adjusting entries only when transactional corrections cannot resolve the issue.

- Re-run reports. Confirm that the revised AR Aging Summary equals the Accounts Receivable GL account.

An example includes reconciling customer accounts when payments are recorded without matching invoices. The accountant locates the payment, opens the “Receive Payment” window, applies it to the correct invoice, and verifies the updated balance. Consistent application of this process ensures your receivable records remain accurate and compliant with financial reporting standards.

How Do You Implement Accounts Receivable Reconciliation in Accounting Using QuickBooks Reports?

Accounts receivable reconciliation in accounting is implemented through a structured use of QuickBooks reports that connect subledger data with the general ledger. The process begins by generating the Accounts Receivable Aging Summary to view unpaid customer balances. Next, you open the Customer Balance Detail report to confirm that each customer’s transactions are properly linked. Afterward, the General Ledger or Trial Balance report is reviewed to verify that the total AR control account equals the detailed AR list.

In practice, accountants use these reports together to identify the cause of differences. For example, unapplied credits appear in the Customer Balance Detail but not in the AR control account until correctly linked. The Transaction List by Customer and Sales by Customer Summary help track recurring discrepancies or delayed postings.

Implementing reconciliation through these reports ensures internal control over receivables, strengthens audit reliability, and prevents financial misstatements. Many businesses, such as retail stores and consulting firms, rely on this method at month-end to confirm revenue accuracy and maintain trust with clients and investors.

How Can You Fix Common Issues Like AR Invoices Appearing in Bank Reconciliation?

You can fix AR invoices appearing in bank reconciliation in QuickBooks by identifying and removing transactions that were incorrectly categorized as cash or bank activity. This issue occurs when sales invoices are recorded to the wrong account, such as directly to the bank account rather than to Accounts Receivable. The problem creates inflated bank balances and inaccurate receivable totals.

The correction process involves reviewing the transaction’s account assignment. Open the invoice, confirm that the “Deposit To” or “Account” field is set to Accounts Receivable, and not a bank account. Once corrected, re-run the reconciliation window and verify that the invoice no longer appears.

Another frequent cause involves journal entries posted to both the bank account and AR account simultaneously. Accountants can fix this by reversing the entry and posting it correctly. Reports such as the Transaction Detail by Account help isolate the source of the error. According to a 2024 QuickBooks Online Accountant study, nearly 28% of reconciliation discrepancies arise from incorrect account coding. Proper mapping and periodic training for staff minimize such errors over time.

What Role Does the Undeposited Funds Account Play in AR Reconciliation?

The Undeposited Funds account in QuickBooks serves as a temporary holding account that groups multiple customer payments before they are deposited into the bank. Its role in accounts receivable reconciliation is to ensure that payments received from customers match both the AR records and the final bank deposit.

When a payment is received in QuickBooks but not yet deposited, it is posted to Undeposited Funds. This account prevents direct deposits from being overstated or duplicated. During reconciliation, the accountant reviews the Undeposited Funds balance to ensure that every recorded customer payment has been either properly deposited or cleared.

For example, a company receiving five separate payments totaling $5,000 will show those transactions in Undeposited Funds until the combined deposit hits the bank. When reconciled, the AR subledger, Undeposited Funds, and bank register all align. Mismanagement of this account is one of the most common causes of AR discrepancies. By routinely clearing the Undeposited Funds account, accountants maintain accuracy in both receivable and cash balances.

How Do You Verify Customer Balances and Resolve Discrepancies During AR Reconciliation?

You verify customer balances during AR reconciliation in QuickBooks by comparing detailed customer-level reports to the general ledger balance. Start with the Accounts Receivable Aging Summary report to view outstanding balances for each customer. Then, open the Customer Balance Detail report to trace transactions tied to those balances. Compare the totals from both reports to the Accounts Receivable account on the Trial Balance or Balance Sheet.

Discrepancies occur when unapplied credits, duplicate invoices, or data entry errors distort totals. To resolve them, locate the customer profile where the issue exists, review the applied transactions, and correct mismatches. For example, unapplied credits can be linked to the correct invoice through the “Receive Payment” window. Duplicates can be deleted or voided once verified.

A 2023 CPA Journal survey found that consistent reconciliation reduces AR errors by up to 40%, emphasizing its importance for financial accuracy. Businesses in service industries, retail, and B2B sales rely on this process to maintain accurate receivable records and strengthen cash flow management. Once verified, the reconciled customer balances provide confidence for decision-making and reporting integrity.

What Are the Best Tools and Reports for Effective AR Reconciliation in QuickBooks?

The best tools and reports for effective accounts receivable reconciliation in QuickBooks are those that connect transaction-level activity with the general ledger to ensure completeness and accuracy. QuickBooks’ built-in reports, such as the Accounts Receivable Aging Summary, Customer Balance Detail, Transaction List by Customer, and Trial Balance, provide real-time visibility into outstanding receivables. Each report isolates inconsistencies between customer transactions and the AR control account.

The Reconciliation Discrepancy Report helps accountants detect manual adjustments or deletions that create differences between periods. For cash-basis businesses, the Sales by Customer Summary and Open Invoices Report highlight receivables yet to be paid or cleared.

Beyond QuickBooks’ native features, automation tools such as QuickBooks Accountant Toolbox, Numeric.io, and SaaS-based reconciliation add-ons integrate AI-powered matching algorithms that flag anomalies faster than manual reviews. A 2024 QuickBooks survey reported that companies adopting automated reconciliation tools reduced month-end closing time by 35%. Using these tools and reports together creates a robust control environment that ensures accuracy and compliance.

Where Can You Hire an Expert to Handle Accounts Receivable Reconciliation?

You can hire an expert to handle accounts receivable reconciliation through professional accounting service providers that specialize in QuickBooks processes. Skilled professionals can be found through JMAccountingServices, a reliable network that offers certified accountants experienced in managing AR reconciliations, subledger balancing, and audit preparation.

These experts understand how to interpret QuickBooks reports, correct recurring errors, and implement automation tools that streamline reconciliation cycles. Many small businesses, startups, and growing corporations outsource this task to ensure independent review and maintain internal controls.

When selecting a professional, verify their QuickBooks certification, industry familiarity, and ability to prepare reconciliations compliant with Generally Accepted Accounting Principles (GAAP). Contracting an experienced accountant from JMAccountingServices ensures accurate reconciliation, reduces audit risk, and allows business owners to focus on core operations rather than daily ledger maintenance.

How Often Should You Reconcile Accounts Receivable to Maintain Compliance and Cash Flow?

You should reconcile accounts receivable at least monthly to maintain compliance and preserve accurate cash-flow visibility. Monthly reconciliation aligns with standard accounting periods and ensures that financial statements reflect the correct receivable balances before closing. Many high-volume businesses perform weekly reconciliations to identify issues early, while smaller operations with fewer transactions may choose a monthly cycle.

Frequent reconciliation prevents discrepancies from aging into uncollectible errors and supports compliance with GAAP revenue recognition standards. According to a 2023 Accounting Today analysis, companies reconciling receivables monthly report a 25% faster resolution of payment errors compared to those reconciling quarterly.

Timely reconciliations improve working capital management by providing accurate data on customer payment patterns and overdue balances. Regular reviews ensure that revenue, collections, and outstanding receivables remain synchronized with your cash inflows—strengthening both compliance and liquidity.