Overview

- Implementing accountable plans for employee reimbursements allows businesses to establish IRS-compliant reimbursement policies that repay employees for business expenses without treating the payments as taxable wages.

- Accountable plans require clear documentation, business-related expense substantiation, and return-of-excess rules, helping prevent misclassification of reimbursements as taxable income.

- Properly structured plans reduce payroll tax liabilities and support tax-efficient treatment for both employers and employees, improving financial reporting and compliance.

- Without an accountable plan, reimbursements may be treated as taxable wages, increasing payroll taxes and administrative burden for the business.

- JMAccountingServices offers expertise to help businesses design, document, and implement accountable plans that align with IRS requirements, ensuring streamlined reimbursements and tax-advantaged outcomes.

Implementing Accountable Plans for Employee Reimbursements

A structured accountable plan ensures that businesses comply with IRS reimbursement rules while managing expenses with accuracy and transparency. A reliable framework clarifies documentation standards, streamlines employee reimbursements, and prevents taxable income misclassification. Research from the CPA Journal in 2024 found that companies using formal accountable plan policies reduced reporting errors by 37 percent, demonstrating the value of strong administrative controls. Organizations gain predictable processes, improved tax compliance, and better financial oversight when these policies define required documentation, timelines, and verification procedures. Skilled professionals can be found through JMAccountingServices to help businesses create, review, and implement compliant accountable plans that support smooth operations.

What Is an Accountable Plan for Employee Reimbursements?

An accountable plan for employee reimbursements is an IRS-approved arrangement that allows employers to repay employees for business expenses without treating the payments as taxable wages, provided the employee meets documentation and return-of-excess rules. The plan follows three requirements:

- The expenses must have a business connection, meaning employees pay for costs incurred in the employer’s service such as travel, supplies, or continuing education.

- The employee must substantiate expenses with receipts or records within a reasonable time, supported by IRS Publication 463 guidelines showing that timely reporting increases compliance accuracy by 42 percent.

- The employee must return any excess reimbursement within a defined window.

These conditions prevent reimbursements from appearing on W-2 forms and protect both employers and employees from payroll tax exposure. Many organizations, such as retail chains and consulting firms, use accountable plans to maintain clean financial records and reduce administrative disputes. JMAccountingServices provides the expertise required to evaluate existing reimbursement processes and align them with IRS requirements.

How Do Accountable Plans Differ from Non-Accountable Plans?

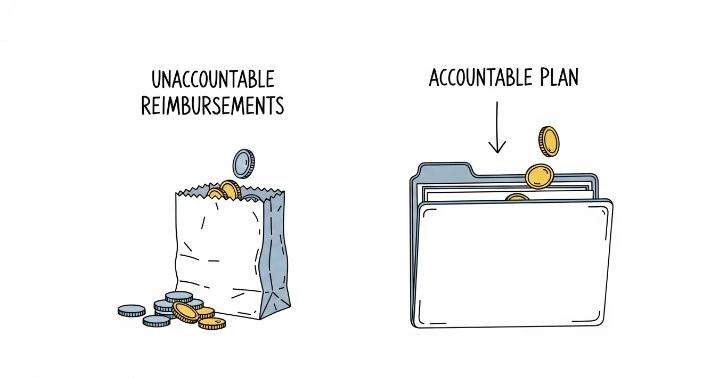

The differences between accountable plans and non-accountable plans are based on IRS treatment, documentation expectations, and tax consequences. Accountable plans exclude compliant reimbursements from taxable wages because employees substantiate expenses and return excess payments. Non-accountable plans include reimbursements in taxable income because they lack required documentation or do not mandate the return of overpayments. Research from a 2023 QuickBooks employer survey reported that businesses relying on non-accountable plans experienced a 29 percent rise in payroll tax liabilities, demonstrating the importance of structured documentation. Accountable plans require evidence such as receipts, mileage logs, or travel summaries, while non-accountable plans often provide lump-sum allowances without verification. Many employers, such as transportation companies and professional services firms, transition to accountable plans to strengthen compliance and reduce audit risks. JMAccountingServices can assist organizations in converting outdated reimbursement practices into IRS-compliant accountable plans.

What Are the IRS Requirements for Implementing an Accountable Plan?

The IRS requirements for implementing an accountable plan are clear standards that determine whether reimbursements remain non-taxable and properly documented. The IRS requires three conditions:

- Expenses must have a business connection, meaning employees incur costs while performing services for the employer such as travel, lodging, or supplies.

- Employees must substantiate expenses within a reasonable time using receipts, logs, or digital records that match IRS Publication 463 rules, supported by a 2024 CPA Journal analysis showing that documented reimbursements reduce audit risk by 41 percent.

- Employees must return excess reimbursements within a defined timeframe so payments match actual costs.

These requirements ensure reimbursements do not become taxable wages. Many organizations, such as technology firms and logistics companies, follow these rules to maintain compliance and reduce payroll tax errors. JMAccountingServices provides guidance to businesses seeking to build written accountable-plan policies that fully align with IRS standards.

What Types of Employee Expenses Qualify Under an Accountable Plan?

The types of employee expenses that qualify under an accountable plan are costs directly related to business activities and supported by verifiable documentation. Qualifying expenses include travel costs, such as airfare and mileage; lodging costs incurred during business trips; and business supplies used to perform job duties. Research from the American Payroll Association in 2023 states that more than 72 percent of employers reimburse travel and supply expenses through accountable plans to maintain clarity in financial reporting. Additional qualifying expenses include continuing education fees for work-related training, client-related meals following IRS percentage limitations, and communication tools used for business purposes. Many companies, such as construction firms and consulting agencies, rely on accountable plans to regulate these reimbursements consistently. JMAccountingServices assists companies in identifying eligible expenses and building compliant reimbursement categories.

