Overview

- Implementing accounts payable automation means digitising and streamlining the entire invoice-to-payment workflow, replacing manual steps with digital capture, routing, matching and payments.

- Automation reduces errors, late payments and processing bottlenecks—leading to faster approvals, fewer duplicate entries and improved vendor relationships.

- The use of OCR, AI, and structured workflows gives businesses real-time visibility into outstanding liabilities and cash-flow, making financial management more strategic.

- Choosing the right AP automation solution involves ensuring integration with existing accounting systems, secure workflows and scalability as invoice volumes grow.

- Partnering with JM Accounting Services enables businesses to implement AP automation with guidance—from process evaluation to software selection, data migration and ongoing support—ensuring accuracy, compliance and measurable cost/time savings.

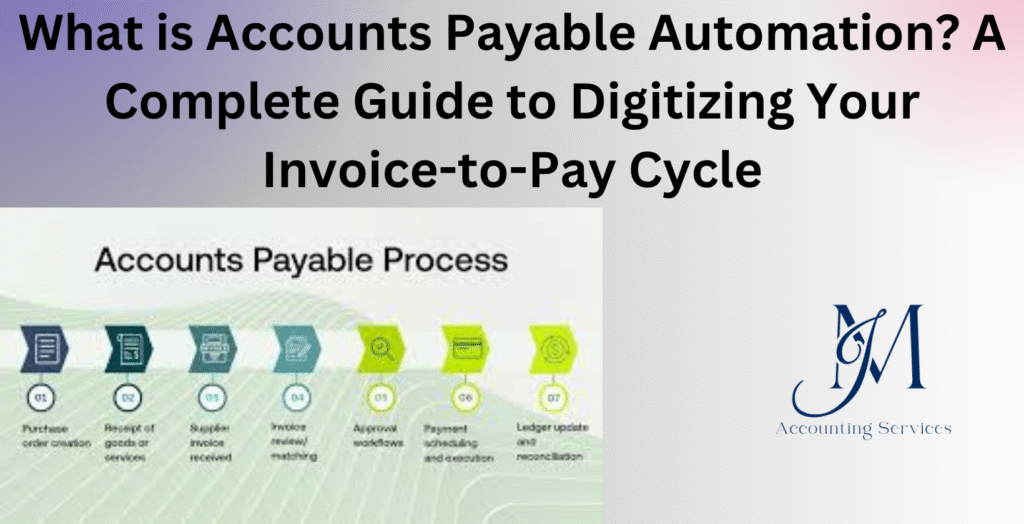

What is Accounts Payable Automation? A Complete Guide to Digitizing Your Invoice-to-Pay Cycle

Accounts payable automation is the process of digitizing and streamlining the invoice-to-payment workflow for businesses. This article explores the meaning and significance of accounts payable automation, its impact on financial operations, and how it digitizes the entire cycle from invoice receipt to payment completion. Drawing insights from industry research and accounting technology reports, it outlines how automation reduces errors, improves compliance, and enhances cash flow visibility. Businesses across industries—from manufacturing firms to tech startups—are adopting automation to eliminate manual bottlenecks and achieve financial accuracy at scale.

What Is Accounts Payable Automation and Why Does It Matter for Businesses?

Accounts payable automation is the use of technology to manage and process vendor invoices digitally, ensuring faster and more accurate payment cycles. The importance of accounts payable automation for businesses lies in its ability to reduce manual data entry errors, prevent late payments, and optimize cash management. According to a 2024 CPA Journal research survey, nearly 68% of businesses using automated AP systems reported a 40% improvement in process efficiency.

The system captures invoices electronically, routes them for approval, and syncs the data directly with accounting software such as QuickBooks or Xero. This leads to better internal control and audit readiness. Many companies, including e-commerce stores and service firms, depend on automation to maintain consistent vendor relationships by ensuring on-time payments. Automation tools also generate real-time reports on outstanding liabilities, helping financial managers make data-driven decisions about cash reserves and payment schedules.

