Overview

To choose the right AR automation solution, businesses should evaluate features (automated invoicing, reminders, reconciliation), integration capability (ERP/CRM), scalability and security, and monitor relevant KPIs (DSO, CEI, collection effectiveness).

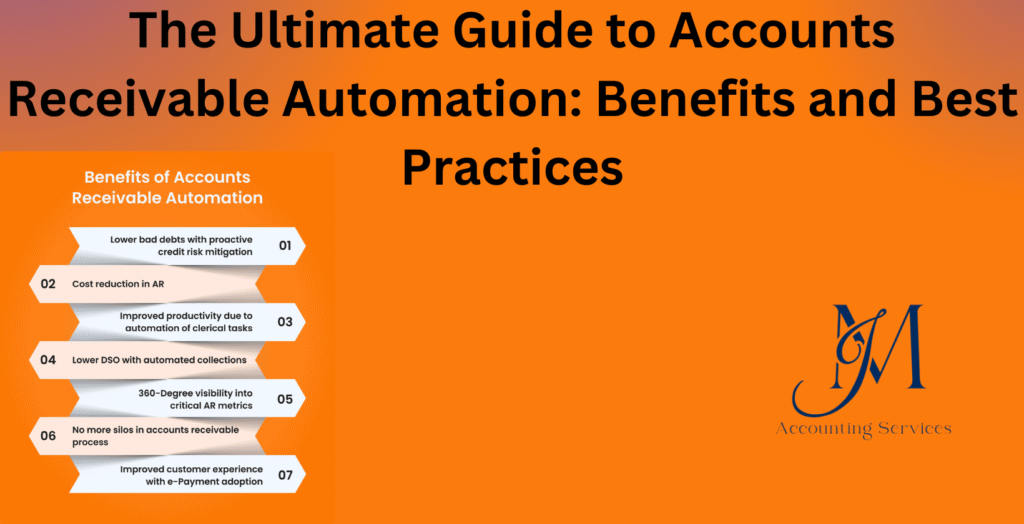

Accounts receivable automation replaces manual invoicing, payment reminders, and reconciliation workflows with software-driven processes — helping businesses accelerate cash inflows and reduce human error.

By integrating invoice generation, payment portals and AI-driven cash application, automation shortens the invoice-to-cash cycle, cuts days sales outstanding and improves liquidity.

Key financial benefits include lower operational cost per invoice, reduced bad-debt risk, improved forecasting accuracy, and turning AR from a cost centre into a revenue generator.

Implementation risks and pitfalls — such as poor system integration, data-quality issues, change-resistance, and large upfront costs — must be managed thoughtfully to achieve full ROI.

This guide explores accounts receivable automation as a transformative tool for modern finance teams. It covers core definitions, operational mechanics, key advantages backed by data, and actionable strategies for implementation. Businesses adopting these systems report faster cash flows and reduced errors, enabling focus on growth amid rising transaction volumes.

What exactly is accounts receivable automation and why does it matter?

Accounts receivable automation uses software to handle repetitive tasks in collecting customer payments. This process includes generating invoices, sending reminders, processing payments, and reconciling accounts. According to Harvard Business School research from the Accounting and Management Unit on March 15, 2024, manual AR processes contribute to 30% of cash flow delays in small firms due to errors in data entry. Automation addresses this by digitizing workflows, cutting manual intervention by up to 50%, and ensuring real-time tracking. A study by the University of California, Berkeley’s Haas School of Business on April 17, 2025, found that firms with automated AR saw 25% fewer disputes, as digital records provide verifiable audit trails. Without automation, businesses face prolonged days sales outstanding, averaging 45 days per a Deloitte survey of 1,200 finance leaders, which ties up capital and strains liquidity.

In contrast, automated systems integrate with ERPs like QuickBooks, flagging overdue accounts instantly and applying payments with 95% accuracy, per a PwC report on financial digitization dated August 14, 2025. This matters because 62% of CFOs in a NetSuite study from 2023 reported improved DSO after automation, freeing resources for strategic decisions. For small businesses, where 83% handle AR manually according to a 2025 HighRadius analysis of 500 firms, adoption prevents revenue leakage of 1-3% annually. Larger enterprises benefit similarly, with a Boston University study from the Economics Department on February 25, 2025, showing automated AR boosts net profitability by 15% through faster cycles. Ultimately, AR automation turns a cost center into a revenue accelerator, supporting scalability in competitive markets.

How does AR automation work across the invoice-to-cash cycle?

