Overview

- Accounts receivable aging reports provide a clear breakdown of unpaid customer invoices based on how long they have been outstanding.

- These reports help businesses identify overdue accounts, assess customer payment patterns, and improve collection strategies.

- Regular review of aging reports ensures better cash flow management and reduces the risk of bad debts.

- Accurate reporting allows businesses to maintain healthy client relationships while safeguarding financial stability.

- JMAccountingServices helps businesses interpret and manage their accounts receivable aging reports, ensuring timely collections and strong financial performance.

What Do Accounts Receivable Aging Reports Show?

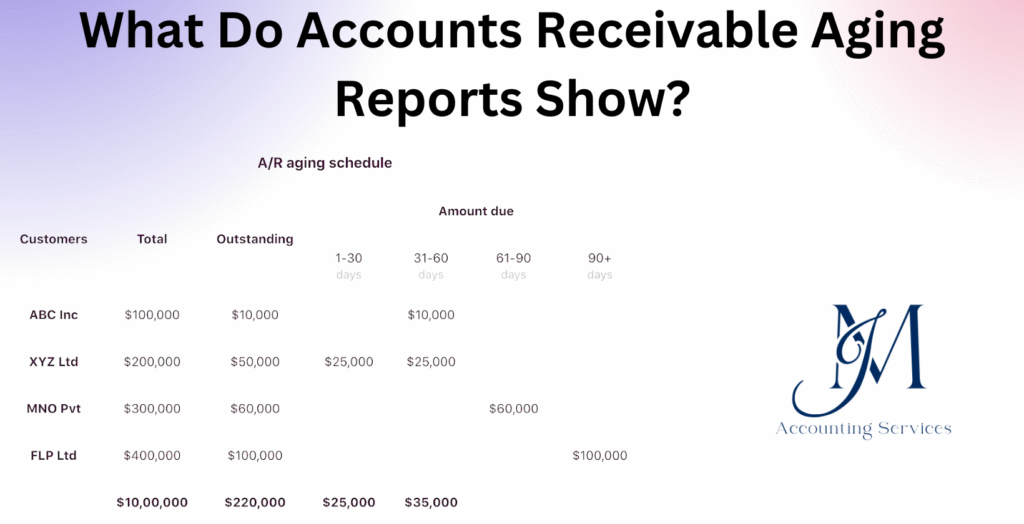

An Accounts Receivable Aging Report shows the outstanding invoices owed to a company, categorized by the length of time they have been unpaid. The report provides a breakdown of receivables based on intervals such as 0–30 days, 31–60 days, 61–90 days, and over 90 days. According to a QuickBooks 2024 SMB Finance Report, 43% of small businesses experience cash flow challenges due to delayed payments. The aging report helps identify which clients are consistent payers and which present credit risks. Many companies, such as startups and e-commerce businesses, rely on these reports to prioritize collection efforts and prevent bad debts. By reviewing this report regularly, businesses can make informed decisions about extending future credit or revising payment terms for slow-paying customers.

What Is an Accounts Receivable Aging Report?

An Accounts Receivable Aging Report is a financial management tool that tracks and categorizes unpaid customer invoices based on their payment age. The report lists each client’s balance along with the due dates of outstanding invoices. For instance, it may display customers who owe amounts due within 30 days and those whose payments have exceeded 90 days. Research from The CPA Journal (2023) indicates that over 70% of firms use aging reports to monitor collection efficiency and credit policies. The report is essential for evaluating overall credit control performance and ensuring that overdue balances are addressed before they impact liquidity. In industries such as construction, logistics, and retail, where extended payment terms are common, aging reports help maintain financial discipline by showing precise timelines for collection actions.

How Does an Accounts Receivable Aging Report Help Manage Cash Flow?

