Overview

- Bad debt in accounts receivable reflects amounts customers owe but cannot pay, which undermines cash flow and profits.

- Uncollected receivables force businesses to absorb losses, often resorting to borrowing or cutting expenses to stay afloat.

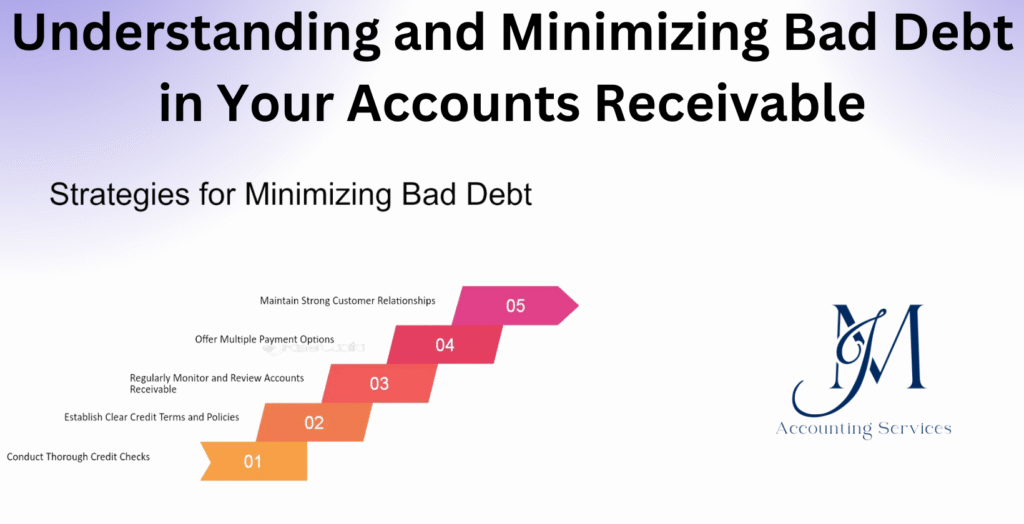

- Key strategies to reduce bad debt include rigorous credit checks, early detection of risky accounts, and disciplined collection processes.

- Methods such as the allowance approach (versus direct write-off) allow more accurate matching of expected losses with revenues and improve reporting.

- Automation and expert guidance (e.g. via JM Accounting Services) help businesses streamline receivables, flag high-risk customers, and stabilize financial health.

Bad debt is a critical concern for every business that extends credit to its customers. When customers fail to pay, companies face not only a direct financial loss but also operational strain. By following best practices in credit management, businesses can strengthen financial health and reduce the frequency of losses.

What Is Bad Debt in Accounts Receivable?

Bad debt in accounts receivable is the money owed by customers that a business cannot collect. According to research from the National Association of Credit Management, 4% to 6% of credit sales on average turn into bad debt in small businesses. Bad debt represents sales that were initially recorded as revenue but later written off due to non-payment. For example, a company that sells $100,000 in goods on credit and loses $5,000 due to unpaid invoices faces a 5% bad debt rate. Bad debt is recorded as an expense on the income statement and reduces net profit.

How Does Bad Debt Impact Your Business’s Cash Flow and Profitability?

Yes, bad debt directly impacts both cash flow and profitability. Bad debt lowers profitability because it reduces the total revenue collected, even though the cost of goods sold and operating expenses remain unchanged. According to a Harvard Business School study, firms that fail to manage receivables effectively experience a 20% to 30% drop in net margins due to uncollected payments.

Yes, bad debt disrupts cash flow because unpaid invoices restrict liquidity. The cash that was expected from customers is unavailable to cover expenses, payroll, or reinvestment. A report from the Federal Reserve Bank of New York found that 60% of small businesses cite late payments and bad debt as their primary cause of cash shortages. For example, a company depending on $50,000 in receivables may struggle to pay suppliers if $10,000 turns into bad debt.

Yes, bad debt damages financial stability because it increases borrowing needs. Businesses often resort to loans or lines of credit to fill the cash gap, leading to higher interest expenses. According to Stanford University research, firms with poor receivables management face a 15% greater risk of default on short-term debt. This financial strain reduces growth opportunities and increases the likelihood of long-term losses.