For instance, JMAccountingServices implements AP automation for small and medium enterprises seeking to modernize financial workflows without increasing staff overhead. When invoices are digitized, the likelihood of duplicate or fraudulent entries declines significantly, ensuring compliance with accounting standards.

How Does Accounts Payable Automation Digitize the Invoice-to-Pay Cycle?

Accounts payable automation digitizes the invoice-to-pay cycle by transforming every manual step—invoice capture, approval routing, and payment execution—into a seamless digital workflow. The digitization process begins with automated invoice capture through OCR (optical character recognition) or electronic data interchange (EDI), converting paper or PDF invoices into structured, machine-readable data.

Once captured, invoices are automatically matched with purchase orders and receipts, a process known as three-way matching. According to a 2023 QuickBooks Enterprise survey, automated three-way matching reduces approval time by up to 60%. After verification, the system routes invoices to the designated approvers via secure digital platforms, ensuring traceability and accountability.

The payment stage is completed through integrated digital banking solutions, enabling ACH transfers, virtual cards, or scheduled batch payments. Companies such as manufacturing firms and digital agencies benefit from real-time payment tracking and digital audit trails, which simplify reconciliations during month-end close. Furthermore, automation systems provide detailed analytics dashboards showing payment trends, vendor performance, and cost-saving opportunities.

By adopting accounts payable automation through providers like JMAccountingServices, businesses eliminate paperwork, accelerate approvals, and gain better control over their cash flow. The entire invoice-to-pay process becomes transparent, secure, and scalable—allowing finance teams to focus on strategy rather than repetitive administrative tasks.

What Are the Key Benefits of Implementing AP Automation?

The key benefits of implementing accounts payable automation are improved efficiency, accuracy, and financial transparency across the organization. AP automation replaces repetitive manual work with digital processes that save time and reduce human error. According to a 2024 Deloitte Finance Transformation Report, companies using automated AP systems achieve up to a 70% reduction in invoice processing time and a 50% decrease in late-payment penalties.

Automated systems strengthen data accuracy by eliminating duplicate entries and mismatched payments. They improve vendor satisfaction by ensuring timely disbursements and transparent communication. Many businesses, such as logistics firms and retail companies, benefit from better cash flow forecasting through real-time visibility into outstanding invoices and approved payments. Additionally, automation tools integrate with existing accounting systems to maintain compliance with tax regulations and audit requirements.

AP automation delivers measurable cost savings by reducing labor-intensive tasks and enabling early-payment discounts. It further improves financial oversight by generating analytical insights that allow executives to optimize working capital management. Overall, the adoption of AP automation enhances organizational productivity and long-term profitability.

What Are the Common Challenges in Manual Accounts Payable Processes?

The common challenges in manual accounts payable processes are inefficiency, human error, and lack of visibility. Manual systems depend heavily on paper invoices and physical approvals, leading to delayed payments and financial inconsistencies. A 2023 Institute of Finance & Management (IOFM) study found that over 40% of businesses using manual AP systems experience payment delays exceeding 10 days.

Errors in data entry and missing invoices are frequent in non-automated environments, creating discrepancies in general ledger accounts. Many companies, including construction and service firms, face difficulty reconciling invoices with purchase orders, resulting in overpayments or unapproved expenditures. Manual processes also expose organizations to risks such as invoice fraud and compliance breaches due to limited audit trails.

The absence of centralized data makes it challenging for accounting teams to track pending approvals or monitor vendor performance. These inefficiencies increase administrative workload and hinder strategic financial planning. Over time, the accumulation of such bottlenecks limits a company’s scalability and responsiveness to business growth.

How to Choose the Right AP Automation Software for Your Needs?

The right accounts payable automation software should align with your company’s financial workflows, scalability goals, and integration requirements. When choosing an AP automation solution, organizations should evaluate usability, compatibility with existing accounting systems, and vendor support. According to a 2024 Gartner Financial Systems Review, businesses that select software based on integration capability experience 30% faster implementation success.

