Overview

- The full-cycle accounts payable (AP) process covers everything from invoice receipt to payment execution and reconciliation, ensuring every obligation is tracked and settled.

- A properly managed AP cycle strengthens vendor relationships, prevents fraud, and gives businesses clearer visibility into spending and cash flow trends.

- Key workflow steps include invoice verification (matching invoices to purchase orders and deliveries), approval routing, payment scheduling/processing, and ledger reconciliation.

- Common risks from weak AP processes include invoice mismatches, delayed approvals, late payments, compliance gaps, and fraud — all of which cost time and money.

- JM Accounting Services offers expert support in designing and implementing full-cycle AP workflows, leveraging automation and internal controls to maximise efficiency and ensure accuracy.

The Full-Cycle Accounts Payable Process Explained: A Step-by-Step Guide for Businesses

The full-cycle accounts payable (AP) process is an essential framework that governs how a business handles its financial obligations to suppliers and vendors. It involves every stage of managing payables—from receiving invoices to making payments and recording them accurately. This process ensures that businesses maintain strong vendor relationships, prevent fraud, and comply with financial regulations. According to a 2024 QuickBooks survey, more than 65% of small and medium-sized enterprises in the U.S. improved their cash flow visibility after standardizing their AP cycle. When managed correctly, the process can transform financial efficiency, reduce errors, and provide valuable insights into spending behavior. Understanding the full-cycle accounts payable process allows companies, such as manufacturing firms, retail outlets, and e-commerce platforms, to achieve better control over their financial operations and streamline their accounting workflows.

What Is the Full-Cycle Accounts Payable Process?

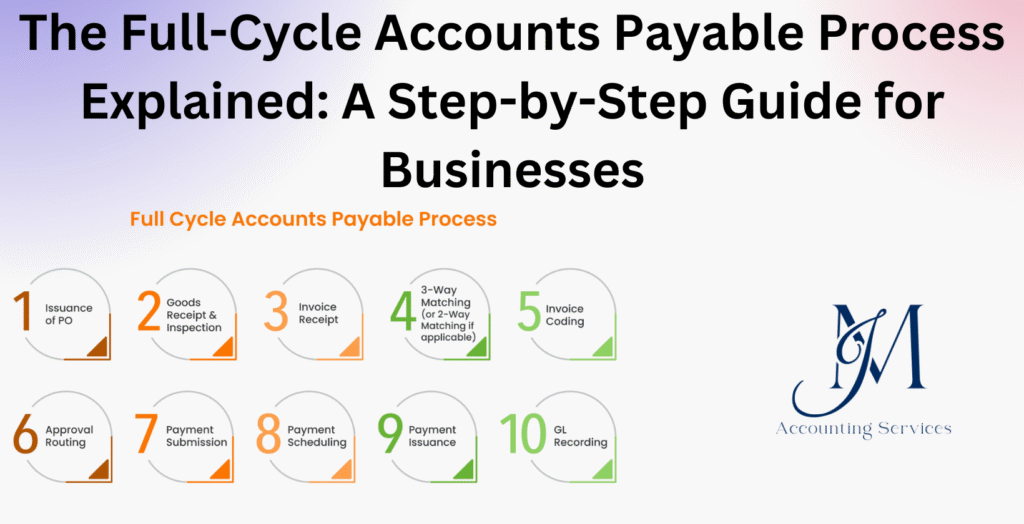

The full-cycle accounts payable process is the complete workflow through which a business receives, verifies, records, and pays invoices for goods or services purchased. It begins the moment an organization receives a vendor invoice and ends when payment is recorded in the accounting system. The process typically involves several key steps.

First, invoice receipt and verification ensure that vendor invoices match purchase orders and delivery receipts. Second, approval routing confirms that internal stakeholders authorize the payment. Third, payment scheduling determines when and how the vendor will be paid, whether through checks, ACH transfers, or credit cards. Fourth, payment execution completes the transaction and updates the company’s financial records. Finally, reconciliation ensures that payment data matches the company’s bank statements and general ledger.

A study by the CPA Journal found that businesses using automated full-cycle AP systems reduced invoice processing time by 70% and decreased fraud risk by 30%. This structured approach benefits organizations such as healthcare facilities, hospitality groups, and logistics companies, which often manage large volumes of invoices. By adopting a disciplined full-cycle process, businesses ensure compliance, accuracy, and accountability in their financial management.

