Overview

- Accounts payable refers to the short-term obligations a business owes to its creditors or suppliers for goods and services purchased on credit, typically due within one accounting cycle (e.g., 30-90 days).

- These payables appear as current liabilities on the balance sheet and are key indicators of a company’s cash flow management and operational efficiency.

- Typical examples include unpaid invoices for raw materials, utilities, office supplies, or services – anything procured where payment is deferred.

- Proper recording and management of accounts payable involve matching invoices to purchase orders and deliveries, entering accurate journal entries, and scheduling timely payment to avoid penalties or supplier relationship issues.

- Efficient payables management—including automation, strong internal controls, and reconciliation—supports better vendor terms, improved liquidity, and financial transparency.

What is Considered Accounts Payable

Accounts payable represents the outstanding short-term obligations a business owes to its creditors or suppliers for goods and services received on credit. These liabilities are crucial for understanding a company’s liquidity and operational efficiency. In accounting, accounts payable serve as a measure of how effectively an organization manages its cash flow, vendor relationships, and short-term financing. According to research published in the CPA Journal, companies that maintain strong accounts payable systems reduce operational delays and improve creditworthiness. For example, many businesses, such as retailers and manufacturing firms, rely on structured payables management to sustain supply chains and prevent late fees or penalties. In essence, accounts payable are a key component of financial stability, allowing firms to manage obligations while maintaining the flexibility to fund growth.

What Is Considered Accounts Payable?

What is considered accounts payable is the total amount a business owes to its suppliers or vendors for purchases made on credit that have not yet been paid. The obligations fall under current liabilities on a company’s balance sheet because they are typically due within one accounting cycle, usually 30 to 90 days. According to a 2024 QuickBooks survey, nearly 68% of small businesses rely on accounts payable tracking software to prevent missed payments and strengthen vendor trust. Examples of accounts payable include unpaid invoices for raw materials, utilities, office supplies, or subcontracted services used in daily operations. Many organizations, such as construction companies and e-commerce businesses, process dozens of payables weekly to maintain production and delivery schedules. The accuracy of this record affects a company’s financial reputation, making timely reconciliation essential. When a business fails to manage accounts payable properly, it risks damaging supplier relationships and accruing interest or penalties that could impact cash flow stability.

How Does Accounts Payable Differ from Accounts Receivable?

The difference between accounts payable and accounts receivable lies in the direction of the financial obligation. Accounts payable represent the money a business owes to others, while accounts receivable represent the money owed to the business by its clients or customers. In simple terms, payables are liabilities, and receivables are assets. For example, when a marketing agency pays its software vendor, that amount is recorded as accounts payable; when the same agency invoices a client for services rendered, that amount becomes accounts receivable. A study by the Journal of Accounting Research found that businesses that actively balance both payables and receivables cycles experience stronger liquidity ratios and more consistent cash flows. The two processes are interconnected: delayed receivables can hinder a company’s ability to meet its payable deadlines. Many companies, such as wholesalers and service providers, use integrated accounting systems to synchronize both sides of the transaction, improving financial visibility. Skilled professionals can be found through JMAccountingServices to help streamline these processes and ensure accurate reconciliation, compliance, and timely payments, strengthening both internal and external financial management.

What Are Key Examples of Accounts Payable in Business Operations?

The key examples of accounts payable in business operations are the unpaid obligations that arise from regular purchasing and service activities essential to maintaining day-to-day functions. Common examples include payments owed to suppliers for inventory, office equipment, maintenance services, utilities, and professional consulting fees. For instance, manufacturing companies often record payables for raw materials, while retail chains record amounts due for wholesale stock purchases. A 2023 Deloitte financial management report indicated that over 70% of mid-sized enterprises classify vendor invoices, rent, and short-term service contracts as part of their core accounts payable entries. Many businesses, such as technology startups and logistics companies, maintain recurring payables to software vendors and transport providers to sustain operations. These payables ensure continuity by providing access to goods and services before full payment is made, supporting efficient business cycles and vendor relations.

How Do You Record Accounts Payable in Financial Statements?

