Taxation shapes economies and individual lives, with terms like tax evasion and tax avoidance often sparking confusion. This article clarifies these concepts, exploring their meanings and legal differences. Understanding these distinctions helps taxpayers navigate federal income tax laws, avoid legal pitfalls, and make informed financial decisions.

What do “tax avoidance” and “tax evasion” actually mean?

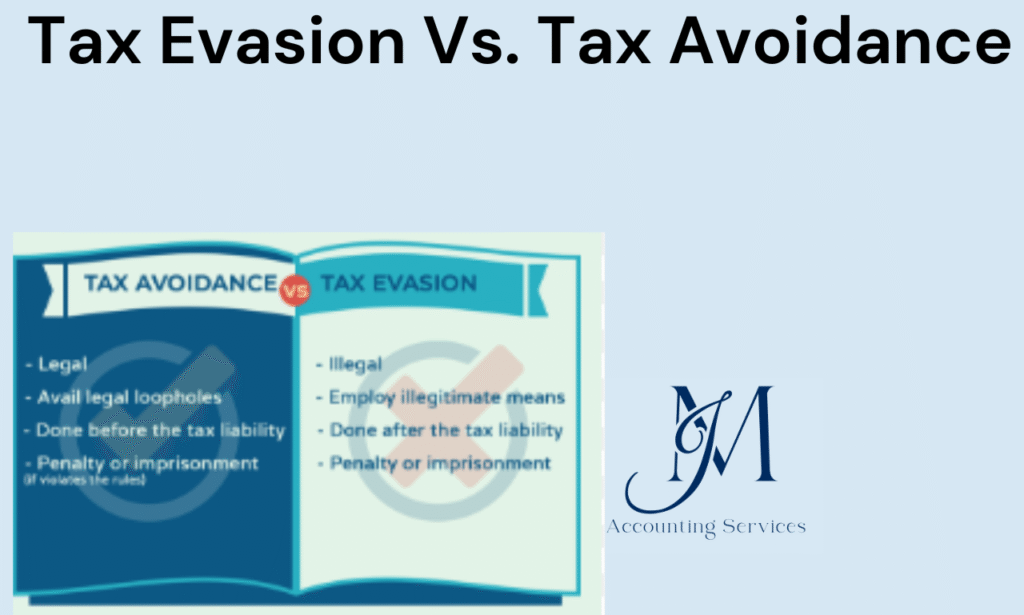

Tax avoidance refers to legal strategies that minimize tax liability within the boundaries of federal tax laws. Taxpayers use deductions, credits, and exemptions to reduce their federal income tax. For example, claiming a mortgage interest deduction or contributing to a retirement account lowers taxable income legally. A 2023 study from the University of Chicago’s Economics Department found that 78% of U.S. taxpayers engage in some form of tax avoidance, such as maximizing deductions, to lower their tax burden.

Tax evasion, in contrast, involves illegal actions to escape paying taxes owed. This includes underreporting income, falsifying deductions, or hiding assets. The IRS estimates that tax evasion costs the U.S. government $400 billion annually in lost revenue, with 15% of taxpayers admitting to minor misreporting in a 2024 survey by the National Bureau of Economic Research.

How does legality differ between avoidance and evasion?

Tax avoidance is legal, while tax evasion is not. Tax avoidance leverages provisions in the federal tax code to reduce tax liability. Taxpayers can claim legitimate deductions, such as business expenses or charitable contributions, to lower their federal income tax. A 2022 report from the Tax Policy Center noted that 90% of small businesses use legal tax avoidance strategies, like writing off equipment costs, to minimize taxes. These actions comply with IRS regulations and face no penalties.

Tax evasion, however, violates federal tax laws through fraudulent means. Underreporting income, inflating deductions, or using offshore accounts to hide revenue are common evasion tactics. The IRS imposes severe penalties for evasion, including fines up to $250,000 and imprisonment for up to seven years. A 2024 study from Stanford University’s Law School highlighted that 10% of audited taxpayers faced evasion charges due to unreported cash income, underscoring the legal risks. Taxpayers can stay compliant by consulting a tax expert or using services like JMAccountingServices.com to ensure accurate tax returns.

Why is tax avoidance encouraged while evasion is penalized?