The software should feature automated invoice capture, approval routing, digital payment options, and comprehensive reporting dashboards. Companies such as manufacturing and consulting firms benefit from AI-enabled tools that can detect anomalies and flag duplicate or fraudulent invoices. Security standards, including encryption and role-based access control, are crucial to protect sensitive financial data.

Scalability is another critical factor, ensuring that the software can handle higher invoice volumes as the business grows. Partnering with professionals like JMAccountingServices helps organizations evaluate software options based on real-world accounting needs and implementation best practices. A well-chosen AP automation platform streamlines financial operations and ensures measurable ROI through efficiency gains.

What Steps Are Involved in Implementing AP Automation in Accounting?

The steps involved in implementing accounts payable automation in accounting include process evaluation, software selection, data migration, staff training, and continuous monitoring. The first step is assessing the existing AP workflow to identify pain points and define measurable improvement goals. Companies such as startups and financial service providers often begin by mapping their current invoice-to-pay process to determine automation priorities.

Next, the appropriate AP automation software is selected based on integration needs and budget considerations. Data migration follows, where historical invoices and vendor records are securely imported into the new system. According to a 2023 CPA Technology Insights survey, businesses that properly plan data migration achieve 90% fewer integration errors.

Staff training ensures that accounting teams understand how to manage and approve invoices within the automated system. Once deployed, the system undergoes a testing phase to confirm accurate data capture, approval routing, and payment execution. The final step involves ongoing monitoring and performance analysis to fine-tune efficiency and compliance.

Implementing AP automation with guidance from JMAccountingServices ensures a structured transition, enabling businesses to modernize their accounting operations while maintaining accuracy, security, and transparency throughout the process.

How Can AP Automation Ensure Compliance and Reduce Fraud Risks?

AP automation ensures compliance and reduces fraud risks by enforcing structured approval workflows, maintaining transparent audit trails, and validating transactions against authorized data sources. Automated systems require every invoice to go through rule-based validation, ensuring alignment with internal control policies and regulatory standards such as GAAP and SOX. According to a 2024 CPA Journal study, businesses using automated AP solutions experienced a 43% reduction in compliance-related errors compared to those relying on manual systems.

Compliance is strengthened because all financial activities are digitally recorded and time-stamped, providing a clear audit trail. This transparency allows internal and external auditors to review the financial process easily. Many organizations, including healthcare institutions and financial service firms, rely on automation to meet strict reporting standards and prevent misappropriation of funds.

Fraud risk is minimized through advanced security measures such as role-based access controls, vendor authentication, and duplicate invoice detection. Automated three-way matching—comparing invoices, purchase orders, and receipts—prevents unauthorized or inflated payments. Platforms implemented by JMAccountingServices integrate fraud detection algorithms that identify anomalies in payment patterns, further protecting the business from potential financial misconduct.

What Role Does AI and OCR Play in Modern AP Automation?

The role of AI and OCR in modern accounts payable automation is to enhance accuracy, speed, and data intelligence in invoice processing. AI (artificial intelligence) algorithms analyze large volumes of invoice data to detect irregularities, predict payment behaviors, and optimize cash flow management. OCR (optical character recognition) technology extracts text and numerical data from scanned or digital invoices, eliminating the need for manual entry.

According to a 2023 QuickBooks AI Innovation Report, the use of AI and OCR in AP automation reduces invoice processing time by up to 80% and improves accuracy rates to above 98%. AI-driven tools learn from historical payment data, automatically categorizing expenses and suggesting approval routes based on prior patterns. Many businesses, such as manufacturing firms and marketing agencies, benefit from OCR’s ability to recognize various invoice formats and vendor templates across multiple languages and currencies.

AI also supports predictive analytics by identifying potential bottlenecks and recommending process adjustments. For example, JMAccountingServices uses AI-enhanced automation to flag unusual invoice amounts and optimize payment scheduling. Together, AI and OCR turn traditional AP functions into data-driven, error-free operations that boost financial efficiency and control.

How Much Time and Cost Savings Can Businesses Expect from AP Automation?

