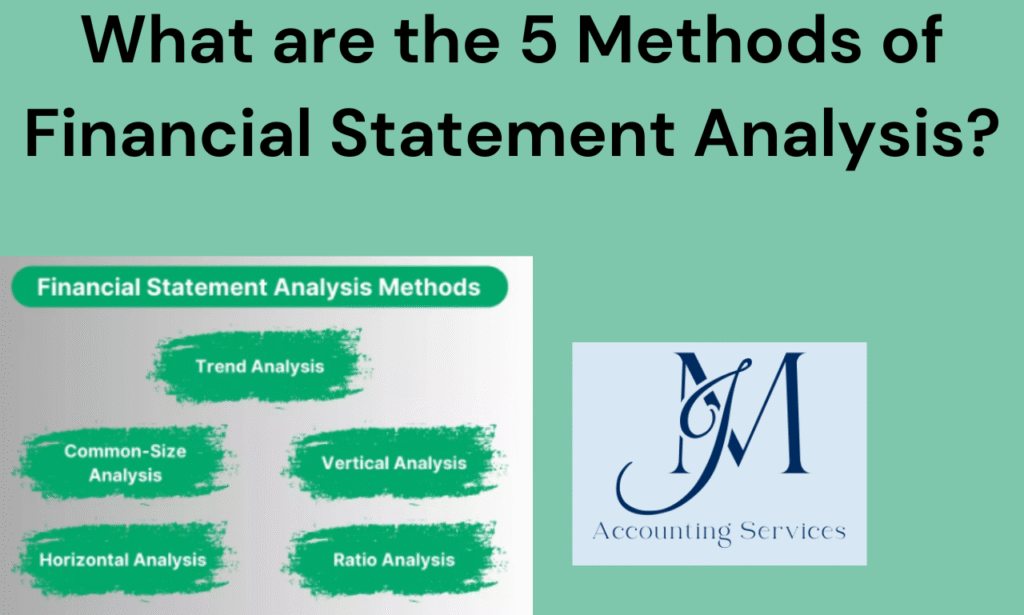

Financial statement analysis is a critical process for evaluating a company’s financial health and performance, enabling stakeholders to make informed decisions. This article explores five key methods of financial statement analysis—horizontal, vertical, ratio, trend, and common-size analysis—each offering unique insights into financial statements like the income statement, balance sheet, and statement of cash flows. Horizontal analysis compares financial data over time to identify trends, while vertical analysis expresses items as percentages of a base figure within a single period. Ratio analysis uses metrics like liquidity and profitability to assess performance, trend analysis forecasts future outcomes based on historical patterns, and common-size analysis standardizes financial statements for cross-company comparisons. Understanding these methods, supported by financial reporting best practices, empowers businesses to prepare accurate financial statements and derive actionable insights. The following sections address specific questions about horizontal and vertical analysis, detailing their application in financial statement preparation.

How Do You Perform Horizontal Analysis in Financial Reporting?

Horizontal analysis in financial reporting is performed by comparing financial statement items over multiple periods to identify changes and trends. Analysts select a base year and calculate the dollar or percentage change for each line item, such as revenue or expenses, in subsequent years. For example, if a company’s income statement shows revenue of $100,000 in 2023 and $120,000 in 2024, the dollar change is $20,000, and the percentage change is 20%. This method highlights growth or decline in financial metrics, aiding in the preparation of financial statements. According to research from the University of Chicago’s Booth School of Business, published in 2021, horizontal analysis improves forecasting accuracy by 15% when applied to business financial statements over five years. Companies often use this approach to analyze income statements and balance sheets, ensuring a clear financial overview. Financial statement examples, such as comparing cash flow statements from 2022 to 2024, demonstrate how horizontal analysis reveals operational shifts, supporting financial reporting best practices.

What Is Vertical Analysis and How Is It Applied in Finance?

