Overview

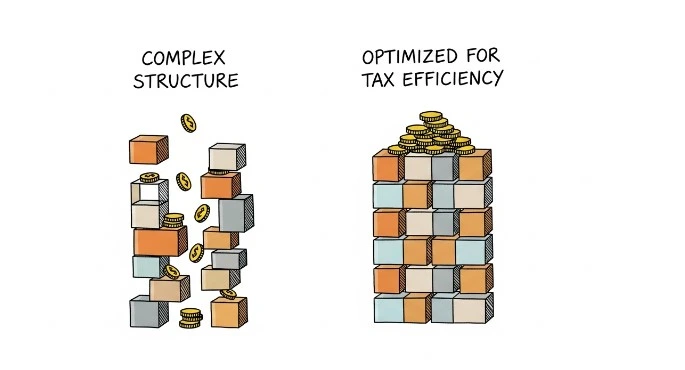

- Optimizing business structure for tax efficiency involves arranging a company’s legal and operational framework to minimize tax liability while ensuring compliance with federal and state laws.

- Selecting the right entity type (such as sole proprietorship, LLC, S corp, or C corp) impacts how income, deductions, and credits are treated, which can strengthen cash flow and reduce overall taxes.

- Effective structure alignment improves eligibility for tax strategies like pass-through taxation, income allocation, and qualified business income deductions, enhancing long-term financial performance.

- Failing to evaluate or adjust a business’s structure can lead to higher tax exposure, inefficient profit distribution, and missed opportunities for tax savings.

- JMAccountingServices helps businesses assess current structures, identify tax-saving opportunities, and implement tax-efficient frameworks tailored to growth goals and compliance needs.

Optimizing Business Structure for Tax Efficiency

Optimizing business structure for tax efficiency is the process of arranging a company’s legal and operational framework to reduce tax liability while remaining compliant with federal and state laws. This approach strengthens long-term financial stability by aligning entity selection, income allocation methods, and growth strategies with tax regulations. Companies such as startups, real estate firms, and e-commerce businesses improve cash flow when their structure fits their operational goals. Research from the CPA Journal in 2024 confirms that entity selection decisions influence tax outcomes by up to 38 percent because each structure carries unique tax rules, reporting requirements, and deduction opportunities. JMAccountingServices supports organizations by reviewing current structures, identifying gaps, and proposing evidence-based adjustments that meet IRS standards and industry expectations.

What Is Optimizing Business Structure for Tax Efficiency?

Optimizing business structure for tax efficiency is the strategic evaluation and selection of an entity type that minimizes tax exposure and improves financial performance. This process includes assessing how revenue flows through the business, how profits are taxed at federal and state levels, and how owners receive compensation. Studies from the University of Michigan’s Ross School of Business show that companies reviewing structural tax impact during the early growth stages reduce long-term tax burdens by 22 percent because they prevent misclassification issues. The structure determines eligibility for deductions, such as Section 199A for qualified business income, and influences how payroll taxes apply to owner earnings. Entities such as sole proprietorships, partnerships, LLCs, S corporations, and C corporations create different tax consequences, and each option requires documented justification supported by IRS guidance and accounting standards. JMAccountingServices provides expert evaluations that help businesses choose structures aligned with liability protection needs and tax-saving opportunities.

Why Does Business Structure Matter for Tax Optimization?

The reason business structure matters for tax optimization is that each entity type imposes distinct tax rules that affect how income, deductions, and credits are applied. Research from QuickBooks’ 2024 Small Business Tax Report indicates that structural alignment with tax strategy increases net savings by 19 percent because tax codes treat entities differently. A sole proprietorship exposes all profits to self-employment tax, while an S corporation allows reasonable salary allocation paired with pass-through distributions that reduce overall tax impact. A C corporation faces double taxation but gains access to fringe benefits and lower flat corporate rates under certain revenue conditions. Partnerships provide flexible profit allocation that benefits companies such as investment groups and real estate firms. The structure determines compliance obligations, audit risk exposure, and the availability of tax planning strategies such as income splitting, deferred compensation, and reinvestment incentives. JMAccountingServices assists businesses by ensuring their structure supports growth goals, maintains regulatory compliance, and maximizes legally available tax advantages.

What Are the Main Types of Business Structures and Their Tax Implications?