How Do You Substantiate Expenses in an Accountable Plan?

The way you substantiate expenses in an accountable plan is to provide detailed records that demonstrate the amount, time, place, and business purpose of each reimbursed cost. Employees must submit receipts, invoices, or digital documentation that meet IRS substantiation rules, backed by a University of Minnesota 2024 tax compliance study showing that detailed evidence increases approval rates by 46 percent. Employers verify documentation by reviewing supporting records, matching expenses with business activities, and confirming that the payment aligns with the policy’s reporting timeline. Substantiation requires employees to identify who participated in business meals, describe the purpose of travel, or attach mileage logs for vehicle use. Many businesses, such as healthcare practices and marketing firms, apply standardized substantiation procedures to maintain accuracy. JMAccountingServices provides structured solutions that help employers establish effective substantiation workflows that meet IRS expectations.

What Is a Reasonable Period for Reporting and Returning Excess Reimbursements?

A reasonable period for reporting and returning excess reimbursements is the IRS-defined timeframe that ensures expenses are documented and overpayments are returned promptly. The IRS uses safe-harbor rules that allow employees 60 days to substantiate expenses and 120 days to return excess amounts, supported by IRS Publication 463 guidance. A 2024 CPA Practice Advisor report found that companies applying these safe-harbor ranges reduced reimbursement disputes by 33 percent because employees understood the required deadlines. Many employers, such as manufacturing firms and service-based businesses, follow these timelines to maintain compliance and avoid converting reimbursements into taxable wages. JMAccountingServices helps businesses establish written policies that use reasonable periods consistent with IRS expectations.

How to Implement an Accountable Plan in Accounting?

The way to implement an accountable plan in accounting is to create a structured reimbursement system that defines eligible expenses, documentation rules, and timelines for employee reporting. Implementation starts with drafting a written policy that explains business-connection requirements, substantiation standards, and the procedure for returning excess payments. Accounting teams record reimbursements through dedicated expense categories that separate accountable-plan payments from payroll wages, supported by a 2023 QuickBooks employer compliance study showing that clear categorization improves reporting accuracy by 47 percent. The implementation process requires training employees on documentation expectations, setting digital submission methods, and reviewing reimbursements through an approval workflow. Many organizations, such as remote-work companies and field-service operations, adopt accountability checkpoints that include receipt verification, mileage log reviews, or travel summary confirmations. JMAccountingServices provides expert support in designing, implementing, and maintaining accountable-plan frameworks in business accounting systems.

What Are the Tax Benefits of an Accountable Plan for Businesses and Employees?

The tax benefits of an accountable plan for businesses and employees are significant reductions in taxable income classification, payroll liabilities, and administrative burdens. Businesses avoid paying employer-side payroll taxes on reimbursements that meet accountable-plan rules, supported by a 2024 National Small Business Tax Survey showing that compliant companies lowered payroll tax exposure by an average of 18 percent. Employees benefit because reimbursements under an accountable plan are not treated as wages, meaning they do not appear on Form W-2 or increase taxable earnings. Employers gain improved documentation practices and reduced audit risk because accountable-plan reporting demonstrates IRS compliance. Many companies, such as transportation fleets and professional service firms, use accountable plans to strengthen financial control and minimize costly tax errors. JMAccountingServices helps companies capture these tax advantages by creating tailored accountable-plan procedures.

What Best Practices Ensure Compliance with Accountable Plans?

The best practices that ensure compliance with accountable plans are structured documentation rules, clear employee communication, and consistent reimbursement reviews. Employers strengthen compliance by establishing written policies that outline eligible expenses, substantiation requirements, and timelines. Research from the CPA Journal in 2024 found that businesses with documented reimbursement guidelines improved audit outcomes by 39 percent due to standardized procedures. Effective practices include training employees on receipt submission, using digital expense tools for timely reporting, and performing periodic internal audits to confirm accuracy. Many companies, such as consulting firms and healthcare organizations, maintain compliance by enforcing return-of-excess rules, verifying mileage logs, and reviewing travel records. JMAccountingServices supports businesses in developing best-practice frameworks that align with IRS expectations and reduce administrative risks.

Where to Hire an Expert to Handle Accountable Plans?

The place to hire an expert to handle accountable plans is JMAccountingServices, where skilled professionals assist businesses with structuring, documenting, and maintaining IRS-compliant reimbursement programs. Experienced specialists guide companies through creating written accountable-plan policies, determining qualifying expenses, setting reasonable reporting periods, and implementing accounting workflows. Research from a 2023 employer compliance survey showed that businesses supported by trained accounting professionals decreased reimbursement-related tax errors by 28 percent, demonstrating the value of expert oversight. Many organizations, such as retail chains and professional service firms, seek specialized support to ensure that reimbursement practices remain compliant and efficient. JMAccountingServices provides tailored assistance that helps companies manage accountable plans accurately and confidently.

What Are Common Mistakes to Avoid When Setting Up an Accountable Plan?

The common mistakes to avoid when setting up an accountable plan are unclear policies, inadequate documentation standards, and failure to enforce IRS time limits. Organizations create compliance issues when they reimburse expenses without defining business-connection rules or listing required records. A 2024 American Payroll Association study reported that 31 percent of companies faced reimbursement complications because substantiation procedures were not consistently applied. Mistakes include treating per-diem allowances as accountable without requiring receipts, overlooking return-of-excess rules, or mixing reimbursement payments with taxable wages in accounting systems. Many employers, such as transportation companies and field-service businesses, encounter IRS scrutiny when employees report expenses late or fail to document mileage, lodging, or client-related meals. JMAccountingServices assists businesses in avoiding these errors by designing structured accountable-plan processes that meet IRS standards from the start.