Businesses can expect significant time and cost savings from AP automation, with measurable improvements in efficiency, accuracy, and resource allocation. A 2024 PayStream Advisors Report found that organizations implementing AP automation reduced invoice processing costs from an average of $12 per invoice to less than $3. This represents a cost reduction of nearly 75%.

In terms of time, automated workflows accelerate invoice approvals from several days to a few hours. Many companies, such as logistics providers and consulting agencies, have reported a 65% faster approval cycle after implementing digital payment systems. The elimination of paper-based tasks cuts administrative time, allowing accounting staff to focus on financial analysis and strategic budgeting.

Automation systems generate real-time insights that help identify cost-saving opportunities, such as early payment discounts or optimized vendor contracts. Moreover, error reduction minimizes rework costs and mitigates financial discrepancies. Partnering with experts at JMAccountingServices helps businesses design automation frameworks that maximize ROI, achieve predictable cash flow, and sustain long-term financial efficiency.

Where to Hire Experts for AP Automation Implementation and Support?

Experts for AP automation implementation and support can be hired through specialized accounting service providers such as JMAccountingServices, which offers end-to-end automation setup, customization, and ongoing maintenance. These professionals bring expertise in financial systems integration, data migration, and compliance management, ensuring a smooth transition from manual to digital accounts payable workflows.

Hiring experienced professionals ensures that businesses select the right automation software compatible with their accounting platforms such as QuickBooks, Xero, or Sage. According to a 2024 Accounting Today report, 73% of companies that partnered with certified implementation specialists experienced faster adoption and higher user satisfaction rates. Many organizations, including startups, retail brands, and construction firms, rely on experts to train staff, configure approval hierarchies, and secure vendor payment channels.

Working with JMAccountingServices ensures technical precision, process optimization, and ongoing support tailored to business-specific needs. Their certified accountants and system analysts help companies monitor post-implementation performance, enhance fraud protection, and update workflows as financial regulations evolve. Engaging such professionals ensures long-term efficiency, compliance, and scalability in accounts payable management.

What Are Real-World Examples of Successful AP Automation Transformations?

Real-world examples of successful AP automation transformations demonstrate how digital innovation streamlines finance operations, enhances compliance, and boosts profitability. For instance, a mid-sized logistics company that transitioned to AP automation through JMAccountingServices reduced its invoice processing time by 65% and achieved 100% visibility into payment approvals. This change eliminated paper invoices, minimized late fees, and improved vendor trust.

In another case, a manufacturing firm processing over 10,000 invoices monthly implemented AI-enabled AP automation, which cut administrative costs by 45% within the first quarter. According to a 2023 CPA Journal analysis, organizations in industries such as healthcare, retail, and technology that adopted automated AP systems saw up to a 60% improvement in cash flow predictability and audit accuracy.

A professional services firm that partnered with JMAccountingServices achieved full integration between its ERP and banking systems, enabling same-day vendor payments and automatic reconciliation. These examples show that automation not only delivers measurable ROI but also strengthens internal governance, positioning businesses for sustainable growth.

How Will AP Automation Evolve in the Future for Better Efficiency?

AP automation will evolve in the future through deeper integration with artificial intelligence, blockchain technology, and predictive analytics to enhance accuracy and decision-making. Emerging systems will move beyond reactive payment processing to proactive financial management that predicts cash flow, negotiates vendor terms, and prevents fraud before it occurs.

AI will play a central role in adaptive learning, allowing systems to identify new spending patterns and automatically adjust approval workflows. Blockchain will ensure tamper-proof transaction records, improving transparency and auditability. According to a 2025 FinTech Outlook Report, over 80% of enterprises plan to integrate blockchain-based invoice verification by 2028 to enhance payment security.

Cloud-based AP platforms will continue expanding, enabling real-time collaboration between accounting teams, vendors, and financial institutions. Many companies, such as global retailers and SaaS providers, are already adopting API-driven systems for cross-border payment synchronization.

Experts at JMAccountingServices anticipate that future automation will deliver not just efficiency but also strategic intelligence—transforming accounts payable from a cost center into a core contributor to business growth and financial forecasting accuracy.