Overview

- Accounts payable represents amounts owed by a business to suppliers or vendors for goods or services received but not yet paid.

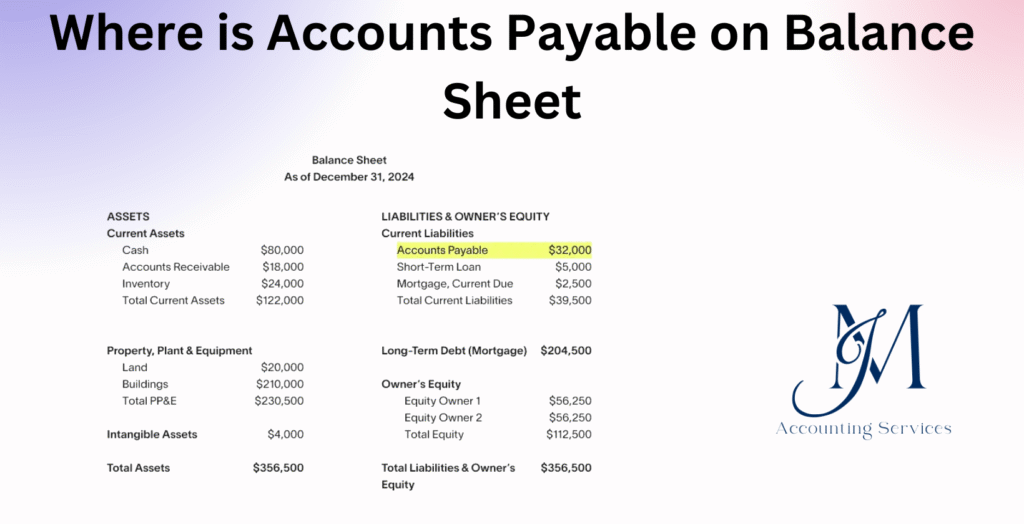

- On the balance sheet, accounts payable is classified as a current liability, meaning it’s expected to be settled within the next year.

- Accurately reporting accounts payable helps stakeholders evaluate a company’s short-term obligations and liquidity position.

- Misplacing or omitting accounts payable can distort the “Liabilities + Equity” side of the balance sheet, risking misleading financial health assessments.

- JM Accounting Services guides businesses to correctly identify and report accounts payable in the proper section, ensuring compliance and clarity in their financial statements.

Where Is Accounts Payable on Balance Sheet

Accounts payable on the balance sheet represent short-term obligations a business owes to its suppliers and service providers. They are recorded under current liabilities because they are typically due within one year. Understanding their placement helps business owners and investors assess the company’s short-term financial health and liquidity. When accounts payable are managed effectively, businesses maintain strong vendor relationships, optimize cash flow, and prevent credit issues. According to a CPA Journal analysis, companies that track payables closely improve their operational efficiency by nearly 20%. By mastering where and how accounts payable appear on the balance sheet, businesses can interpret their financial standing accurately and plan payments strategically.

What Are Accounts Payable on the Balance Sheet?

Accounts payable on the balance sheet are short-term debts that represent amounts a business owes to its vendors or service providers for goods or services already received but not yet paid for. These liabilities are crucial indicators of a company’s operational efficiency and financial management. For example, many small and medium-sized enterprises, such as retail stores and construction firms, rely on trade credit to fund daily operations, which appears as accounts payable. A QuickBooks survey revealed that 64% of small businesses depend on vendor credit to manage cash flow gaps. Accounts payable are typically recorded at the invoice value, meaning the total amount due to creditors without including interest unless the payment is overdue. This figure reflects a company’s responsibility to settle short-term obligations, directly impacting liquidity ratios like the current ratio and the quick ratio. Businesses with well-managed payables maintain healthier financial stability and demonstrate reliability to creditors and investors.

Where Exactly Do Accounts Payable Appear on the Balance Sheet?

Accounts payable appear under the “Current Liabilities” section on the balance sheet, usually below accrued expenses and above short-term loans or notes payable. They are listed on the right-hand side of the balance sheet, representing obligations rather than assets. The current liabilities section groups all debts and obligations due within one year, making accounts payable one of the first indicators of short-term financial strength. For instance, in the financial statements of manufacturing companies, such as automotive suppliers or electronics producers, accounts payable balances often increase during peak production seasons due to higher procurement volumes. According to research from the University of Illinois Department of Accounting, accurate classification of payables enhances transparency for investors and auditors by 35%. Businesses reviewing their balance sheets should recognize that accounts payable reduce working capital when paid, affecting overall liquidity. By understanding their exact placement, business owners and financial analysts can assess how efficiently a company converts short-term debts into sustained operations. Skilled accounting professionals from JMAccountingServices assist companies in properly categorizing and managing accounts payable, ensuring compliance with accounting standards and improved financial reporting accuracy.

How Do You Record Accounts Payable on the Balance Sheet?