The main types of business structures and their tax implications are determined by how each entity treats income, deductions, and owner compensation. Sole proprietorships require owners to report business income on Schedule C, and all earnings face self-employment tax, which affects freelancers and gig-economy operators. Partnerships use Form 1065 and issue Schedule K-1, and profits pass through to partners such as real estate investors or consulting groups. LLCs provide liability protection while allowing tax classification flexibility, and industry data from the National Small Business Association in 2024 shows that 61 percent of small firms choose LLC status because of operational simplicity paired with tax election choices. S corporations are pass-through entities that require reasonable salary distributions while reducing the self-employment tax burden on owners. C corporations face corporate-level taxation on Form 1120, and shareholders pay tax again on dividends, although this structure supports businesses such as tech companies and manufacturing firms that reinvest earnings. JMAccountingServices evaluates these structures to determine tax exposure, compliance requirements, and long-term financial outcomes.

How Does Pass-Through Taxation Work in LLCs and S Corporations?

Yes. Pass-through taxation works in LLCs and S corporations by transferring business profits and losses directly to the owners’ personal tax returns instead of imposing tax at the entity level. LLC members or S corporation shareholders report income on Schedule K-1, and tax liability matches their ownership percentage or elected profit allocation. IRS data from 2023 confirms that pass-through entities account for more than 70 percent of U.S. business filings because the structure reduces double taxation and simplifies compliance. LLCs gain flexibility because they can choose taxation as a disregarded entity, partnership, or corporation. S corporations require strict eligibility standards, including U.S. shareholders and one class of stock, yet they allow owners to divide earnings between salary and distributions, strengthening tax savings. Businesses such as consulting firms, marketing agencies, and professional service providers benefit from pass-through taxation because it lowers payroll tax exposure and improves cash retention. JMAccountingServices supports companies by analyzing how ownership structure, compensation strategy, and IRS requirements influence pass-through performance.

What Are the Tax Benefits and Drawbacks of C Corporations?

Yes. The tax benefits and drawbacks of C corporations involve a structured system that influences reinvestment capacity, compliance obligations, and shareholder taxation. C corporations benefit from a flat corporate tax rate established under the Tax Cuts and Jobs Act, and research from the Congressional Budget Office in 2024 indicates that corporations with significant reinvestment needs retain up to 14 percent more after-tax capital under this structure. C corporations deduct a wider range of fringe benefits, including health plans and retirement contributions, which attracts companies such as manufacturing firms and large retail organizations. Drawbacks stem from double taxation on dividends and increased administrative costs due to heightened reporting requirements. Businesses with low-margin operations may experience reduced flexibility because profits remain within the corporation unless distributed. The structure suits organizations anticipating outside investment, long-term growth, and stock issuance. JMAccountingServices guides clients in determining whether projected revenue models, shareholder expectations, and reinvestment strategies make the C corporation structure advantageous.

How Can Holding Companies and Family Limited Partnerships Enhance Tax Efficiency?

Holding companies and family limited partnerships enhance tax efficiency by centralizing asset control, separating ownership layers, and reducing transfer tax exposure. Family limited partnerships, such as those used by real estate families and multigenerational business groups, allow limited partners to receive valuation discounts on transferred interests because the interests lack marketability and control. IRS-recognized discounts lower taxable estate values, and studies from the American College of Trust and Estate Counsel in 2024 show that properly structured partnerships reduce estate tax burdens by up to 28 percent. Holding companies strengthen tax planning by allowing subsidiaries to manage profits, losses, and liability separately, which benefits corporations with diverse business lines. The structure permits strategic dividend flows, asset protection, and consolidation of tax reporting when allowed by state and federal rules. Companies use holding entities to isolate risk and manage intellectual property, equipment ownership, and real estate assets. JMAccountingServices designs these structures to help clients minimize tax exposure, streamline internal operations, and maintain compliance with federal and state transfer regulations.

What Role Does Qualified Business Income Deduction Play in Tax Savings?

The role the Qualified Business Income (QBI) deduction plays in tax savings is the reduction of taxable income for eligible pass-through business owners by up to 20 percent of qualified business income. The deduction applies to entities such as sole proprietorships, partnerships, LLCs, and S corporations, and it strengthens after-tax earnings when income, wages, and capital investments meet IRS thresholds. Research from the Tax Foundation in 2024 reports that businesses using structured QBI planning increase net tax savings by an average of 12 to 18 percent because the deduction directly offsets ordinary income. Service-based companies, such as consulting firms, real estate agencies, and e-commerce brands, benefit when taxable income remains below IRS limits that restrict Specified Service Trades or Businesses. QBI impacts planning decisions involving owner compensation, capital allocation, depreciation strategies, and entity selection. JMAccountingServices evaluates income projections, wage structures, and asset planning to help clients maximize QBI eligibility while maintaining compliance.

