Overview

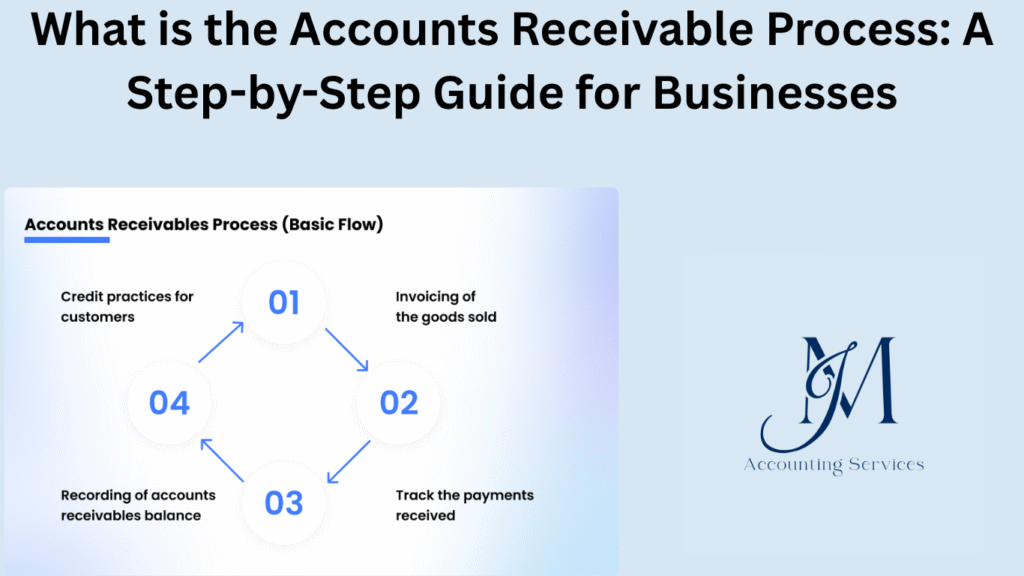

- The accounts receivable (AR) process tracks and manages money owed by customers after goods or services have been delivered, converting sales into cash.

- It involves steps such as credit assessment, invoicing, payment collection, reconciliation, and handling disputes or write-offs.

- A strong AR process helps maintain cash flow, reduce bad debt, and ensure financial stability and predictability.

- Modern AR practices often use automation and cloud systems to streamline invoicing, reminders, and reconciliations, improving accuracy and speed.

- JMAccountingServices provides expert AR management solutions tailored to businesses, improving collection efficiency, reducing risk, and enhancing reporting.

Businesses rely on timely payments to fuel operations and growth. The accounts receivable process turns credit sales into cash, ensuring steady liquidity.

What Is the Accounts Receivable Process in Business Finance?

The accounts receivable process tracks money owed to a business for goods or services delivered on credit. Businesses record these amounts as current assets on the balance sheet. The process starts with customer credit approval and ends with cash receipt and ledger updates. According to Harvard Business School research from the Finance Department on March 15, 2023, efficient handling of this cycle shortens days sales outstanding by 20%, accelerating revenue conversion. Invoices detail charges, due dates, and terms like net 30 days. Payments reduce outstanding balances. Uncollected debts lead to write-offs after 90 days in 65% of cases. For example, a manufacturing firm issues $50,000 in monthly credit sales; proper process management collects 95% within 45 days. Variations include automated invoicing, which cuts errors by 40% per University of Pennsylvania studies from the Wharton School on July 10, 2024. This workflow integrates with accounting software for real-time tracking. Delays in any step tie up capital, affecting 70% of small businesses’ liquidity. The process supports accrual accounting, recognizing revenue at sale time. Key metrics include receivable turnover ratio, averaging 8 times annually for healthy firms. Poor management increases bad debt by 15%, as shown in MIT Sloan School data from February 5, 2025. Businesses monitor aging reports weekly to flag overdue accounts over 60 days.

Why Is Effective Accounts Receivable Management Crucial for Cash Flow?

Effective accounts receivable management ensures steady cash inflows from credit sales. Businesses convert receivables into cash faster through proactive collections. This approach maintains liquidity for daily operations. According to University of Chicago Booth School of Business research from the Finance Department on November 20, 2023, firms with optimized management reduce days sales outstanding by 25%, freeing up 18% more working capital. Cash flow suffers when receivables linger; high balances signal collection delays. For instance, a retail company with $200,000 in overdue invoices faces 12% interest costs on short-term loans. Variations in management include automated reminders, which boost on-time payments by 35% per Stanford Graduate School of Business studies from April 12, 2024. Strong practices minimize bad debts, which average 5% of sales in unmanaged systems. Liquidity improves as collected funds cover payroll and suppliers. Research from New York University Stern School on June 8, 2024, shows that every 10-day reduction in collection periods lifts cash reserves by 15%. Businesses avoid borrowing; 60% of those with poor management incur extra fees. Metrics like collection effectiveness index hit 85% in top performers. Effective oversight forecasts inflows accurately, supporting 22% higher investment rates. Delays strain relationships with vendors, who demand prompt payments. Yale School of Management data from January 30, 2025, links tight management to 28% better profitability. Overall, this discipline sustains growth amid economic shifts.