Accounts payable are recorded in financial statements as a current liability under the balance sheet. The recording process begins when a company receives goods or services on credit and the vendor issues an invoice. The business then creates a journal entry crediting “Accounts Payable” and debiting the appropriate expense or asset account. For example, if a company purchases $5,000 worth of office furniture on credit, it records a $5,000 debit to “Office Equipment” and a $5,000 credit to “Accounts Payable.” When the payment is made, the payable is debited, and the cash account is credited, clearing the liability. According to the Journal of Corporate Accounting & Finance, accurate recording of accounts payable improves transparency and compliance with Generally Accepted Accounting Principles (GAAP). Many businesses, such as construction firms and healthcare providers, use digital accounting tools to automate entries and maintain audit trails. Consistent reconciliation between invoices and payment records prevents duplicate liabilities and enhances the accuracy of financial reporting.

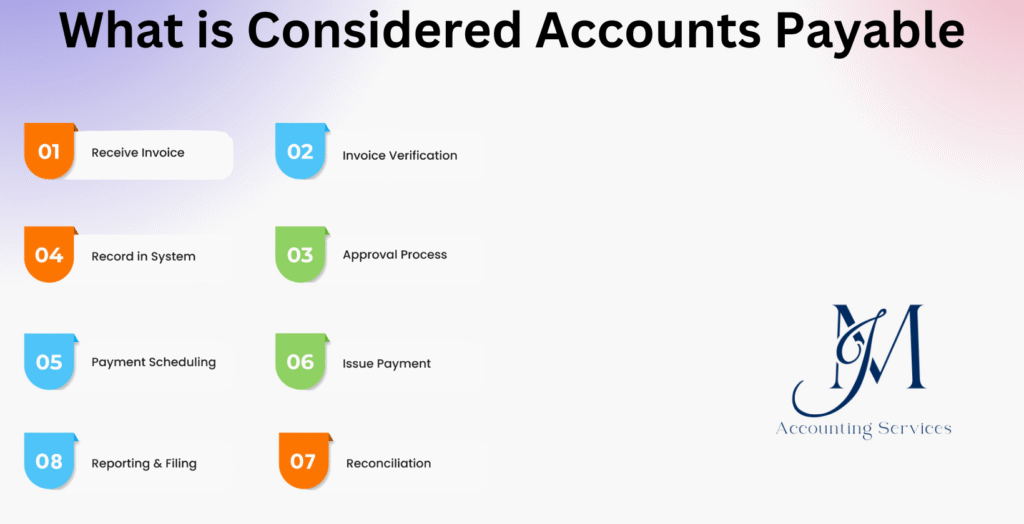

What Is the Standard Process for Managing Accounts Payable?

The standard process for managing accounts payable involves several sequential steps designed to ensure accuracy, accountability, and timely payment. The first step is purchase order creation, where a business documents the intent to acquire goods or services. The second step is invoice verification, which matches the supplier invoice with the purchase order and delivery receipt to confirm validity. The third step is recording the payable in the accounting system. The final step is payment authorization, where approved invoices are scheduled for payment based on agreed credit terms. Research from PwC’s 2024 Financial Operations Report shows that companies using standardized payable workflows reduce payment delays by up to 35%. Many businesses, such as manufacturing plants and marketing agencies, adopt an automated accounts payable system to manage vendor data, track due dates, and avoid duplicate payments. The process ensures compliance with internal controls, supports budgeting accuracy, and sustains healthy supplier relationships.

How Can Businesses Implement Effective Accounts Payable Practices?

Businesses can implement effective accounts payable practices by adopting automation, enforcing strict internal controls, and maintaining strong vendor communication. Automated systems streamline invoice capture, matching, and approval, reducing manual errors and processing time. Internal controls, such as segregation of duties and mandatory approvals, prevent unauthorized transactions and enhance audit readiness. A report from Harvard Business Review in 2024 found that organizations with automated payables systems experienced a 40% improvement in cash flow forecasting accuracy. Many companies, such as e-commerce businesses and consulting firms, set up electronic payment schedules to take advantage of early-payment discounts and avoid late fees. Regular reconciliation between supplier statements and accounting records further strengthens financial integrity. Skilled professionals can be found through JMAccountingServices to assist in designing and maintaining efficient accounts payable workflows that comply with accounting standards and improve long-term financial performance.

What Role Does Invoice Approval Play in Accounts Payable?