Yes, an Accounts Receivable Aging Report helps manage cash flow by offering visibility into expected incoming payments and potential delays. The report enables financial managers to predict cash inflows accurately and plan expenses accordingly. According to a Harvard Business Review study (2023), companies that analyze their aging reports monthly are 35% more likely to maintain positive cash flow. By identifying overdue accounts, businesses can take early action such as sending payment reminders, imposing late fees, or negotiating revised payment terms. This proactive approach reduces the risk of cash shortages. For example, service-based firms like marketing agencies and manufacturers can use the report to align their credit policies with operational needs, ensuring that revenue cycles remain consistent. Furthermore, accountants use these reports during financial forecasting to determine how much working capital is accessible for investments or debt repayment.

Where to Hire an Accounting/Bookkeeping Expert

Skilled professionals can be found through JMAccountingServices, which offers experienced bookkeepers and accountants specializing in financial reporting, reconciliation, and receivables management. Businesses seeking accurate Accounts Receivable Aging Reports and cash flow analysis can engage their experts to maintain financial health, implement efficient collection procedures, and ensure compliance with accounting standards.

Why Is an Accounts Receivable Aging Report Important for Estimating Bad Debts?

An Accounts Receivable Aging Report is important for estimating bad debts because it helps determine which customer accounts are unlikely to be collected. Businesses use this report to analyze overdue invoices and assess the probability of nonpayment. According to a 2023 Deloitte Financial Insights Survey, nearly 56% of companies rely on aging data to set aside an allowance for doubtful accounts. When invoices remain unpaid for long periods, such as more than 90 days, they often indicate potential defaults. By categorizing receivables based on aging brackets, businesses can estimate the portion of receivables that might become uncollectible and adjust their financial statements accordingly. Many organizations, such as manufacturers and service firms, use these estimates to comply with Generally Accepted Accounting Principles (GAAP) that require accurate representation of expected losses. This process strengthens financial transparency and helps companies maintain realistic revenue forecasts.

How Do You Read and Interpret an Accounts Receivable Aging Report?

To read and interpret an Accounts Receivable Aging Report, start by reviewing the columns that display time intervals such as 0–30, 31–60, 61–90, and over 90 days. These columns show how long customer invoices have remained unpaid. The older the invoice, the greater the risk of default. A CPA Journal 2024 analysis notes that businesses should pay close attention to the “Over 90 Days” column, as this category often represents the highest risk of bad debt. When interpreting the report, assess which clients consistently delay payments and calculate what percentage of receivables are overdue. For example, a company may discover that 25% of its outstanding invoices fall in the 60–90 day range, signaling potential collection issues. By understanding these trends, finance teams can prioritize follow-ups with specific clients, modify credit limits, or tighten collection policies to safeguard liquidity.

How to Create an Accounts Receivable Aging Report in Accounting Software?

To create an Accounts Receivable Aging Report in accounting software, users must first ensure that all customer invoices are accurately recorded with correct issue and due dates. Most accounting platforms, including QuickBooks and Xero, have built-in aging report features that automatically categorize invoices by payment age. According to QuickBooks Business Benchmark Report (2024), small businesses that generate automated aging reports monthly reduce overdue payments by up to 32%. The process typically involves selecting the desired reporting date, choosing the aging intervals, and generating the report to view or export. After the report is created, accountants review it for anomalies such as unapplied credits or incorrect invoice dates. Businesses like e-commerce platforms and service providers use these reports to maintain up-to-date receivables tracking and ensure that financial decisions are supported by real-time data.

How to Implement Accounts Receivable Aging Reports in Your Accounting Process?

To implement Accounts Receivable Aging Reports in your accounting process, integrate them as a recurring component of financial review and cash management routines. The first step is to schedule report generation—weekly or monthly—to ensure consistent monitoring of receivables. A University of Michigan Accounting Study (2023) found that organizations incorporating monthly aging analysis improved their collection timelines by 27%. Assign responsibility to accounting staff to review overdue accounts, communicate with clients, and adjust credit terms where necessary. Implementation should include automation through accounting systems that flag delinquent accounts and trigger reminders. Many companies, such as logistics firms and healthcare providers, embed aging reports within their internal controls to track payment behavior and forecast revenue. When executed properly, this process enhances financial discipline, supports compliance with auditing standards, and strengthens overall cash flow predictability.

What Are Common Mistakes to Avoid When Using Accounts Receivable Aging Reports?

