Overview

- Accounts payable represents the total amount a business owes to its suppliers or service providers for purchases made on credit.

- It appears on the liability side of the balance sheet and typically involves short-term debts (commonly 30-90 days).

- Proper tracking and recording of accounts payable is crucial for cash-flow management, supplier relationships and credit standing.

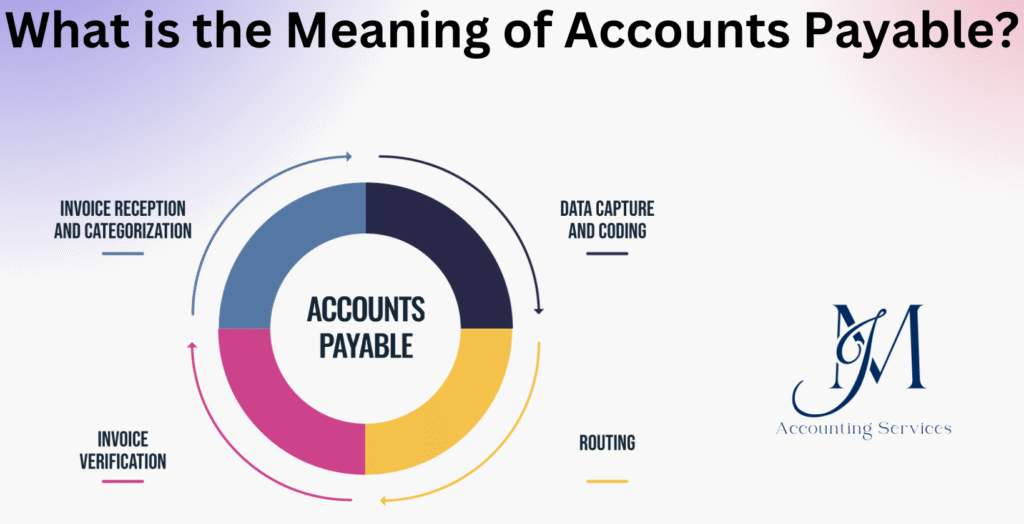

- A standard accounts payable process includes receiving invoices, verifying them (purchase order, delivery receipts), recording the liability, approving payment and clearing the outstanding amount.

- Businesses that automate and apply strong internal controls over their payables reduce errors, improve liquidity, capture early-payment discounts and ensure compliance.

What Is the Meaning of Accounts Payable?

The meaning of accounts payable is the total amount a company owes to its suppliers or service providers for purchases made on credit. In simple terms, it is the liability section of a company’s balance sheet that tracks short-term debts due within a specific period, typically 30 to 90 days. According to a 2024 QuickBooks small business report, 64% of U.S. small businesses rely on accounts payable to manage vendor payments efficiently. Accounts payable ensures that all outstanding obligations are documented and paid on time, helping maintain good supplier relationships and credit ratings.

For example, when a company purchases office furniture on credit, the supplier’s invoice becomes part of accounts payable until the business settles it. Accounts payable is vital for cash flow management because it allows companies to plan payments strategically without disrupting daily operations.

How Does Accounts Payable Differ from Accounts Receivable?

Accounts payable differs from accounts receivable in its financial direction and purpose. Accounts payable represents money that a business owes to others, while accounts receivable represents money owed to the business by its clients or customers. In other words, accounts payable is a liability, whereas accounts receivable is an asset.

According to a CPA Journal study, companies that track both accounts payable and receivable effectively achieve up to 20% higher liquidity efficiency than those that do not. For instance, a manufacturer that buys raw materials from a supplier on credit records this transaction as accounts payable. In contrast, when it sells finished goods to retailers on credit, the transaction becomes accounts receivable.

Managing both accounts payable and accounts receivable together provides a complete view of a business’s short-term financial position. Companies, such as retail chains and construction firms, rely on this dual system to forecast cash needs, manage vendor relationships, and ensure a balanced cash cycle.

What Are the Key Examples of Accounts Payable Transactions?

The key examples of accounts payable transactions include payments owed to vendors for goods, utilities, professional services, and maintenance. These transactions typically arise during normal business operations when goods or services are received before payment is made.

Common examples of accounts payable transactions include:

- Purchasing inventory or raw materials on credit from a supplier.

- Paying for monthly office utilities, such as electricity, water, and internet.

- Engaging professional services like accounting, marketing, or legal assistance.

- Subscribing to software or maintenance contracts billed on a deferred payment basis.

According to a 2023 American Institute of CPAs (AICPA) report, over 70% of small and mid-sized companies automate accounts payable to reduce processing errors and improve payment timelines. For instance, when a business hires a cleaning service and receives an invoice payable in 30 days, that transaction is recorded as accounts payable until the payment clears.