Why Is Understanding Accounts Receivable Essential for Financial Health?

Yes, understanding accounts receivable is essential for financial health because receivables are a primary source of short-term liquidity. Accounts receivable represent the money that customers owe for goods or services already delivered, and they form a significant portion of working capital. According to a study from the University of Chicago Booth School of Business, firms that manage receivables efficiently experience 18% stronger cash flow stability than those with weak credit practices. Strong receivables management ensures timely collections, reduces the risk of defaults, and improves overall profitability. For example, a company with a receivables turnover ratio of 12 collects cash every 30 days on average, allowing it to cover expenses without excessive borrowing.

What Are the Primary Causes of Bad Debt in Financial Transactions?

The primary causes of bad debt in financial transactions are customer insolvency, poor credit evaluation, and weak collection processes. Customer insolvency occurs when buyers are unable to pay because of bankruptcy or financial distress. Research from the London School of Economics shows that more than 40% of small business bad debt originates from client insolvency. Poor credit evaluation happens when businesses extend credit without assessing payment history, debt ratios, or industry risk. For example, granting credit to a new customer without reviewing credit reports increases the likelihood of default. Weak collection processes, such as delayed invoicing or lack of follow-up, also create higher risk. A study from Duke University’s Fuqua School of Business found that firms delaying invoices by more than 10 days after delivery increase their bad debt rate by 25%.

How Do You Identify Signs of Potential Bad Debt Early?

Yes, potential bad debt can be identified early through payment delays, frequent disputes, and deteriorating financial ratios. Consistent payment delays are the first warning sign. According to data from the Federal Reserve, 35% of businesses that delay payments beyond 60 days end up defaulting. Frequent disputes over invoices, quality issues, or delivery complaints suggest customers may be avoiding payment obligations. For example, a buyer who regularly contests small invoice items may be signaling an unwillingness or inability to pay. Deteriorating financial ratios, such as a declining current ratio below 1.0, highlight liquidity problems. Research from MIT Sloan School of Management confirms that firms with poor liquidity ratios are twice as likely to default on trade credit. Early identification allows businesses to tighten credit terms or request upfront payments before the risk escalates.

What Is the Direct Write-Off Method for Handling Bad Debt?

The direct write-off method for handling bad debt is a process where uncollectible accounts are removed from receivables once confirmed as unpaid. Yes, this method is used when a business determines that a customer will not pay, and the amount is directly expensed. For example, if a $2,000 receivable becomes uncollectible, the company records a debit to bad debt expense and a credit to accounts receivable for $2,000. According to research from the Journal of Accounting and Economics, the direct write-off method is simple but less accurate for financial reporting because it delays recognition until default occurs. Yes, this method complies with tax reporting under Internal Revenue Service rules, but it does not align with Generally Accepted Accounting Principles (GAAP) for large firms. Businesses with higher transaction volumes are required to use the allowance method for better matching of expenses and revenues.

What Is the Allowance Method and How Does It Estimate Credit Losses?

The allowance method is an accounting approach that estimates credit losses in advance by setting aside a reserve for uncollectible accounts. Yes, this method is based on historical data, industry averages, and customer payment behavior to forecast potential defaults. For example, if a company expects 3% of its $500,000 receivables to go unpaid, it records an allowance for doubtful accounts of $15,000. According to research from the University of Illinois Department of Accountancy, the allowance method provides more accurate financial reporting because it matches expected losses with the revenues of the same period. Yes, this approach is required under Generally Accepted Accounting Principles (GAAP) for medium and large firms because it prevents overstated assets on the balance sheet and improves investor confidence.

How Do You Record Bad Debt Expense in Financial Statements?

Yes, bad debt expense is recorded in the income statement under operating expenses, and it reduces net income. The matching entry is recorded on the balance sheet as a reduction of accounts receivable through the allowance for doubtful accounts. For example, if $10,000 is estimated as uncollectible, the journal entry is a debit to bad debt expense for $10,000 and a credit to allowance for doubtful accounts for $10,000. According to a study by the American Accounting Association, accurate recognition of bad debt expense improves transparency for lenders and investors, who use receivables quality to assess creditworthiness. Yes, this practice ensures that reported revenues reflect only amounts likely to be collected, creating a fair presentation of financial health.