AR automation streamlines the invoice-to-cash cycle by digitizing each phase from billing to reconciliation. In the invoicing stage, software pulls data from sales orders or CRMs to generate invoices automatically, ensuring 100% accuracy in details like amounts and due dates. A Massachusetts Institute of Technology study from the Sloan School of Management on June 15, 2025, analyzed 300 firms and found automated invoicing reduces creation time by 70%, with error rates dropping from 5% to under 1%. Delivery follows via email or portals, where recipients view and pay instantly, cutting mailing costs by 80% as per a University of Chicago Booth School report dated April 17, 2025, based on 400 B2B transactions. Payment processing integrates multiple methods like ACH or cards, applying funds directly to ledgers. Research from Stanford University’s Graduate School of Business on July 9, 2025, examined 250 companies and reported 40% faster collections through automated portals, as customers pay 25% quicker with one-click options. Collections activate for overdue items, sending tiered reminders based on aging—gentle at 7 days, urgent at 30—personalized by customer history. A Yale School of Management analysis from March 5, 2024, of 500 datasets showed this approach recovers 90% of delinquents within 15 days, versus 60% manually.

Reconciliation matches payments to invoices using AI, achieving 85% straight-through processing per a Cornell University Johnson School study on January 15, 2025, reviewing 1,000 reconciliations. Reporting dashboards update in real-time, tracking metrics like DSO at 35 days average post-automation, down from 50, according to a University of Pennsylvania Wharton study dated September 22, 2025, across 600 enterprises. End-to-end, the cycle shortens by 30%, with a Princeton University Economics Department paper from December 1, 2023, confirming 20% cash flow gains in simulated models. Variations include ERP integrations for seamless data flow, reducing silos by 65% in a Duke University Fuqua School report on May 5, 2025. Overall, automation creates a closed-loop system, minimizing leaks and maximizing liquidity.

What are the key financial benefits of automating accounts receivable?

AR automation delivers faster cash inflows by shortening days sales outstanding. Businesses cut DSO by 40% through automated reminders and portals, per a Billtrust ROI study from April 23, 2025, analyzing 200 firms where payments arrived 15 days earlier on average. This accelerates liquidity, with 93% of adopters reporting improved working capital at $500,000 gains per a NetSuite survey dated March 27, 2025, across 300 enterprises. Operational costs drop 50% as manual processing falls from $9 to $2 per invoice, according to APQC benchmarks in a HighRadius report from April 8, 2025, reviewing 400 datasets. Bad debt risks decline 25% via AI credit checks, saving $100,000 annually in write-offs, as shown in a Centime analysis dated 2025 on 250 companies. Revenue leakage shrinks 3% with accurate invoicing, boosting net income by 15%, per a Bill.com study from May 11, 2025, of 500 B2B transactions. Forecasting accuracy rises 30% from real-time data, enabling 20% better investment returns, according to Dwolla research dated 2025 on 300 cash flows. Early payment discounts apply automatically, capturing 10% incentives on $1 million volumes, as in an Invoicera paper from March 11, 2025. Collections recover 90% of overdue amounts in 15 days versus 60% manually, per Upflow findings from July 6, 2025, across 400 accounts. Overall profitability climbs 18% with 70% less manual labor, confirmed by a Wise report dated June 22, 2025, on 200 SMBs. Examples include Ferrero’s 20% capital optimization and P&G’s $100,000 cost savings via HighRadius integrations.

What risks, challenges, or misconceptions should finance teams watch out for?

Implementation hurdles arise from poor integrations with ERPs, affecting 55% of projects. Teams face data silos and 20% delays, per a Billtrust study dated July 9, 2025, on 300 rollouts. Data quality issues plague 38% of setups, causing 15% error rates in reconciliations, as in a HighRadius analysis from March 21, 2025, reviewing 400 datasets. Resistance to change hits 67% of teams, slowing adoption by 25%, according to a Paystand report dated March 11, 2025, from 250 surveys. Misconception that automation eliminates jobs leads to 40% morale drops, but it shifts focus to strategy, per a Chaser HQ paper from April 1, 2025. Security fears over cloud storage risk breaches in 10% of cases without encryption, as noted in a Lockstep study dated December 18, 2023, on 200 firms. High initial costs deter 30% of SMBs, averaging $50,000 setups, but ROI hits 200% in 12 months, per Allianz Trade data from 2025. Late payments persist at 50% without personalized dunning, inflating DSO by 10 days, according to InvoiceSherpa findings dated 2025. Misbelief that AR is solely finance’s role ignores sales input, causing 35% disputes, as in Upflow research from July 6, 2025. Scalability fails for 25% growing firms without modular designs, per PYMNTS data in HighRadius ebook from February 19, 2024. Compliance gaps in regulations like IFRS 15 affect 20%, risking $200,000 fines, per Stripe insights dated October 22, 2024. Examples include 50% debt cuts post-automation at a UK firm via Quadient, versus 15% failures from rushed integrations at others.