Tax avoidance is encouraged because it operates within federal tax laws, promoting economic activity and compliance. Governments design tax codes with incentives like deductions and credits to encourage behaviors such as home ownership or charitable giving. A 2023 study from the University of Pennsylvania’s Wharton School found that 82% of taxpayers who used legal avoidance strategies, like retirement contributions, boosted local economies by reinvesting savings. These incentives reduce federal income tax legally, aligning with policy goals.

Tax evasion, however, is penalized because it undermines public revenue through illegal means. Evasion deprives the government of funds for services like infrastructure and healthcare, costing $400 billion annually, per a 2024 IRS report. Penalties, including fines up to $250,000 or seven years in prison, deter fraudulent acts like underreporting income, ensuring fairness in the tax system.

Which legal tools count as tax avoidance?

Legal tools for tax avoidance include deductions, credits, exemptions, and deferrals allowed under federal tax laws.

- Deductions reduce taxable income for expenses like mortgage interest or business costs. For example, a small business owner deducting equipment purchases lowers their tax liability.

- Tax credits, such as the Earned Income Tax Credit, directly reduce taxes owed. A 2022 Tax Policy Center study noted that 25% of low-income families benefit from this credit annually.

- Exemptions exclude specific income types, like municipal bond interest, from taxation.

- Deferrals, such as contributions to 401(k) plans, postpone taxes to future years. According to a 2024 report from the Brookings Institution, 65% of middle-class taxpayers use retirement accounts for tax deferral. These tools, when used correctly, comply with IRS rules and help taxpayers manage federal tax brackets effectively. Consulting a tax expert from JMAccountingServices.com ensures proper application.

What are common evasion tactics that cross the line?

Common tax evasion tactics include:

- Underreporting income

- Inflating deductions

- Hiding assets,

All of the above tactics violate federal tax laws. Underreporting income occurs when taxpayers fail to declare cash earnings, such as tips or freelance payments. A 2024 study from the National Bureau of Economic Research found that 12% of audited taxpayers underreported cash income by an average of $10,000.

Inflating deductions involves claiming false expenses, like nonexistent business costs. Hiding assets, such as transferring money to unreported bank accounts, conceals wealth from the IRS. The IRS detected $50 billion in hidden assets in 2023, per a Treasury Department report. These illegal tactics trigger audits, fines, and potential imprisonment, unlike legal tax avoidance strategies that align with the tax code.

How do offshore strategies fit into avoidance vs. evasion?

Offshore strategies can be legal tax avoidance or illegal tax evasion, depending on their execution. Legal offshore tax avoidance involves using foreign accounts or investments within IRS regulations, such as reporting foreign income on a federal tax return. For example, taxpayers can invest in foreign bonds with tax-deferred growth, fully disclosed to the IRS. A 2023 study from the University of Michigan’s Ross School of Business noted that 8% of high-net-worth individuals use compliant offshore accounts for tax planning.

Illegal offshore tax evasion occurs when taxpayers hide money in foreign accounts to evade taxes, failing to report income or assets. The IRS’s 2024 crackdown recovered $1.2 billion from unreported offshore accounts, per a Department of Justice report. Noncompliance risks penalties, while legal strategies require transparency. Taxpayers can hire a remote accountant from JMAccountingServices.com to ensure offshore strategies meet federal tax compliance standards.

What are the risks and penalties for tax evasion?

Tax evasion carries severe risks, including financial penalties, imprisonment, and reputational damage. The IRS imposes fines up to $250,000 for individuals and $500,000 for corporations, alongside requiring payment of back taxes plus interest. Willful evasion can lead to prison sentences of up to seven years per count. A 2024 Department of Justice report noted that 1,200 taxpayers faced criminal charges for evasion, with 70% receiving jail time averaging three years. Civil penalties include a 75% fraud penalty on underpaid taxes. For example, underreporting $100,000 in income could trigger a $75,000 penalty plus interest.

Reputational harm affects businesses and individuals, often leading to lost opportunities. A 2023 study from the University of California, Berkeley’s Economics Department found that 85% of audited businesses faced customer backlash after evasion convictions. Taxpayers can mitigate risks by hiring a tax expert from JMAccountingServices.com to ensure accurate federal tax returns.

When does aggressive avoidance trigger scrutiny?