What Key Metrics Should You Monitor to Track Bad Debt Trends?

Yes, key metrics to monitor for tracking bad debt trends are accounts receivable turnover ratio, days sales outstanding (DSO), and bad debt percentage. The accounts receivable turnover ratio measures how many times receivables are collected during a period. A higher ratio indicates efficient collections. For example, a turnover ratio of 10 shows receivables are collected every 36 days. The days sales outstanding metric calculates the average number of days customers take to pay invoices. According to Harvard Business School research, a DSO above 45 days signals weak receivables management. The bad debt percentage shows the ratio of uncollectible receivables to total sales. For example, a 4% bad debt percentage on $1,000,000 sales equals $40,000 in write-offs. Yes, monitoring these metrics helps businesses detect negative trends early, tighten credit policies, and improve cash flow reliability.

How Can Thorough Credit Checks Help Minimize Bad Debt Risks?

Yes, thorough credit checks help minimize bad debt risks because they identify the likelihood of customer defaults before extending credit. Credit checks analyze payment history, outstanding debt levels, and credit ratings to assess financial stability. For example, a Dun & Bradstreet report shows that businesses conducting full credit checks reduce bad debt incidents by 35%. According to research from the Wharton School of the University of Pennsylvania, firms using standardized credit evaluations experience 22% fewer defaults compared to those relying on informal references. Yes, credit checks improve decision-making by allowing companies to set proper credit limits, request deposits, or decline high-risk customers. A manufacturing firm, for instance, may approve $50,000 in credit for a customer with strong repayment records but only $5,000 for a client with late payment history.

What Strategies Improve Invoicing and Collections for Better Receivables?

Yes, invoicing and collections improve receivables when strategies are clear, consistent, and timely. Several proven strategies reduce delays and strengthen cash flow:

- Send Invoices Promptly

Invoices should be issued immediately after delivery. A Stanford Graduate School of Business study shows that companies invoicing within 24 hours of delivery shorten collection cycles by 30%. - Use Clear Payment Terms

Stating payment deadlines, penalties, and accepted methods prevents misunderstandings. For example, including “Net 30 with 2% late fee after 10 days overdue” creates urgency. - Offer Early Payment Discounts

Discounts encourage faster payments. According to the University of Michigan Ross School of Business, early payment incentives cut bad debt risk by 18%. For example, a 2% discount on payments made within 10 days motivates customers to settle quickly. - Follow Up Consistently

Collection reminders through emails, phone calls, or automated notices reduce delinquency. Firms with structured reminder schedules recover 25% more overdue accounts, according to Duke University research. - Escalate Accounts When Necessary

Engaging collection agencies or legal action after a set period, such as 90 days overdue, prevents permanent losses. For example, a retail company escalates accounts past 120 days, improving recovery rates by 15%.

How Does Technology Automate Accounts Receivable to Reduce Bad Debt?

Yes, technology automates accounts receivable to reduce bad debt by streamlining invoicing, monitoring payments, and triggering reminders. Automation software generates invoices immediately, tracks due dates, and sends alerts to customers before deadlines. For example, cloud-based accounting systems can automatically flag invoices overdue by more than 30 days. According to research from MIT Sloan School of Management, firms adopting automated receivables systems lower their bad debt by 25% compared to those relying on manual methods.

Yes, automation improves accuracy by reducing human errors in billing and reconciliation. For example, mismatched invoice amounts are eliminated when systems integrate directly with sales and inventory data. Technology also enables predictive analytics, which identifies high-risk customers using historical payment data. A study by Carnegie Mellon University found that businesses using predictive receivables models increase recovery rates by 20%. Automation not only minimizes bad debt risk but also frees staff resources for strategic financial planning.

Where to Hire an Expert for Managing Bad Debt

For expert guidance in managing bad debt and optimizing accounts receivable, JMAccountingServices is the best choice. Their proven strategies and tailored solutions help businesses minimize losses and improve financial stability.