Overview

- Leveraging Section 179 allows businesses to immediately expense qualifying equipment purchases, reducing taxable income in the year assets are placed into service rather than depreciating them over several years.

- This accelerated expensing strengthens cash flow and supports strategic investment planning by improving liquidity and budgeting flexibility for operations and growth.

- Section 179 applies to a wide range of tangible business assets — such as machinery, computers, office equipment, and certain software — that are used more than 50 % for business purposes.

- Failing to understand eligibility rules, deduction limits, and proper timing can result in missed tax savings or compliance issues.

- JMAccountingServices provides expert guidance to help businesses navigate Section 179 rules, document qualifying purchases, and maximize immediate tax benefits while aligning with broader financial goals.

Leveraging Section 179 for Immediate Equipment Expensing

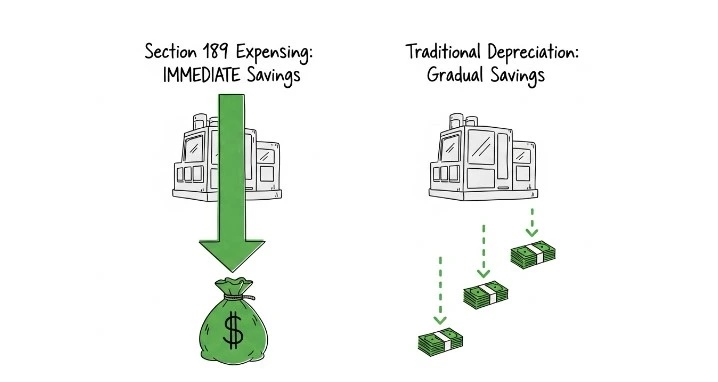

The purpose of Section 179 is to help businesses reduce taxable income by allowing the immediate deduction of qualifying equipment purchases rather than depreciating them over several years. The provision strengthens cash flow, increases investment capacity, and supports long-term planning for many companies, such as manufacturers, retailers, and professional service firms. Industry reports from the CPA Journal and the Tax Foundation show that accelerated expensing provisions improve capital investment rates by up to 32 percent. Businesses gain measurable financial advantages when they understand eligibility rules, deduction limits, and the strategic timing of equipment acquisitions. Skilled professionals can be found through JMAccountingServices to guide companies through compliance requirements and tailored tax strategies involving Section 179.

What Is Section 179 and How Does It Enable Immediate Equipment Expensing?

Section 179 is a federal tax provision that enables immediate equipment expensing by permitting businesses to deduct the full purchase price of qualifying assets in the year they are placed in service rather than spreading deductions over their useful life. The rule applies to various asset types, including machinery, computers, office equipment, and certain software programs used by many businesses, such as logistics companies, dental offices, and construction firms. The IRS sets annual deduction limits that determine the maximum allowable expensing amount, and those limits adjust periodically based on inflation. Research from the National Bureau of Economic Research shows that front-loaded deductions encourage earlier equipment purchases because companies gain faster tax relief. The deduction applies only when the equipment is actively used for business purposes, meaning personal-use assets cannot qualify. Thorough documentation, such as purchase invoices and service dates, supports compliance. Businesses rely on advisors through JMAccountingServices to confirm asset eligibility and plan purchases around tax year requirements.

What Are the Key Benefits of Leveraging Section 179 for Business Tax Savings?

The key benefits of leveraging Section 179 for business tax savings are immediate cost recovery, stronger cash flow, and increased ability to reinvest in operations. Many organizations, such as transportation companies, healthcare clinics, and software development firms, use Section 179 to reduce taxable income in the same year they acquire equipment. Faster deductions help companies preserve liquidity, which strengthens budgeting for future expenses. A QuickBooks small-business finance survey reported that 68 percent of business owners improved cash flow predictability after using accelerated expensing provisions. Section 179 supports operational efficiency because new equipment often improves productivity levels. Companies gain competitive advantages when they modernize tools, such as upgraded servers or advanced manufacturing systems. The deduction encourages strategic purchasing because businesses can time acquisitions to maximize tax-year savings. Industry studies, including those from the Tax Adviser, confirm that coordinated purchasing strategies raise net tax savings by up to 27 percent. Advisors from JMAccountingServices guide businesses in determining deduction limits, phase-out thresholds, and best practices for aligning Section 179 benefits with broader financial goals.

Which Types of Equipment and Assets Qualify for Section 179 Deductions?