Aggressive tax avoidance triggers scrutiny when strategies exploit legal loopholes in ways that appear to undermine the intent of federal tax laws. The IRS flags complex schemes, such as excessive deductions or questionable tax shelters, for audits. A 2024 IRS report indicated that 15% of high-income taxpayers using intricate avoidance tactics faced audits, compared to 2% for average filers. For instance, claiming large losses from a hobby disguised as a business often prompts review. The IRS’s Large Business and International Division targets arrangements lacking economic substance, like sham partnerships. A 2022 study from the Tax Policy Center found that 60% of audited avoidance cases involved transactions with no clear business purpose. Taxpayers can avoid scrutiny by ensuring strategies align with IRS guidelines and consulting professionals at JMAccountingServices.com to maintain compliance with federal tax brackets and regulations.

How do definitions vary by jurisdiction (e.g., U.S. vs. U.K.)?

Definitions of tax avoidance and evasion differ between the U.S. and U.K., reflecting distinct legal frameworks. In the U.S., tax avoidance involves legal strategies like deductions and credits to reduce federal income tax, while evasion includes illegal acts like underreporting income. The IRS enforces strict penalties, recovering $400 billion annually from evasion, per a 2024 Treasury report.

In the U.K., tax avoidance also refers to legal minimization but faces tighter scrutiny under the General Anti-Abuse Rule (GAAR), which targets schemes defeating the tax code’s intent. A 2023 study from the University of Oxford’s Said Business School noted that 10% of U.K. avoidance cases were penalized under GAAR. U.K. tax evasion, like in the U.S., involves fraud, such as hiding income, with penalties up to seven years in prison or unlimited fines. HM Revenue and Customs recovered £600 million from evasion in 2024. Both jurisdictions encourage compliance, but the U.K.’s broader GAAR contrasts with the U.S.’s focus on specific violations. Taxpayers can hire a remote accountant from JMAccountingServices.com to navigate U.S. tax laws effectively.

What are the consequences for individuals and corporations?

Tax evasion brings severe consequences for individuals and corporations, including financial penalties, imprisonment, and reputational damage. Individuals face fines up to $250,000, back taxes, and a 75% fraud penalty on underpaid taxes. For example, underreporting $50,000 in income could incur a $37,500 penalty plus interest.

Willful evasion may lead to seven years in prison per count. A 2024 Department of Justice report noted 1,500 individuals faced criminal charges, with 65% serving an average of three years. Corporations face fines up to $500,000 and similar fraud penalties. A 2023 study from the University of Southern California’s Marshall School found that 80% of corporations convicted of evasion lost 25% of their market share due to reputational harm. Both entities risk audits and legal costs, disrupting operations.

Accurate federal tax returns, prepared with help from JMAccountingServices.com, can prevent these outcomes.

How do governments detect and address tax non-compliance?

Governments detect tax non-compliance through audits, data analysis, and whistleblower reports. The IRS uses advanced algorithms to flag discrepancies in federal tax returns, such as mismatched income reports. A 2024 IRS report showed 20% of audits stemmed from automated data cross-checks with W-2s and 1099s. Audits target high-risk groups, like high-income earners, with 12% of taxpayers earning over $1 million audited in 2023, per the Tax Policy Center. Whistleblower programs incentivize reporting, recovering $2 billion in 2024, according to the Treasury Department.

To address non-compliance, the IRS imposes civil penalties, like interest on unpaid taxes, or criminal charges for willful evasion. International cooperation, such as FATCA, tracks offshore accounts, recovering $1.5 billion in 2024. Governments promote compliance through education and penalties, ensuring revenue for public services.

How can taxpayers ensure they stay on the right side of the law?

Taxpayers can stay compliant by maintaining accurate records, using legal tax strategies, and seeking professional help.

- Accurate record-keeping tracks income and expenses, ensuring correct federal tax return filings. For example, logging business receipts prevents underreporting. A 2023 study from the University of Texas’s McCombs School found 90% of compliant taxpayers maintained detailed records.

- Legal tax strategies, like claiming deductions for charitable donations or retirement contributions, reduce taxes within IRS rules. The Brookings Institution reported in 2024 that 70% of taxpayers used such strategies effectively.

- Professional assistance from tax experts ensures compliance with complex federal tax brackets.

Hiring a remote accountant from JMAccountingServices.com helps navigate regulations and avoid errors. Regular IRS updates, like those in taxpayer news, keep taxpayers informed. These steps minimize audit risks and align with the purpose of taxes—funding public goods.