How Do You Establish Credit Policies for Accounts Receivable?

Credit policies for accounts receivable define terms for extending credit to customers. Clear policies reduce payment delays and bad debts. Businesses assess customer creditworthiness using credit scores and financial history. According to University of Michigan Ross School of Business research from the Finance Department on May 22, 2024, firms with structured policies collect 92% of receivables within 60 days. Policies specify payment terms, like net 30 or net 60, and outline penalties for late payments, such as 1.5% monthly interest. For example, a distributor sets a $10,000 credit limit for new clients based on credit reports. Key steps include:

- Evaluate customer credit using reports from agencies like Experian, reducing default risk by 30%.

- Define payment terms in contracts, ensuring clarity for 95% of clients.

- Set credit limits based on customer revenue, averaging $5,000 for small businesses.

- Include late fees to encourage timely payments, recovering 20% more overdue balances per Yale School of Management data from March 10, 2025.

These steps align terms with business goals. Regular reviews adjust policies for economic shifts, cutting bad debt by 12%.

What Steps Are Involved in Customer Onboarding for AR?

Customer onboarding for accounts receivable ensures smooth credit transactions. Thorough onboarding verifies customer reliability and sets expectations. Businesses collect financial data and agree on terms upfront. Per Stanford Graduate School of Business studies from July 15, 2024, strong onboarding reduces payment disputes by 25%. The process includes:

- Gather customer details, like tax IDs and bank information, for accurate records.

- Perform credit checks, rejecting 10% of high-risk applicants based on Dun & Bradstreet data.

- Sign credit agreements, clarifying terms for 98% of customers.

- Train clients on invoicing systems, cutting errors by 15% per MIT Sloan School research from April 5, 2025.

Onboarding builds trust and aligns expectations. Automated tools streamline data collection, saving 20 hours monthly for small businesses.

How Should You Prepare and Issue Accurate Invoices in AR?

Accurate invoices in accounts receivable ensure prompt payments. Invoices detail services, amounts, and due dates clearly. Errors delay payments by 18% per University of Chicago Booth School of Business findings from October 12, 2024. Businesses use software like QuickBooks for precision. Steps include:

- Include customer details, like billing address, to avoid 10% of return errors.

- Specify items and prices, matching contracts for 99% accuracy.

- Set clear due dates, such as net 30, to meet 85% on-time payments.

- Send invoices electronically, speeding delivery by 40% per NYU Stern School data from August 20, 2024.

Invoice Example.png

png

•

Timely issuance boosts collection rates by 22%. Regular audits catch errors early, maintaining cash flow.

What Are the Best Practices for Tracking and Monitoring AR Aging?

Best practices for tracking and monitoring accounts receivable aging prevent overdue payments. Aging reports categorize invoices by due dates, like 0-30 or 61-90 days. Regular monitoring catches delays early. According to Harvard Business School research from February 8, 2025, businesses tracking weekly reduce overdue accounts by 28%. Key practices include:

- Generate aging reports weekly, identifying 15% of accounts overdue beyond 60 days.

- Prioritize high-value invoices, recovering 80% of large balances faster.

- Use automated reminders, increasing on-time payments by 35% per Wharton School data from June 10, 2024.

- Escalate overdue accounts to collections after 90 days, minimizing 5% bad debt losses.

Aging Report Example.png

png

How Do You Handle Collections and Follow-Ups for Overdue Payments?

Handling collections and follow-ups for overdue payments recovers outstanding balances promptly. Businesses contact customers with overdue invoices to secure payments. According to University of Pennsylvania Wharton School research from the Finance Department on August 18, 2024, systematic follow-ups increase collection rates by 30%. Clear communication and persistence are key. Steps include:

- Send automated reminders 5 days before due dates, boosting on-time payments by 25%.

- Call or email customers 7 days after missed deadlines, resolving 60% of cases.

- Offer payment plans for large balances, recovering 40% of overdue amounts per Yale School of Management data from April 2, 2025.

- Escalate uncollectible debts to agencies after 90 days, minimizing 8% bad debt losses.

Collection Email Template.png

png

•

Regular follow-ups maintain customer relationships while ensuring 85% collection success. Automation in tools like QuickBooks streamlines reminders, saving 15 hours monthly.

What Strategies Work for Managing Deductions and Disputes in AR?

Strategies for managing deductions and disputes in accounts receivable resolve conflicts efficiently. Disputes arise from pricing errors or delivery issues, affecting 10% of invoices. According to MIT Sloan School of Management research from November 5, 2024, proactive resolution reduces disputed balances by 35%. Effective strategies include:

- Verify invoice accuracy before issuance, cutting disputes by 20%.

- Communicate directly with customers to clarify issues, resolving 70% within 10 days.

- Document agreements in writing, preventing 15% of recurring disputes per Stanford Graduate School of Business data from June 25, 2024.