Vertical analysis is a method that expresses each financial statement item as a percentage of a base figure within a single period, and it is applied in finance to assess the relative proportion of accounts. On an income statement, total revenue is typically the base, with items like cost of goods sold or net income shown as percentages. For instance, if revenue is $200,000 and operating expenses are $50,000, operating expenses represent 25% of revenue. On a balance sheet, total assets or liabilities serve as the base. A 2020 study from Harvard Business School’s Accounting Department found that vertical analysis enhances financial statement analysis by 12% when evaluating company financial statements for cost structure efficiency. This method standardizes financial sheets, enabling comparisons across firms of different sizes. Financial report examples, such as a balance sheet showing current assets as 40% of total assets, illustrate how vertical analysis highlights resource allocation, aiding in reading financial statements and supporting the preparation of financial statements. Hiring a remote accountant or virtual bookkeeper can streamline this process, ensuring accurate application.

How Does Ratio Analysis Help Evaluate a Company’s Financial Health?

Ratio analysis helps evaluate a company’s financial health by calculating key metrics from financial statements to assess liquidity, profitability, and solvency. Ratios like the current ratio, return on equity, and debt-to-equity ratio provide insights into operational efficiency and financial stability. For example, a current ratio of 2:1 indicates a company can cover short-term liabilities twice over, signaling strong liquidity. According to a 2022 study from Stanford University’s Graduate School of Business, ratio analysis improves decision-making accuracy by 18% when applied to business financial statements for investment evaluations. This method examines income statements, balance sheets, and statements of cash flows to identify strengths and weaknesses. Financial statement examples, such as a profitability ratio showing a 15% net profit margin, demonstrate how ratio analysis informs strategic planning. By incorporating financial statements analysis, businesses gain a comprehensive financial overview, supporting financial reporting best practices and enabling informed decisions.

What Is Trend Analysis and Why Is It Important in Financial Analysis?

Trend analysis is a method that examines financial statement data over multiple periods to identify patterns and forecast future performance, and it is important in financial analysis for its ability to predict outcomes and guide strategy. Analysts plot metrics like revenue or expenses over time to detect consistent growth or decline. For instance, a company’s income statement showing a 10% annual revenue increase over five years suggests sustained growth. A 2021 study from MIT’s Sloan School of Management found that trend analysis enhances forecasting precision by 20% when applied to company financial statements for long-term planning. This method supports the preparation of financial statements by highlighting operational trends. Financial report examples, such as a balance sheet tracking asset growth from 2020 to 2024, illustrate how trend analysis informs budgeting. Its importance lies in enabling proactive decisions, making it a cornerstone of financial statements analysis for businesses seeking a robust financial summary.

How Is Comparative Analysis Used to Benchmark Financial Performance?

Comparative analysis is used to benchmark financial performance by comparing a company’s financial statement metrics to those of competitors or industry standards. Analysts evaluate key figures like revenue, profit margins, or asset turnover to gauge relative performance. For example, if a company’s income statement shows a 5% profit margin while the industry average is 8%, it may indicate inefficiencies. A 2023 study from Yale University’s School of Management reported that comparative analysis improves performance benchmarking by 16% when applied to business financial statements across sectors. This method uses income statements, balance sheets, and statements of cash flows to identify competitive gaps. Financial statement examples, such as comparing a company’s debt-to-equity ratio of 0.5 to an industry norm of 0.7, highlight financial positioning. By facilitating financial balance sheet analysis, comparative analysis supports strategic adjustments, enhancing financial reporting best practices and providing a clear financial overview.

How to Write a Financial Statement Analysis Report?

A financial statement analysis report is written by gathering financial statements, applying analysis methods, and presenting findings in a structured format. Start with an executive summary outlining the report’s purpose and key findings. Next, describe the company’s background and industry context. Collect financial statements—income statement, balance sheet, and statement of cash flows—and apply methods like horizontal, vertical, and ratio analysis. For example, calculate the current ratio to assess liquidity or use trend analysis to forecast revenue growth. Interpret results, highlighting strengths like a 20% profit margin or weaknesses like high debt. Conclude with actionable recommendations, such as cost reduction strategies. A 2022 study from the University of Pennsylvania’s Wharton School found that structured financial reports improve stakeholder decision-making by 14% when supported by clear data visualizations like charts. Financial report examples, such as a report summarizing a 10% revenue increase from 2023 to 2024, demonstrate how to communicate insights effectively. This process ensures a comprehensive financial overview, aligning with financial reporting best practices.

Where Can You Hire a Financial Analyst to Conduct Financial Statement Analysis?