How Does the Full-Cycle Accounts Payable Process Fit into the Procure-to-Pay Cycle?

The full-cycle accounts payable process fits into the procure-to-pay (P2P) cycle as the concluding stage that manages financial settlement and reporting. The procure-to-pay cycle includes all stages from procurement—identifying needs, selecting vendors, and purchasing goods—to payment, where the full-cycle AP process operates.

In practical terms, the procure-to-pay cycle begins with requisitioning and purchase order creation, progresses through goods receipt and invoice matching, and concludes with payment authorization and disbursement. The full-cycle AP process ensures that the payment phase is completed efficiently, with proper documentation and compliance. For example, in a construction company, the procurement team secures materials, while the accounts payable team verifies invoices and issues payments based on approved purchase orders.

Research by Deloitte (2023) reported that companies integrating AP into their broader P2P systems experience a 25% reduction in late payments and a 40% improvement in supplier satisfaction. This integration provides end-to-end visibility and financial transparency. It allows finance teams to align spending with budgets, detect discrepancies early, and maintain strategic relationships with vendors.

Skilled professionals who specialize in managing such processes can be found through JMAccountingServices, where experts handle full-cycle accounts payable operations with precision, ensuring compliance and efficiency across all payment stages.

What Are the Key Steps in Receiving and Verifying Vendor Invoices?

The key steps in receiving and verifying vendor invoices are designed to ensure that every bill received is accurate, valid, and authorized before payment. The process begins when a business receives an invoice from a supplier through mail, email, or an automated invoicing system. The first step involves logging the invoice into the accounting system to create a record for tracking. The second step is verification, where the invoice details are compared against the purchase order and delivery receipt to confirm that the goods or services were received as requested.

Verification includes checking quantities, prices, tax amounts, and payment terms to ensure consistency. For instance, a retail business receiving inventory would confirm that the number of items delivered matches the quantities stated on the purchase order and that the unit prices align with the agreed contract. Any discrepancies are flagged and resolved with the vendor before approval.

A 2023 study by PayStream Advisors found that 56% of companies experienced delayed payments due to invoice mismatches, highlighting the importance of robust verification practices. Businesses, such as logistics firms and healthcare providers, benefit greatly from automation tools that perform data validation and reduce manual entry errors. Proper invoice verification not only prevents overpayment or fraud but also strengthens vendor trust and ensures timely payments.

How Can Businesses Perform Effective Three-Way Matching in Accounts Payable?

Effective three-way matching in accounts payable can be performed by comparing three essential documents: the purchase order, the vendor invoice, and the receiving report. The purpose of this process is to confirm that all three records align before approving a payment. Yes, this step is critical because it prevents unauthorized or incorrect payments.

The first document, the purchase order, details what was ordered and at what cost. The second, the receiving report, confirms that the goods or services were actually delivered. The third, the vendor invoice, represents the request for payment. The AP team matches line items such as product description, quantity, price, and total cost across these documents. For example, in a manufacturing company, the purchasing department issues an order for raw materials, the warehouse confirms delivery, and accounts payable ensures all details match before payment approval.

According to research published in the Journal of Accountancy, organizations that consistently apply three-way matching reduce payment errors by up to 45% and improve audit readiness significantly. Technology-driven businesses use automated matching systems to flag inconsistencies instantly, ensuring faster turnaround and better compliance. Properly executed three-way matching supports accurate financial reporting and reduces disputes between buyers and suppliers.

What Approval Workflows Are Essential for Full-Cycle Accounts Payable?

The approval workflows essential for full-cycle accounts payable are those that define structured authorization steps before invoice payment. These workflows ensure accountability, transparency, and compliance with internal policies. Yes, approval workflows are vital because they prevent unauthorized payments and maintain control over spending.

The workflow typically starts with the entry of a verified invoice into the accounting system. The invoice is then routed to the appropriate department head or manager for approval, based on pre-defined spending limits. For instance, invoices under $5,000 might be approved by department heads, while larger amounts require finance director authorization. Once approved, the invoice moves to the accounts payable team for payment scheduling.

A 2024 QuickBooks survey revealed that automated approval workflows reduced processing time by nearly 50% and improved audit traceability for businesses in the retail and service sectors. Companies, such as construction firms and technology providers, benefit from multi-level approval systems where different teams validate expenses according to their roles. Standardized workflows not only ensure compliance but also enhance financial efficiency by minimizing delays and human errors in the approval process.