Companies can ensure accuracy and compliance in these transactions by using accounting systems such as QuickBooks or hiring skilled professionals through JMAccountingServices. These experts specialize in managing payables efficiently, preventing late fees, and ensuring transparency in financial reporting.

How Do You Record Accounts Payable in Journal Entries?

The way to record accounts payable in journal entries is by crediting the Accounts Payable account and debiting the corresponding expense or asset account. This reflects the liability created when a company receives goods or services on credit. For example, when a business purchases office equipment worth $2,000 on credit, the entry records a debit to the Equipment account and a credit to Accounts Payable for the same amount.

When the payment is made, the business reverses part of the liability by debiting Accounts Payable and crediting Cash. According to the American Institute of CPAs (AICPA), accurate journal entries reduce financial discrepancies by nearly 40% in small to medium-sized enterprises. Proper documentation and consistent recording of these transactions ensure that the balance sheet reflects the company’s true financial obligations. Many businesses, such as manufacturers and retailers, maintain subsidiary ledgers to track individual vendor balances, which improves accuracy and accountability in financial reporting.

What Is the Standard Accounts Payable Process Step by Step?

The standard accounts payable process follows a step-by-step approach to ensure accuracy, compliance, and timely payments. The steps are as follows:

- Receiving the Supplier Invoice: The process begins when the company receives an invoice for goods or services delivered. The invoice includes the amount owed, payment terms, and due date.

- Verifying and Matching Documents: The accounts payable team verifies the invoice against the purchase order and delivery receipt to confirm accuracy—a process known as the three-way match.

- Recording the Transaction: Once verified, the invoice is recorded in the company’s accounting system, increasing the Accounts Payable balance.

- Approving the Payment: The invoice goes through an internal approval workflow before payment is released.

- Making the Payment: The payment is processed on or before the due date via check, bank transfer, or electronic payment.

- Recording the Payment: Finally, the payment is recorded as a debit to Accounts Payable and a credit to Cash or Bank.

A 2024 QuickBooks survey found that businesses automating these steps experienced 25% faster invoice approvals and 15% fewer payment errors. Organizations, such as logistics firms and e-commerce platforms, use automation tools to streamline these stages and ensure supplier satisfaction.

How Does Accounts Payable Impact Cash Flow Management?

Accounts payable impacts cash flow management by influencing the timing and amount of cash outflows. When a business delays payment strategically within the agreed credit terms, it preserves cash for other operational needs, improving liquidity. Conversely, paying too early can strain cash reserves, while paying late can harm supplier relationships and credit standing.

According to a 2023 CPA Journal research, companies that manage accounts payable effectively maintain up to 18% stronger cash positions than those with inconsistent payment cycles. For example, a construction company managing several supplier contracts can optimize cash flow by scheduling payments close to due dates, allowing more funds for project expenses.

Efficient accounts payable management ensures that cash flow statements reflect realistic projections and supports budgeting accuracy. Businesses that review aging reports regularly and prioritize vendor payments strategically enhance both short-term liquidity and long-term financial stability.

What Are the Best Metrics for Measuring Accounts Payable Efficiency?

The best metrics for measuring accounts payable efficiency include Days Payable Outstanding (DPO), Invoice Processing Time, and Cost per Invoice. Each provides insights into how well a company manages its liabilities and payment processes.

- Days Payable Outstanding (DPO): This metric measures the average number of days a company takes to pay its suppliers. A higher DPO indicates better cash retention, provided vendor terms are not violated.

- Invoice Processing Time: This tracks the average time it takes to verify, approve, and record an invoice. A lower processing time reflects operational efficiency.

- Cost per Invoice: This evaluates the total cost of processing an invoice, including labor, software, and administrative expenses. Reducing this cost through automation improves profitability.

A 2024 PayStream Advisors report revealed that companies using digital accounts payable systems achieved a 30% reduction in invoice processing costs. Businesses, such as manufacturing firms and service providers, benefit from monitoring these metrics regularly to identify inefficiencies and improve cash management. Skilled professionals available through JMAccountingServices can assist in setting up systems that track and optimize these key performance indicators effectively.

How to Implement Effective Accounts Payable Automation in Accounting?

The way to implement effective accounts payable automation in accounting is by integrating digital tools that streamline invoice processing, approvals, and payments. Automation replaces manual data entry with systems that capture, verify, and process invoices electronically. The process begins with selecting accounting software compatible with existing financial systems such as QuickBooks or Xero. Once implemented, automation minimizes human error, enhances transparency, and accelerates payment cycles.