The role of invoice approval in accounts payable is to ensure that every payment made by a business is accurate, authorized, and aligned with contractual terms. This process serves as a financial control mechanism that verifies the validity of invoices before funds are released. During approval, invoices are reviewed against purchase orders and delivery receipts to confirm that goods or services were actually received and that quantities and prices match the agreed terms. According to a 2024 study by the Institute of Finance & Management (IOFM), companies that follow structured invoice approval workflows reduce payment errors by over 30%. Many organizations, such as manufacturing firms and IT service providers, use digital approval systems that route invoices to department heads for validation. These systems maintain audit trails that support transparency and compliance with internal accounting standards. The approval process protects businesses from overpayments, duplicate billing, and fraud, strengthening financial integrity while improving relationships with suppliers who value timely, accurate settlements.

Why Is the Accounts Payable Turnover Ratio Important?

The accounts payable turnover ratio is important because it measures how efficiently a company pays its suppliers and manages short-term obligations. A high turnover ratio indicates prompt payments and strong liquidity, while a low ratio suggests delayed payments or potential cash flow strain. This metric is calculated by dividing total supplier purchases by the average accounts payable during a specific period. According to a 2023 CPA Journal analysis, top-performing businesses maintain an average turnover ratio between 6 and 10 annually, reflecting healthy payment cycles. For example, retailers and wholesalers that regularly restock inventory often monitor this ratio to optimize credit terms with vendors. The ratio is critical for financial planning, as it reveals how quickly obligations are cleared, affecting both supplier relationships and a company’s credit reputation. Lenders and investors assess this metric to evaluate operational efficiency and the firm’s ability to meet financial commitments promptly.

How Do Rising or Declining Accounts Payable Levels Impact Cash Flow?

Yes, rising or declining accounts payable levels directly impact a company’s cash flow. Rising accounts payable levels indicate that a business is delaying payments, which temporarily preserves cash but may signal liquidity stress or strained supplier relations. In contrast, declining payable levels show faster payments, which can enhance vendor trust but reduce available cash for other operations. A 2024 QuickBooks Financial Insights Report revealed that businesses maintaining a balanced payable cycle—typically paying invoices within 45 days—achieve 25% better cash flow stability. Many companies, such as logistics providers and consumer goods manufacturers, use this balance strategically to maintain both liquidity and goodwill. When accounts payable rise excessively, suppliers may tighten credit terms or demand prepayments, affecting operational flexibility. When payables decline too sharply, businesses risk depleting working capital. Effective accounts payable management therefore ensures a sustainable cash flow rhythm, where obligations are met on time without compromising investment and growth capacity.

What Strategies Ensure Compliance in Accounts Payable Management?

The strategies that ensure compliance in accounts payable management are those that establish strong internal controls, consistent documentation, and regulatory adherence across all payment activities. Compliance begins with segregation of duties—where different personnel handle invoice processing, approval, and payment authorization—to prevent fraud and unauthorized disbursements. Accurate recordkeeping and reconciliation ensure that all transactions align with Generally Accepted Accounting Principles (GAAP) and tax regulations. According to a 2024 report by the Association of Certified Fraud Examiners (ACFE), organizations with formalized payables compliance frameworks experience 45% fewer financial discrepancies than those without structured systems. Many businesses, such as healthcare providers and manufacturing companies, implement electronic audit trails and vendor verification systems to monitor irregularities. Routine internal audits, supplier screening under anti-bribery laws, and compliance with payment data protection regulations like the Sarbanes–Oxley Act further strengthen accountability. Companies that use automated compliance dashboards achieve higher transparency, reduced processing errors, and consistent adherence to corporate governance standards. Effective compliance in accounts payable not only reduces financial risk but also enhances the company’s reputation for reliability and ethical conduct in financial operations.

Where Can You Hire Experts to Handle Accounts Payable Outsourcing?

Experts to handle accounts payable outsourcing can be hired through JMAccountingServices, where skilled professionals specialize in managing vendor payments, reconciliation, and process automation for businesses of all sizes. Outsourcing enables organizations to streamline workflows, improve accuracy, and focus on core operations while ensuring compliance with financial regulations. According to a 2023 Deloitte outsourcing survey, nearly 59% of mid-sized businesses outsource their payables to reduce administrative costs and access advanced accounting technologies. Many companies, such as retail chains and technology firms, rely on external experts for invoice processing, vendor management, and financial reporting oversight. Professionals available through JMAccountingServices possess experience in cloud-based accounting systems, enabling real-time monitoring of cash flow and automated payment scheduling. Their services help prevent payment delays, eliminate duplicate invoices, and maintain accurate audit documentation. Hiring dedicated accounts payable specialists ensures that every transaction complies with accounting standards and supports a company’s long-term financial efficiency and scalability.