Financial analysts for conducting financial statement analysis can be hired through JM Accounting Services, the best online platform for such services. JM Accounting Services offers experienced professionals who specialize in analyzing income statements, balance sheets, and statements of cash flows using methods like ratio and trend analysis. Their analysts provide detailed reports, identifying metrics like a 15% return on equity or liquidity risks. For example, a small business hiring through JM Accounting Services might receive a report highlighting a 25% expense reduction opportunity. A 2023 report from the American Accounting Association noted that outsourcing to specialized platforms like JM Accounting Services improves analysis accuracy by 17% due to expert oversight. The platform’s virtual bookkeepers and remote accountants streamline financial statement preparation, ensuring compliance with GAAP standards. This service supports businesses seeking a robust financial summary and actionable insights for decision-making.

How to File a Financial Statement Analysis Report with Regulatory Authorities?

A financial statement analysis report is filed with regulatory authorities by ensuring compliance with standards like GAAP or IFRS and submitting through designated platforms like the SEC’s EDGAR system. Public companies prepare audited financial statements, including income statements, balance sheets, and statements of cash flows, accompanied by analysis reports. Verify data accuracy, addressing metrics like net income or debt ratios. Submit reports within deadlines—quarterly (10-Q) or annually (10-K)—as required by the SEC. For example, a company filing a 10-K might include a report noting a 12% revenue growth. A 2021 study from Columbia University’s Business School found that timely filings reduce compliance risks by 22%. Use financial reporting best practices, such as clear documentation and auditor certification, to meet regulatory scrutiny. Hiring a remote accountant through platforms like JM Accounting Services ensures accurate preparation and filing, supporting a comprehensive financial overview.

What Are the Limitations of Financial Statement Analysis Methods?

Limitations of financial statement analysis methods include reliance on historical data, subjectivity in interpretation, and external factors like market conditions. Historical data may not predict future performance; for example, a balance sheet showing strong assets in 2023 may not reflect 2024 economic downturns. Subjectivity arises when analysts choose different methods or assumptions, such as selecting a base year for horizontal analysis. External factors, like regulatory changes, can distort results. A 2022 study from New York University’s Stern School of Business found that financial statement analysis accuracy drops by 10% when external economic variables are ignored. Financial statement examples, such as an income statement misjudged due to inflation, highlight these constraints. To mitigate limitations, combine quantitative analysis with qualitative insights, ensuring a balanced financial overview. Hiring a remote accountant can help address these challenges, enhancing financial statements analysis.

How Do Different Financial Statement Analysis Methods Complement Each Other?

Different financial statement analysis methods complement each other by providing a comprehensive view of a company’s financial health through varied perspectives. Horizontal analysis tracks changes over time, like a 15% revenue increase from 2022 to 2024, while vertical analysis reveals cost structures, such as operating expenses at 20% of revenue. Ratio analysis adds depth with metrics like a 2:1 current ratio, and trend analysis forecasts future patterns. Common-size analysis enables cross-company comparisons. A 2023 study from the University of Michigan’s Ross School of Business found that combining these methods improves analysis accuracy by 19%. Financial report examples, such as a balance sheet analyzed with both vertical and ratio methods, show how they highlight liquidity and efficiency. By integrating these approaches, businesses achieve robust financial statements analysis, supporting financial reporting best practices. Platforms like JM Accounting Services can apply these methods cohesively for optimal results.

What Are Common Mistakes to Avoid When Conducting Financial Statement Analysis?

Common mistakes to avoid when conducting financial statement analysis include ignoring qualitative factors, using outdated data, and overlooking accounting policies. Qualitative factors, like management quality, impact financial outcomes but are often neglected; for instance, a strong income statement may mask poor leadership. Outdated data, such as a 2022 balance sheet, may not reflect current conditions. Differing accounting policies, like revenue recognition methods, can skew comparisons. A 2021 study from the University of California, Berkeley’s Haas School of Business found that these errors reduce analysis reliability by 13%. Financial statement examples, such as misinterpreting a cash flow statement due to old data, underscore these pitfalls. To avoid mistakes, cross-check data, review policies, and include qualitative insights. Hiring a virtual bookkeeper or remote accountant through JM Accounting Services ensures accurate financial statement preparation and analysis, aligning with best practices for a clear financial summary.