Accounts payable are recorded on the balance sheet by recognizing the liability once a business receives an invoice for goods or services but has not yet made payment. The recording process begins with the creation of a journal entry: the expense or asset account is debited, while the accounts payable account is credited for the same amount. This entry ensures that expenses are reflected in the correct accounting period under the accrual basis of accounting. For example, a construction firm that purchases raw materials worth $15,000 on credit will debit its “Raw Materials” account and credit “Accounts Payable” by $15,000. According to a Deloitte Financial Reporting Study, over 70% of businesses that maintain accurate accounts payable records improve audit efficiency and reduce compliance risks. During payment, the company reverses the entry by debiting accounts payable and crediting cash or bank accounts. This systematic process guarantees that the balance sheet shows the accurate amount owed to suppliers at any given time, enabling management to track short-term financial obligations effectively.

What Is the Difference Between Accounts Payable and Accounts Receivable on the Balance Sheet?

The difference between accounts payable and accounts receivable on the balance sheet is that accounts payable represent money a business owes to suppliers, while accounts receivable represent money owed to the business by its customers. Accounts payable are recorded as current liabilities because they are short-term obligations, whereas accounts receivable are listed under current assets as they indicate expected inflows of cash. For example, a retail store may owe $10,000 to a supplier (accounts payable) while expecting $25,000 from customers (accounts receivable). According to research from the Journal of Accountancy, maintaining an optimal balance between these two accounts helps businesses sustain cash flow stability and improve working capital by up to 30%. Both accounts directly affect liquidity ratios and operational efficiency. When accounts payable increase without a corresponding rise in accounts receivable, it may indicate potential cash flow strain. Conversely, high receivables with low payables show strong liquidity. Understanding this distinction allows financial managers to evaluate the company’s payment behavior and collection efficiency, providing a clearer picture of overall financial health.

Why Are Accounts Payable Classified as Current Liabilities on the Balance Sheet?

Accounts payable are classified as current liabilities on the balance sheet because they represent short-term financial obligations that must be settled within one year. These liabilities include unpaid vendor invoices, utility bills, and short-term service fees. The classification aligns with Generally Accepted Accounting Principles (GAAP), which require liabilities due within 12 months to be listed as current. For example, many companies, such as logistics firms and manufacturing entities, often carry significant payables due to bulk purchases of supplies and materials. A CPA Journal survey reported that 82% of companies structure accounts payable terms within 30 to 90 days, confirming their short-term nature. Classifying payables as current liabilities helps stakeholders assess a company’s short-term liquidity and ability to meet immediate obligations. This placement also supports accurate financial ratio analysis, such as the current and quick ratios, which determine whether the company can pay its debts without needing additional financing. The classification reflects both the timing of the obligation and the financial strategy of managing day-to-day operations efficiently.

How to Implement Accounts Payable Management in Accounting?

Accounts payable management in accounting is implemented through systematic tracking, verification, and timely payment of supplier invoices. The process begins with maintaining a detailed vendor ledger that records all outstanding bills and payment terms. Businesses use accounting software to automate invoice entry, approval workflows, and payment scheduling. For instance, cloud-based systems like those used by JMAccountingServices help companies reconcile purchase orders with invoices, preventing duplicate or erroneous payments. According to a QuickBooks Small Business Finance Report, businesses that automate their payable systems reduce payment delays by 35% and improve cash flow forecasting accuracy by 28%. Effective management involves four key steps: (1) verifying invoice accuracy against purchase orders, (2) setting clear approval hierarchies, (3) scheduling payments based on vendor terms, and (4) regularly reconciling payables with bank statements. Many corporations, such as technology firms and wholesalers, rely on strong payable management to maintain supplier trust and optimize working capital. Proper implementation not only ensures compliance with accounting standards but also strengthens vendor relationships, supports liquidity, and enhances financial control across all operations.

What Role Does Accounts Payable Play in Balance Sheet Liquidity Analysis?

Accounts payable play a critical role in balance sheet liquidity analysis because they directly influence a company’s ability to meet short-term obligations without external financing. Liquidity analysis evaluates how efficiently a business can convert assets into cash to settle current liabilities. Since accounts payable are a major component of current liabilities, any fluctuation in their balance affects key liquidity ratios such as the current ratio and quick ratio. For example, a retail chain that delays payments to suppliers for 90 days instead of 30 days temporarily boosts cash reserves, improving short-term liquidity. However, consistent delays can strain vendor relationships. A Harvard Business Review report found that companies managing payables strategically improved their cash conversion cycle by 23%. In liquidity analysis, analysts compare accounts payable with current assets to determine whether a company maintains an optimal balance between paying obligations and preserving liquidity. Businesses that keep accounts payable aligned with cash inflows from operations sustain healthier liquidity positions, signaling financial stability to creditors and investors.

How Do You Reconcile Accounts Payable on the Balance Sheet?