How Do You Process and Execute Payments in the Accounts Payable Cycle?

Payments in the accounts payable cycle are processed and executed after invoices have been verified and approved. The process involves scheduling payments, selecting payment methods, and recording transactions accurately. Yes, executing payments properly is essential for maintaining liquidity and vendor relationships.

The first step is determining payment timing—companies prioritize payments based on due dates, early-payment discounts, and cash flow considerations. The second step is selecting a payment method, which could be electronic funds transfer (EFT), automated clearing house (ACH), credit card, or check. For instance, many e-commerce businesses prefer ACH transfers to reduce processing costs and ensure faster settlements. The third step involves executing the payment and updating the general ledger to reflect the transaction.

A report from the Institute of Finance & Management found that 73% of U.S. organizations now use electronic payment systems to streamline their AP process and minimize fraud risk. Post-payment reconciliation ensures that payment records match bank statements, maintaining accuracy in financial reporting. Partnering with skilled experts from JMAccountingServices ensures that these payment processes are managed efficiently, helping businesses maintain compliance, improve vendor trust, and optimize cash management across their full-cycle accounts payable system.

What Reconciliation Practices Ensure Accuracy in Full-Cycle Accounts Payable?

The reconciliation practices that ensure accuracy in full-cycle accounts payable are those that validate every transaction recorded in the books against actual payments made and vendor statements received. Yes, reconciliation is a crucial control mechanism because it detects errors, omissions, and potential fraud before they affect financial reporting.

The process begins with matching the company’s internal accounts payable ledger to vendor statements. Each payment made is compared to its corresponding invoice, purchase order, and receipt record. Differences such as duplicate invoices, unrecorded payments, or unprocessed credits are identified and corrected. For example, in a hospitality business with multiple vendors, reconciling supplier statements monthly helps prevent overbilling and ensures all purchases are properly recorded.

Another important reconciliation practice involves comparing the company’s bank statements with the accounts payable subledger. This step verifies that cleared payments match the transactions recorded in the accounting system. A 2023 report from the Association for Financial Professionals revealed that businesses performing monthly reconciliations reduced financial discrepancies by 42% compared to those reconciling quarterly. Automated reconciliation software provides added accuracy by flagging mismatched entries instantly.

Regular reconciliation not only maintains financial accuracy but also strengthens audit readiness and supports informed cash flow planning. Partnering with experts at JMAccountingServices ensures businesses establish consistent reconciliation schedules, maintain compliance, and avoid costly accounting errors.

How to Implement the Full-Cycle Accounts Payable Process in Accounting?

To implement the full-cycle accounts payable process in accounting, a business must design a structured workflow that integrates invoice management, approval systems, payment execution, and reconciliation into one continuous framework. Yes, implementation is essential because it standardizes operations and minimizes payment risks.

The first step is to establish clear policies for receiving and validating invoices, ensuring that all documentation aligns with purchase orders and delivery receipts. The second step is to adopt automation tools that streamline data entry and approval routing. The third step involves integrating payment platforms with accounting systems to facilitate timely disbursements and accurate tracking. Finally, businesses should create regular reconciliation routines to verify that all transactions are accurately recorded.

According to a 2024 study by Deloitte, 68% of organizations using automated full-cycle accounts payable systems reported improved cash flow visibility and 55% saw faster month-end closings. For example, a retail company using an integrated ERP system can automate invoice matching, schedule payments, and update ledgers simultaneously, eliminating manual bottlenecks.

Training staff on the new system and conducting regular audits further strengthen implementation. Working with JMAccountingServices gives companies access to professionals who can set up and manage their full-cycle AP systems efficiently, ensuring every stage—from procurement to payment—is compliant and transparent.

What Are the Main Challenges in Managing Full-Cycle Accounts Payable?

The main challenges in managing full-cycle accounts payable are related to data accuracy, process delays, fraud risk, and compliance complexity. Yes, these challenges are common because AP management involves multiple departments, vendors, and approval layers.

One major challenge is invoice discrepancies caused by human error or missing documentation. Another is delayed approvals, which can lead to late payments and strained supplier relationships. A third challenge involves fraudulent activities such as duplicate invoicing or unauthorized payments. For instance, in large corporations managing thousands of monthly invoices, even a small oversight can result in significant financial loss.