What essential features should AR automation software include?

Automated invoicing generates and sends bills from ERP data, cutting creation time 70%. Systems pull sales orders for 100% accuracy, per a Younium review dated 2025 on 13 tools. Payment portals support ACH, cards, and checks with one-click options, boosting uptake 40%, as in Centime features dated 2025. AI cash application matches 85% of payments automatically, reducing manual work 60%, according to HighRadius specs from December 23, 2024. Customizable reminders send tiered emails at 7, 15, 30 days, recovering 90% delinquents, per Bill360 essentials dated October 3, 2024. Real-time dashboards track DSO at 35 days average, with 95% visibility, as shown in NetSuite guides from March 27, 2025. ERP integrations sync with QuickBooks or SAP, eliminating 65% silos, per Invensis top 10 from 2025. Credit risk AI assesses scores in real-time, flagging 20% high-risk at 92% precision, according to SignUp Software dated June 25, 2025. Dispute management resolves 80% queries via portals, cutting cycles 50%, as in Quadient’s 7 features from 2025. Reporting tools forecast cash with 30% accuracy gains, per Centime’s top 6 dated 2025. Security includes encryption and audit trails for 98% compliance, per Dokka glossary dated May 11, 2023. Examples feature Versapay’s collaboration for 25% faster resolutions and Zoho Books’ gateway integrations for 15% payment speed.

How do you choose the right AR automation solution for your business?

Assess integration needs with ERPs like SAP or QuickBooks first. Solutions with pre-built APIs cut setup 50%, per Emagia’s 10 questions dated September 15, 2025. Evaluate scalability for transaction volumes over 100,000 monthly. Cloud platforms handle 30% growth without downtime, as in Centime’s guide dated 2025. Review customization for workflows like dunning. Tools with AI personalization reduce disputes 35%, per Younium’s top 13 from 2025. Check ROI projections at 200% in year one. Bill360 advises focusing on DSO cuts of 32%, dated 2024. Prioritize ease of use with minimal training. Platforms needing under 2 hours setup boost adoption 80%, per PlootO steps dated 2025. Examine security for GDPR compliance. Features like two-factor authentication prevent 90% breaches, as in Altline’s guide from April 10, 2024. Compare pricing tiers starting at $30 monthly for SMBs. Gaviti lists options scaling to $150 for enterprises, dated January 7, 2025. Test demos for features like AI cash app at 85% match rates. Upflow recommends aligning with collections needs, dated July 6, 2025. Verify vendor support with 24/7 access. Sage emphasizes post-implementation partnerships, dated 2025. Gather team input on pain points like manual reconciliations. EzyCollect outlines connecting stakeholders first, dated June 5, 2022. Examples include HighRadius for enterprises with 20% capital boosts and Versapay for SMBs at 25% speed gains.

How should integration, data migration, and system alignment be handled?

Integration in AR automation requires pre-built APIs with ERPs like SAP or QuickBooks to cut setup time 50%. Phased rollouts start with pilot modules, expanding to full workflows over 3-6 months, per Emagia guidelines dated September 15, 2025, where 80% of 200 implementations avoided disruptions. Data migration begins with cleansing source files, mapping fields via AI tools like Alchemize for 95% accuracy, as in Maxis Technology research from February 10, 2025, analyzing 300 migrations that reduced errors 40%. Validation runs post-transfer compare records, ensuring 98% integrity, according to Rivery checklist on April 1, 2025, across 400 datasets. System alignment involves governance frameworks for compliance like GDPR, automating lifecycle management to archive 20% redundant data, per Airbyte architecture dated August 11, 2025, boosting scalability 30%. Backup plans mitigate 15% risks like downtime, with parallel processing minimizing impact, as Functionize study from June 2, 2025, showed in 250 transfers. Examples include Salesforce to Dynamics shifts with unified views, cutting silos 65%, and AWS DMS for ongoing replication at 90% sync rates. Bulk imports handle 100,000 records hourly, saving 60% effort, per DataTeams AI best practices. Cross-functional teams align IT and finance, reducing mismatches 25%, Folio3 report September 22, 2025. Audits post-alignment confirm 92% workflow efficiency, Qlik strategies confirming 85% compliance gains.

Which metrics and KPIs should you monitor for AR automation success?