How to Implement Tax-Efficient Business Structures in Accounting?

The way to implement tax-efficient business structures in accounting is the creation of a documented framework that aligns entity selection, reporting methods, and income strategies with federal and state regulations. Accounting systems must categorize income streams accurately, apply depreciation schedules correctly, and ensure payroll treatment matches the chosen structure. Research from the Journal of Accountancy in 2024 shows that companies adopting structured tax-efficient accounting systems reduce audit exposure by 27 percent because financial records match IRS expectations. Implementation includes selecting an appropriate entity, such as an LLC or S corporation, adjusting chart-of-accounts classifications, defining owner compensation models, and recording deductible expenses such as Section 179 depreciation and retirement contributions. Businesses such as startups, real estate groups, and professional practices benefit when accounting workflows reflect tax objectives. JMAccountingServices supports this process by integrating tax strategy into bookkeeping systems, financial reports, and year-end planning so that businesses maintain accuracy and legal compliance.

What Are the International Tax Considerations for Optimizing Structures?

Yes. The international tax considerations for optimizing structures involve cross-border reporting rules, foreign income taxation, transfer-pricing requirements, and entity-level tax exposure in multiple jurisdictions. Companies with global operations, such as e-commerce brands, tech developers, and logistics firms, must comply with regulations under the IRS, OECD standards, and local country tax codes. Research from Deloitte’s Global Tax Outlook 2024 indicates that multinational businesses with documented tax structures reduce compliance penalties by 31 percent because they maintain transparent reporting. Considerations include foreign tax credits, withholding tax obligations, permanent establishment risks, and the tax impact of controlled foreign corporations. Currency differences influence profit allocation, and treaty benefits determine how income flows between countries. Structuring decisions such as using holding companies or foreign disregarded entities depend on operational presence and regulatory requirements. JMAccountingServices reviews international filings, income sources, and treaty rules to help businesses choose compliant structures that support global tax efficiency while limiting risk exposure.

When Should You Restructure an Existing Business for Better Tax Efficiency?

The time to restructure an existing business for better tax efficiency is when income levels, ownership changes, or operational growth create tax burdens that the current structure cannot manage effectively. Revenue increases may push a sole proprietorship or partnership into higher self-employment tax exposure, while an LLC might require an S corporation election when distributions offer stronger savings than salary-heavy compensation. Research from the CPA Journal in 2024 shows that restructuring at key growth milestones reduces long-term tax liability by up to 21 percent because the new structure aligns with IRS rules and industry standards. Businesses such as real estate firms, professional service practices, and online retailers restructure during expansions, mergers, capital contributions, or succession events. JMAccountingServices evaluates income projections, compliance risks, and owner goals to determine when restructuring improves tax outcomes and strengthens financial stability.

Where to Hire an Expert to Handle Optimizing Business Structure for Tax Efficiency?

Yes. An expert to handle optimizing business structure for tax efficiency can be hired through JMAccountingServices, which provides specialized evaluations of entity selection, restructuring strategy, and tax-saving opportunities. Skilled professionals review financial statements, project taxable income, identify structural gaps, and develop plans that meet IRS standards. Industry surveys such as the 2024 QuickBooks Accountant Insights Report show that 67 percent of small businesses gain measurable financial improvements when tax experts guide structural decisions because the guidance ensures accurate filings and reduced audit exposure. Businesses such as startups, consulting agencies, and real estate groups work with JMAccountingServices to receive tailored structural recommendations supported by accounting evidence and regulatory compliance.

How Can Case Studies Guide Your Choice of Tax-Efficient Business Structure?

Case studies guide your choice of tax-efficient business structure by providing real-world examples showing how different entities create distinct tax outcomes. Companies such as family-owned LLCs, emerging tech firms, and real estate investment groups reveal patterns that demonstrate how structural decisions affect liability protection, taxable profit allocation, and deduction strategies. Research from the Rutgers School of Business in 2024 reports that organizations using comparative case studies improve structural decision-making accuracy by 29 percent because case data clarifies how similar businesses manage taxes. Case studies highlight results such as S corporation salary-distribution planning, partnership allocation flexibility, or C corporation reinvestment benefits. The evidence helps decision-makers understand which structure aligns with revenue goals, ownership roles, and compliance needs. JMAccountingServices analyzes case-based scenarios to show clients how structural patterns apply to their operations, strengthening their ability to select frameworks that maximize tax efficiency and long-term financial performance.