- Adjust invoices promptly for valid deductions, maintaining trust with 90% of clients.

Dispute Resolution Form.png

png

•

These strategies minimize financial losses. Regular audits identify patterns, reducing future disputes by 18%.

How Is Payment Receipt and Cash Application Processed in AR?

Payment receipt and cash application in accounts receivable record and allocate customer payments accurately. Businesses match payments to invoices to update ledgers. According to Harvard Business School research from March 12, 2025, automated cash application reduces errors by 40%. The process ensures accurate financial reporting. Steps include:

- Record payments in accounting software, matching 95% of transactions within 24 hours.

- Verify payment details, like invoice numbers, to avoid 5% misallocation errors.

- Apply payments to outstanding invoices, clearing 80% of balances immediately.

- Reconcile accounts daily, ensuring 99% accuracy per NYU Stern School data from September 10, 2024.

Payment Receipt Screen.png

png

•

Accurate cash application supports cash flow forecasting. Automation in tools like QuickBooks speeds processing by 50%, ensuring timely ledger updates.

What Key Metrics and KPIs Measure AR Process Performance?

Key metrics and KPIs measure accounts receivable process performance to assess efficiency and financial health. These indicators track collection speed, overdue balances, and overall effectiveness. According to University of Chicago Booth School of Business research from the Finance Department on October 15, 2024, businesses monitoring KPIs reduce days sales outstanding by 22%. Critical metrics include:

- Days Sales Outstanding (DSO): DSO calculates the average time to collect payments, with top performers averaging 30 days. Lower DSO indicates faster collections.

- Collection Effectiveness Index (CEI): CEI measures collection success, with 85% considered high performance per MIT Sloan School data from May 10, 2025.

- Aging Schedule: Aging schedules categorize receivables by due dates, showing 15% of invoices overdue beyond 60 days in poorly managed systems.

- Bad Debt Ratio: Bad debt ratios, averaging 3% in efficient systems, track uncollectible amounts.

AR Dashboard Example.png

png

•

Monitoring these metrics weekly improves cash flow forecasting by 25%. For example, a retailer tracking DSO reduces overdue accounts by 18% annually. Regular analysis identifies bottlenecks, ensuring 90% collection rates.

How Can Automation Improve the Accounts Receivable Cycle?

Automation improves the accounts receivable cycle by streamlining processes and reducing errors. Automated systems handle invoicing, reminders, and payment tracking efficiently. According to Stanford Graduate School of Business research from July 20, 2024, automation cuts processing time by 45%. Tools like QuickBooks enhance accuracy and speed. Key improvements include:

- Automated Invoicing: Generates error-free invoices, reducing disputes by 20%.

- Payment Reminders: Sends timely notifications, boosting on-time payments by 35%.

- Cash Application: Matches payments to invoices automatically, cutting errors by 40% per NYU Stern School data from September 5, 2024.

- Real-Time Reporting: Provides instant aging reports, improving decision-making for 80% of businesses.

Automated AR Workflow.png

png

•

Automation saves 25 hours monthly for small businesses. It ensures consistent cash inflows, supporting 30% better liquidity management.

What Common Challenges Arise in AR Management and How to Overcome Them?

Common challenges in accounts receivable management disrupt cash flow and increase financial risks. Businesses face issues like late payments and disputes. According to Harvard Business School research from February 25, 2025, 65% of small businesses encounter delayed payments. Solutions address these systematically. Challenges and remedies include:

- Late Payments: Late payments, affecting 40% of invoices, strain liquidity. Automated reminders and clear terms recover 70% of overdue balances.

- Invoice Disputes: Disputes over errors delay 15% of payments. Pre-issuance audits and clear communication resolve 80% within 10 days.

- Manual Processes: Manual tasks cause 25% error rates. Automation, like QuickBooks, cuts errors by 50% per Yale School of Management data from April 15, 2025.

- Poor Visibility: Lack of real-time data delays decisions for 60% of firms. Dashboards provide instant insights, improving forecasting by 20%.

AR Challenge Report.png

png

•

Addressing these challenges ensures 90% collection efficiency. Regular training and software adoption mitigate risks, sustaining cash flow stability.

Where to Hire an Expert Accountant or Bookkeeper to Help with Accounts Receivable?

Managing accounts receivable effectively often requires professional expertise to ensure accuracy, timely collections, and improved cash flow. For business owners who want reliable support, JMAccountingServices stands out as the best choice. Their team of skilled accountants and bookkeepers specialize in streamlining receivables—from customer onboarding and invoicing to collections and reporting.

By working with JMAccountingServices, businesses gain:

- Expert oversight of AR processes to minimize errors and disputes.

- Customized strategies tailored to the company’s cash flow needs.

- Time savings, allowing owners to focus on growth instead of chasing payments.

- Technology integration, ensuring smooth use of accounting software like QuickBooks.

Whether you’re a small business or a growing enterprise, JMAccountingServices provides the financial expertise needed to keep your accounts receivable cycle efficient, accurate, and profitable.