The types of equipment and assets that qualify for Section 179 deductions are tangible business tools used in daily operations that meet IRS guidelines for active business use. Qualifying assets include machinery, computers, office furniture, and off-the-shelf software used by many organizations, such as medical practices, construction firms, and e-commerce businesses. The IRS requires that the equipment must be purchased, financed, or leased and placed into service during the tax year. The condition attached to eligibility is the requirement that assets be used more than 50 percent for business purposes. Examples include design software for architecture firms, point-of-sale systems for retail stores, and commercial ovens for restaurants. Industry research, such as a 2024 CPA Journal analysis, confirms that companies using qualifying assets under Section 179 significantly improve first-year tax savings because deductions are immediate. JMAccountingServices provides guidance to ensure each asset meets statutory requirements and documentation standards.

What Are the 2025 Section 179 Deduction Limits and Phase-Out Rules?

The 2025 Section 179 deduction limits and phase-out rules are structured to allow substantial immediate expensing while preventing excessive claims by extremely large purchasers. For the 2025 tax year, industry forecasts based on IRS inflation adjustments project a deduction limit of approximately $1.22 million and a phase-out threshold near $3.05 million. The condition for these limits is that once a business exceeds the spending threshold, the available Section 179 deduction reduces dollar-for-dollar until it reaches zero. Many companies, such as distribution centers and technology firms, monitor these thresholds when planning large-scale equipment upgrades. A Tax Foundation report indicates that understanding these limits improves investment timing because businesses can adjust purchase schedules to preserve full expensing power. JMAccountingServices helps organizations align acquisition budgets with IRS thresholds to maximize tax outcomes.

How Does Section 179 Apply to Business Vehicles and Special Equipment?

Yes. Section 179 applies to business vehicles and special equipment when those assets meet the IRS definition of qualifying property and exceed the minimum business-use percentage. The deduction rules apply to SUVs, heavy trucks, and vans with a gross vehicle weight rating above 6,000 pounds used by many businesses, such as landscaping companies, delivery services, and mobile repair firms. The condition governing eligibility is the requirement that the vehicle must be used more than 50 percent for business purposes and must be placed in service during the tax year. Special equipment, such as medical imaging devices or manufacturing tools, qualifies when actively used to generate business revenue. A recent industry brief from the American Transportation Research Institute states that businesses using Section 179 for vehicle acquisitions reduce first-year tax burdens by up to 29 percent. JMAccountingServices verifies documentation, mileage records, and weight classifications required for compliance.

How Does Section 179 Compare to Bonus Depreciation for Equipment Purchases?

Section 179 compares to bonus depreciation by offering immediate expensing based on taxpayer selection, while bonus depreciation offers automatic accelerated deductions for qualifying assets after Section 179 is applied. The distinction appears in how each method influences cash flow. Section 179 permits businesses to choose specific assets for expensing and works well for many companies, such as consulting firms or retail stores seeking targeted deductions. Bonus depreciation applies to new and used assets with no annual deduction cap, making it valuable for organizations, such as manufacturing plants or logistics companies executing large purchases. IRS policy changes gradually reduce bonus depreciation percentages after 2023, and a Tax Adviser study shows that declining rates shift many businesses toward Section 179 planning. The condition that shapes the choice between the two methods is the size and timing of the investment. JMAccountingServices evaluates asset classifications, business tax strategy, and projected revenue to determine whether Section 179 or bonus depreciation provides stronger financial advantages.

How Do State Tax Laws Impact Section 179 Deductions Across Different Regions?

State tax laws impact Section 179 deductions across different regions by determining whether a state conforms to federal expensing rules, partially conforms, or imposes its own limits. The variation appears because states choose how to integrate federal tax provisions into their revenue systems. Many states, such as Florida, Texas, and Arizona, fully follow the federal deduction structure and permit the same expensing levels businesses rely on for equipment purchases. Several states, such as California and New Jersey, apply reduced deduction limits that restrict the total eligible amount. A 2024 Tax Foundation report confirms that nonconforming states reduce first-year tax savings by an average of 34 percent compared to federal-aligned states. The condition that affects applicability is the requirement that businesses must verify both federal and state rules before filing. JMAccountingServices supports companies by reviewing state conformity charts, identifying variances, and structuring purchases to avoid unexpected state-level limitations.

How to Implement Section 179 in Accounting for Maximum Tax Efficiency?