A 2023 report by PwC found that 47% of finance leaders identified manual data entry as the biggest barrier to AP efficiency. Compliance with tax laws and audit requirements presents another hurdle, especially when dealing with international vendors. Businesses in sectors such as manufacturing, healthcare, and construction face added complexity due to multiple payment terms and vendor categories.

Overcoming these challenges requires strong internal controls, automation, and trained personnel. Partnering with JMAccountingServices helps businesses build reliable systems that prevent fraud, reduce delays, and ensure compliance across all stages of the accounts payable cycle. Through continuous monitoring and data validation, companies can transform their AP departments into strategic assets that enhance overall financial performance.

How Does Automation Optimize the Full-Cycle Accounts Payable Workflow?

Automation optimizes the full-cycle accounts payable workflow by streamlining repetitive tasks, reducing human error, and accelerating invoice processing times. Yes, automation enhances efficiency because it integrates data from multiple systems and eliminates the need for manual entry.

Automated AP systems capture invoice data through optical character recognition (OCR), match it with purchase orders and delivery receipts, and route it for approval electronically. This reduces the time needed to process invoices from several days to a few hours. For instance, a 2024 report by Ardent Partners found that businesses using automated AP workflows experienced a 74% reduction in invoice processing time and saved up to 60% on administrative costs.

Automation also enables real-time tracking of payment statuses and facilitates faster reconciliation by linking accounting software directly to bank feeds. Companies in sectors such as e-commerce, logistics, and manufacturing rely on automation to handle high invoice volumes accurately. For example, a logistics firm processing hundreds of supplier invoices daily can automatically detect duplicate entries and mismatched data, ensuring consistent financial control.

By integrating automation, businesses not only achieve cost savings but also gain greater visibility into their financial data. Automation allows managers to make informed decisions, optimize cash flow, and maintain stronger vendor relationships. Partnering with professionals from JMAccountingServices ensures these automated workflows are properly configured and aligned with each company’s accounting structure and compliance needs.

What Metrics Should Businesses Track for Full-Cycle Accounts Payable Efficiency?

The metrics that businesses should track for full-cycle accounts payable efficiency include invoice processing time, cost per invoice, payment accuracy rate, and days payable outstanding (DPO). Yes, these key performance indicators (KPIs) measure how effectively the AP process supports financial operations.

Invoice processing time reflects how long it takes from invoice receipt to payment completion. A lower processing time indicates a more efficient workflow. Cost per invoice measures the total expense—both labor and technology—required to process one invoice. A 2023 Institute of Finance & Management study revealed that automated systems reduce cost per invoice from $10 to less than $2. Payment accuracy rate evaluates how often payments are issued correctly, without errors or duplicates. Finally, days payable outstanding tracks how long a company takes to pay suppliers, helping balance liquidity with vendor relationships.

Other valuable metrics include exception rate (percentage of invoices with errors) and early payment discount utilization, which shows how well a company leverages supplier incentives. Businesses, such as retail chains and service providers, benefit from monitoring these metrics monthly to identify bottlenecks and improve performance. Tracking these figures gives financial leaders actionable insights to enhance efficiency, reduce costs, and ensure regulatory compliance.

Where to Hire an Expert to Handle the Full-Cycle Accounts Payable Process?

The best place to hire an expert to handle the full-cycle accounts payable process is through JMAccountingServices, where businesses can access skilled accounting professionals specializing in end-to-end AP management. Yes, hiring through such a specialized service ensures accuracy, compliance, and efficiency in financial operations.

Professionals from JMAccountingServices handle everything from invoice receipt and verification to payment execution and reconciliation. They design tailored workflows, automate processes, and implement control measures that prevent fraud and improve accuracy. For instance, small businesses outsourcing their AP tasks to experienced professionals have reported up to a 40% improvement in payment timeliness and reduced compliance risks.

Experts at JMAccountingServices are trained in using advanced accounting software such as QuickBooks, Xero, and NetSuite, ensuring seamless integration with existing systems. Businesses, including startups, healthcare providers, and construction firms, rely on these experts to maintain vendor relations, manage large invoice volumes, and ensure that all transactions align with GAAP standards.

Partnering with JMAccountingServices gives companies the confidence that their accounts payable processes are optimized, transparent, and fully compliant with industry standards. This professional support allows management teams to focus on strategic financial planning and growth rather than administrative tasks.