According to a 2024 Deloitte Finance Automation Study, 68% of mid-sized businesses that adopted accounts payable automation reduced invoice processing time by nearly 50%. To achieve such results, businesses must establish structured workflows, define approval hierarchies, and integrate supplier databases. For example, e-commerce firms and logistics companies use automated invoice matching to validate quantities and pricing before approval.

Automation ensures that all invoices are tracked in real time, promoting accuracy and regulatory compliance. Businesses implementing these systems through professional setup services, such as those provided by JMAccountingServices, gain stronger financial visibility and improved audit readiness.

What Role Do Internal Controls Play in Accounts Payable Compliance?

Internal controls play a vital role in accounts payable compliance by ensuring accuracy, preventing fraud, and maintaining adherence to financial regulations. These controls establish clear processes for authorizing purchases, verifying invoices, and approving payments, reducing the risk of mismanagement or unauthorized transactions.

A 2023 Institute of Management Accountants (IMA) report found that companies with strong internal controls experienced 35% fewer compliance violations. For example, manufacturing and healthcare organizations maintain segregation of duties, where different employees handle invoice entry, approval, and payment. This separation ensures that no single individual can manipulate the system for personal gain.

Internal controls include audit trails, vendor verification, and policy enforcement mechanisms that protect against duplicate or fictitious invoices. They enhance trust in financial reporting and uphold ethical accounting practices. Implementing these controls effectively creates accountability and safeguards corporate assets, forming the foundation of a compliant and transparent accounts payable system.

How Can Businesses Harness Early Payment Discounts in Accounts Payable?

Yes, businesses can harness early payment discounts in accounts payable to improve cost savings and strengthen vendor relationships. Early payment discounts are incentives offered by suppliers for settling invoices before the due date, typically expressed in terms such as “2/10, net 30,” meaning a 2% discount for payment within 10 days on an invoice due in 30 days.

According to a 2024 Payables Insight Report by CFO.com, businesses that consistently utilized early payment discounts achieved an average annual cost reduction of 1.7% on total procurement expenses. To maximize this advantage, companies must track discount opportunities in their accounting systems, prioritize eligible invoices, and maintain sufficient liquidity. For example, retail businesses purchasing inventory in bulk can benefit significantly by paying early and reinvesting the savings into inventory restocking.

Automation supports this strategy by flagging invoices with discount terms and scheduling payments accordingly. Firms that engage professional accountants from JMAccountingServices gain expert guidance on structuring payment policies to capture discounts without straining cash flow. This balance ensures both financial efficiency and supplier goodwill, leading to long-term business sustainability.

Where to Hire an Expert to Handle Accounts Payable Management?

The best place to hire an expert to handle accounts payable management is through JMAccountingServices, a trusted platform specializing in professional bookkeeping and accounting solutions. Skilled professionals from JMAccountingServices possess expertise in managing vendor invoices, processing payments, reconciling accounts, and ensuring compliance with financial regulations. These experts use advanced tools to automate data entry, track outstanding liabilities, and improve payment accuracy.

According to a 2024 U.S. Small Business Finance Report, companies that outsourced accounts payable functions achieved a 22% improvement in cash flow accuracy and a 30% reduction in payment delays. Professionals from JMAccountingServices assist diverse industries such as manufacturing, healthcare, and e-commerce in implementing structured payable workflows.

Hiring a certified accounts payable expert through JMAccountingServices ensures consistent adherence to accounting standards, real-time financial reporting, and reduced operational costs. Businesses benefit from personalized service, confidentiality, and ongoing support designed to scale with their growth. This partnership allows business owners to focus on core operations while ensuring that payables remain efficient, transparent, and compliant.

What Are the Latest Trends in Accounts Payable Software for 2025?

The latest trends in accounts payable software for 2025 focus on artificial intelligence (AI) integration, blockchain security, predictive analytics, and end-to-end automation. These innovations transform how companies process, approve, and monitor financial transactions, resulting in faster workflows and improved data accuracy.

AI-driven automation now enables intelligent invoice capture that eliminates manual data entry and flags anomalies in real time. Blockchain technology enhances transactional security by creating immutable records, ensuring that every invoice and payment is verifiable and tamper-proof. According to a 2025 Gartner FinTech Outlook, 74% of large organizations are adopting blockchain-enabled payables systems for fraud prevention and vendor authentication.

Predictive analytics is another major development, allowing businesses to forecast payment trends and identify optimal timing for cash disbursement. Cloud-based platforms, such as QuickBooks Online and similar enterprise tools, now offer seamless integration with bank feeds and supplier networks to enable real-time reconciliation.

By 2025, accounts payable systems will continue evolving toward full digital ecosystems that minimize human intervention while maximizing control and transparency. Businesses implementing these technologies under the guidance of professionals from JMAccountingServices can achieve faster approval cycles, stronger audit trails, and enhanced financial performance.