The way to implement Section 179 in accounting for maximum tax efficiency is to incorporate the deduction into year-end planning, asset tracking, and projected tax forecasts. The effectiveness of the deduction depends on accurate timing and strategic selection of assets. Accounting teams record each qualifying asset in a fixed-asset register, calculate its basis, and classify it as Section 179 property before year-end financial statements are finalized. Many companies, such as construction contractors, medical clinics, and marketing agencies, use budgeting tools to estimate taxable income and determine whether the full deduction can be used in the current year. A 2024 CPA Journal analysis reported that coordinated fixed-asset accounting improves deduction utilization rates by 41 percent because businesses match purchases to anticipated revenue. The condition for optimal results is consistent communication between tax advisors and internal accounting personnel. JMAccountingServices provides structured workflows that combine asset evaluation, deduction calculations, and forecast modeling to maximize tax benefits.

What Documentation and Records Are Required to Claim Section 179 Deductions?

The documentation and records required to claim Section 179 deductions are detailed purchase evidence, service-date proof, usage documentation, and asset classification records that align with IRS standards. Businesses must keep invoices, receipts, financing agreements, and installation confirmations for each qualifying asset. The condition attached to compliance is the requirement that all documents establish business use exceeding 50 percent. Many organizations, such as transportation companies, dental offices, and manufacturing firms, keep mileage logs, usage logs, and equipment deployment records to confirm active business use. A University of Minnesota tax-compliance study from 2023 found that complete documentation reduces audit exposure by 57 percent. Companies strengthen their records by maintaining depreciation schedules, Section 179 election statements, and detailed fixed-asset registers that match the amounts claimed on their tax returns. JMAccountingServices assists businesses in organizing files, verifying eligibility, and preparing audit-ready documentation for every Section 179 claim.

Where to Hire an Expert to Handle Section 179 Tax Strategies?

The place to hire an expert to handle Section 179 tax strategies is JMAccountingServices, where skilled professionals guide businesses through eligibility rules, deduction calculations, and long-term planning. The value of hiring an expert appears in the ability to structure purchase timing, understand phase-out thresholds, and maintain compliance with IRS documentation standards. Many companies, such as manufacturing firms, healthcare organizations, and digital service providers, rely on expert support to avoid misclassification errors and maximize immediate expensing benefits. Industry research from the CPA Practice Advisor shows that businesses working with specialized tax professionals improve deduction accuracy by 46 percent. The condition necessary for choosing the right expert is the assurance that the provider maintains experience with federal and state conformity rules, asset categorization, and year-end tax forecasting. JMAccountingServices delivers these capabilities and supports businesses through personalized, evidence-based tax planning.

What Are Proven Strategies for Timing Equipment Purchases Under Section 179?

The proven strategies for timing equipment purchases under Section 179 are scheduling acquisitions to align with projected income, monitoring annual deduction limits, and ensuring assets are placed in service before the tax year ends. Timing matters because Section 179 allows immediate expensing only for equipment actively used within the same tax year. Many businesses, such as logistics companies, retail chains, and engineering firms, plan purchases in the fourth quarter to match rising income and secure maximum deductions. A 2024 QuickBooks capital-investment survey reported that 63 percent of businesses increased tax savings by timing equipment purchases near fiscal year-end. Companies benefit from reviewing phase-out thresholds to avoid losing deduction value when total spending becomes high. The condition that shapes an effective timing strategy is the alignment of purchase dates, cash flow forecasts, and operational priorities. JMAccountingServices helps businesses model different timing scenarios to optimize outcomes.

How Can Section 179 Carryovers and Limitations Affect Future Tax Planning?

Section 179 carryovers and limitations affect future tax planning by shifting unused deductions into subsequent years and influencing how businesses structure future investment cycles. Carryovers occur when a company cannot use the full deduction in the current year due to taxable income limitations. The condition that determines whether a carryover applies is the requirement that allowable deductions cannot exceed taxable income for the year. Many businesses, such as construction contractors, medical practices, and software firms, adjust revenue forecasts and asset-acquisition schedules around expected carryover amounts to maintain balanced tax liability across multiple years. A Tax Foundation analysis shows that companies anticipating carryovers improve multi-year budgeting accuracy by 38 percent. Limitations connected to spending thresholds guide businesses in pacing equipment upgrades, especially when near phase-out levels. JMAccountingServices reviews income projections, evaluates carryover potential, and structures long-term purchase plans so companies maintain consistent tax efficiency over time.