The common mistakes to avoid when using Accounts Receivable Aging Reports include overlooking data accuracy, failing to reconcile accounts regularly, and ignoring older overdue invoices. A CPA Practice Advisor (2024) study revealed that 41% of small businesses misinterpret aging data due to incomplete or outdated invoice entries. When companies fail to update payments or misclassify invoice dates, the report becomes unreliable. Another mistake is focusing only on total outstanding balances rather than analyzing individual customer payment patterns. For example, a business might assume it has stable cash flow, yet a single large client could be responsible for most overdue accounts. Companies such as service providers and manufacturers often lose track of credits and unapplied payments, leading to inflated receivable balances. To maintain report accuracy, businesses should perform monthly reconciliations, verify data consistency, and ensure automation tools are properly configured to avoid human error.

How Do Accounts Receivable Aging Reports Support Collections Strategies?

Yes, Accounts Receivable Aging Reports support collection strategies by helping businesses identify which clients require immediate follow-up and which accounts are high-risk. These reports allow companies to segment customers by payment behavior and prioritize recovery actions based on delinquency levels. According to a Harvard Business Review 2023 financial management study, firms that tailor collection efforts based on aging data recover an average of 22% more outstanding revenue than those using generic reminders. For instance, accounts in the 31–60 day range might receive courtesy reminders, while those beyond 90 days might be escalated to formal collection procedures. Many industries, such as wholesale distribution and consulting, apply these insights to negotiate payment plans or enforce stricter terms with chronic late payers. The report ensures that collection teams focus on the most impactful accounts first, reducing write-offs and improving overall cash conversion cycles.

Where to Find Free Templates for Accounts Receivable Aging Reports?

Free Accounts Receivable Aging Report templates can be found on reputable financial resource platforms and professional accounting sites that provide structured spreadsheet formats. However, for precision and integration, it is more efficient to generate customized reports using accounting software such as QuickBooks, which automates calculations and aging intervals. According to the Journal of Accountancy (2024), over 68% of accountants prefer system-generated reports to manual templates due to reduced risk of human error. For businesses seeking a guided setup or template customization, JMAccountingServices offers tailored report formats aligned with standard accounting principles. These templates include automatic date calculations, color-coded overdue indicators, and summary analytics for faster decision-making. Whether for startups, retail stores, or consulting firms, using well-structured templates ensures clarity, accuracy, and consistency in monitoring receivables.

Where to Hire an Expert to Handle Accounts Receivable Aging Reports?

Skilled professionals to handle Accounts Receivable Aging Reports can be hired through JMAccountingServices, a trusted platform that connects businesses with experienced accountants and bookkeepers specializing in financial reporting, receivables tracking, and credit management. These experts ensure accurate preparation, interpretation, and reconciliation of aging reports while helping businesses improve cash flow and reduce overdue invoices. According to a 2024 Accounting Today industry report, 59% of small and mid-sized businesses saw faster payment turnaround after outsourcing receivables management to certified accounting professionals. Many companies, such as e-commerce brands and logistics providers, use JMAccountingServices to gain access to experts familiar with automated systems like QuickBooks, Xero, and FreshBooks. Hiring through this platform allows organizations to maintain compliance with GAAP standards, strengthen credit control policies, and ensure that every receivable is properly tracked and reported.

How Often Should Businesses Review Accounts Receivable Aging Reports?

The frequency of reviewing Accounts Receivable Aging Reports depends on the company’s transaction volume, but most businesses should review them at least once a month. For high-volume operations, such as retail and wholesale companies, weekly reviews are recommended to ensure prompt action on overdue accounts. A 2023 University of Illinois Accounting Study found that firms reviewing their aging reports weekly reduced overdue receivables by 28% within one quarter. Regular analysis helps detect early payment delays, adjust credit limits, and plan collection efforts strategically. During each review, accountants should compare trends against previous months to identify recurring delinquencies or seasonal payment patterns. Businesses that align aging report reviews with their billing cycles tend to maintain more stable cash flow. Consistent reporting ensures management can forecast revenue accurately, plan budgets effectively, and make informed financial decisions based on real-time payment data.