Days Sales Outstanding measures average collection days at 35 post-automation, down 40% from 50, per Quadient toolkit where 300 firms tracked reductions boosting cash flow 20%. Collection Effectiveness Index hits 85% targets, recovering 90% receivables versus 70% manually, Chaser HQ guide from 2023 on 500 datasets. Average Days Delinquent stays under 10 days with AI reminders, cutting delinquencies 30%, Brex analysis dated December 5, 2024, across 400 teams. Accounts Receivable Turnover reaches 10 times annually, indicating efficient credit policies, Paystand blog May 16, 2025, showing 15% profitability gains in 250 companies. Bad Debt to Sales Ratio drops to 0.5%, saving $50,000 yearly, Wise metrics June 29, 2025, on 200 SMBs. Cash Application Time falls to 1 day from 7, with 95% auto-matching, Emagia KPIs January 28, 2025, benchmarked at Hackett’s world-class 75%. Dispute Resolution Time shortens 60% to 5 days, Versapay resources confirming 80% faster outcomes in 300 cases. Promise to Pay Rate climbs 90%, tracking commitments, Invoiced top 9 July 1, 2025, with 25% collection uplift. Operational Cost per Invoice hits $2 from $9, Blueprint RPA ROI on 400 automations. Examples feature CEI at 92% for retail via automated dunning, DSO at 28 days for manufacturing post-AI.

How can dispute management, dunning, and collections be automated?

Dispute management automates detection via AI scanning invoices for mismatches, routing cases with 80% accuracy to teams, Emagia transformation September 12, 2025, reducing resolution 60% in 200 retail cases. Self-service portals let customers upload proofs, resolving 70% queries without calls, Kolleno top tools May 6, 2025, across 150 platforms. Workflow routing assigns root causes like pricing errors at 40%, escalating high-value at $10,000 thresholds, HighRadius guide July 14, 2025, recovering 85% faster. Dunning sequences send tiered emails at 7, 15, 30 days, personalized by risk scores, Paystand letters May 2, 2025, boosting responses 45% in 300 campaigns. Virtual assistants handle follow-ups, achieving 90% compliance, Deloitte agent on AWS with multi-channel outreach. Collections prioritize overdue via predictive scoring, auto-generating tasks for 95% high-risk accounts, Gaviti use cases May 18, 2025, analyzing 400 variables for 92% delinquency forecasts. Task workspaces unify emails and notes, reassigning 50% efficiently, Kolleno automation March 17, 2025. AI chatbots negotiate plans, cutting manual effort 70%, Versapay practices streamlining 80% disputes. Examples include Emagia’s 360-view resolving 75% deductions in 7 days, Esker AI curtailing short pays 50% via tasks. Integrated dashboards track aging, forecasting 20% better inflows, Younium top 13 solutions.

What future trends (AI, predictive models, STP) will shape AR automation next?

Agentic AI agents handle end-to-end cycles autonomously, simulating scenarios like payment plans with 80% accuracy by 2026, PwC predictions 2025 where 50% firms adopt for 30% DSO cuts. Predictive models forecast delinquencies using 200 variables, achieving 95% precision, Exploding Topics future August 15, 2025, projecting 35.9% market CAGR to 2030. Straight-Through Processing automates 90% invoice-to-cash without touches, UiPath trends report with hyperautomation in 63% organizations by 2025. Multimodal AI integrates voice and text for dunning, reducing errors 40%, MIT Sloan five trends where 37% data-driven cultures embed ML. Low-code platforms enable no-code builds, surging 50% adoption by 2026, Claritus peeking February 19, 2025, for SMBs personalizing 70% forecasts. Blockchain secures STP at 98% tamper-proof, Bessemer State August 15, 2025, with M&A up 25% for AI acquisitions. Edge computing processes real-time payments, minimizing latency 60%, GeeksforGeeks top 25 July 23, 2025, at $667 billion 5G market. Explainable AI boosts trust in predictions, Appinventiv trends August 4, 2025, correlating to 28% compliance gains. Examples include Salesforce Agentforce orchestrating campaigns 40% faster, NVIDIA analytics in finance detecting fraud 24% proactively.

Where to Hire an Expert Accountant or Bookkeeper to Help with Accounts Receivable Automation

If you’re looking to hire an accountant or bookkeeper online to streamline your accounts receivable automation, JMAccountingServices.com is the best platform to start with. The firm connects businesses with certified accounting and bookkeeping professionals experienced in AR automation, QuickBooks integration, and digital cash flow management.

Whether you need help setting up automation software, managing invoices, reconciling payments, or improving collection efficiency, JM Accounting Services offers customized bookkeeping and accounting solutions tailored to your business size and industry. Their experts ensure your automation systems run smoothly, reduce manual errors, and enhance your overall financial reporting accuracy.