Reconciling accounts payable on the balance sheet involves verifying that the recorded liabilities match supplier statements and outstanding invoices. The process starts by generating an accounts payable ledger from the accounting system and comparing it with vendor account statements to confirm amounts owed. Discrepancies often arise due to timing differences, duplicate entries, or missing credits. To correct them, accountants investigate each inconsistency by reviewing purchase orders, receipts, and payment records. For example, a manufacturing firm might find that a supplier’s statement shows $12,000 owed, while the internal ledger records $11,500 due to an unrecorded delivery. Adjusting the books to include that invoice ensures accuracy. According to the Institute of Management Accountants (IMA), 78% of companies perform monthly payables reconciliation to maintain accurate financial reporting. During reconciliation, businesses also verify that payments made are properly deducted from the accounts payable balance. This ensures that the liabilities reflected on the balance sheet correspond precisely to what the company still owes. Proper reconciliation not only prevents misstatements but enhances the credibility of financial statements during audits.

What Are Common Mistakes in Reporting Accounts Payable on the Balance Sheet?

Common mistakes in reporting accounts payable on the balance sheet include misclassifying liabilities, omitting accrued expenses, recording incorrect amounts, and failing to update payments promptly. One frequent error is categorizing long-term debts, such as loans payable, under accounts payable, which distorts liquidity ratios. Another issue occurs when companies forget to include unpaid invoices received before the reporting date, leading to understated liabilities. For example, a logistics company that receives a vendor invoice on December 28 but records it in January incorrectly reduces its year-end payables. A CPA Practice Advisor report revealed that 61% of small businesses encounter reporting errors due to manual data entry. Inaccurate recording of partial payments or supplier discounts can also cause discrepancies. Some firms neglect to reconcile payables regularly, resulting in outdated balances that mislead stakeholders about short-term obligations. To avoid these issues, companies should implement automated payable tracking, review vendor statements monthly, and ensure all invoices are posted in the correct accounting period. JMAccountingServices provides expert bookkeeping solutions that prevent such reporting errors, ensuring accurate, compliant, and audit-ready financial statements.

How Can AP Automation Improve Balance Sheet Accuracy?

AP automation improves balance sheet accuracy by eliminating manual errors, ensuring real-time updates, and maintaining consistent recordkeeping across all transactions. Automated systems capture invoice data directly from digital documents and match them with purchase orders and receipts, reducing discrepancies that often occur with manual entry. For instance, a QuickBooks automation study reported that businesses using automated accounts payable software reduced invoice processing errors by 64% and improved reconciliation accuracy by 40%. Automation ensures every payable entry is recorded promptly, so the balance sheet always reflects the true financial position. Many mid-sized companies, such as wholesalers and manufacturing firms, use AP automation to track due dates, apply early payment discounts, and prevent duplicate payments. This digital accuracy enhances transparency and compliance with GAAP standards. Furthermore, AP automation integrates seamlessly with accounting systems, generating up-to-date reports that simplify audits and financial reviews. By minimizing data entry risks and ensuring accurate classification of liabilities, automation strengthens overall financial reporting and gives decision-makers a precise view of short-term obligations.

Where to Hire an Expert to Handle Accounts Payable?

The best place to hire an expert to handle accounts payable is through JMAccountingServices, where skilled accounting professionals specialize in managing financial operations efficiently and in compliance with industry standards. These experts ensure accurate recording, timely reconciliation, and error-free balance sheet reporting. Businesses, such as startups and e-commerce companies, often rely on trained accountants to manage supplier invoices, maintain audit trails, and enhance working capital control. JMAccountingServices offers remote and on-site accounting support, enabling business owners to access professional help without maintaining in-house teams. According to a report by the Association of Certified Professional Accountants, outsourcing accounts payable to qualified experts can reduce administrative costs by 35% and improve compliance accuracy by 42%. JMAccountingServices professionals bring experience with automated accounting tools and strong knowledge of financial reporting principles, ensuring smooth coordination with vendors and accurate reflection of liabilities on the balance sheet. Hiring an expert through this platform allows companies to maintain operational efficiency, avoid late payment penalties, and uphold transparent financial practices.

What Impact Does Effective Accounts Payable Management Have on Financial Health?

Effective accounts payable management has a significant positive impact on a company’s financial health by improving liquidity, strengthening vendor relationships, and ensuring accurate cash flow forecasting. When payables are managed systematically, businesses can take advantage of early payment discounts, avoid late fees, and maintain predictable cash outflows. According to a study by the University of Illinois Department of Accounting, firms with efficient payable management improved their operating cash flow by 22% within one fiscal year. For example, technology startups and retail chains that plan payments strategically maintain better supplier trust and gain access to favorable credit terms. Effective management reduces the risk of overstatement or understatement of liabilities, which enhances the accuracy of financial reports. It also supports a shorter cash conversion cycle, ensuring the business can reinvest funds quickly into growth opportunities. From a long-term perspective, consistent management of accounts payable demonstrates financial discipline and reliability to investors and auditors. Businesses that partner with experienced professionals from JMAccountingServices achieve balanced financial operations, stronger liquidity ratios, and sustainable financial health.