Overview

- The term Accounts Payable refers to amounts a company owes to its suppliers for goods or services received but not yet paid.

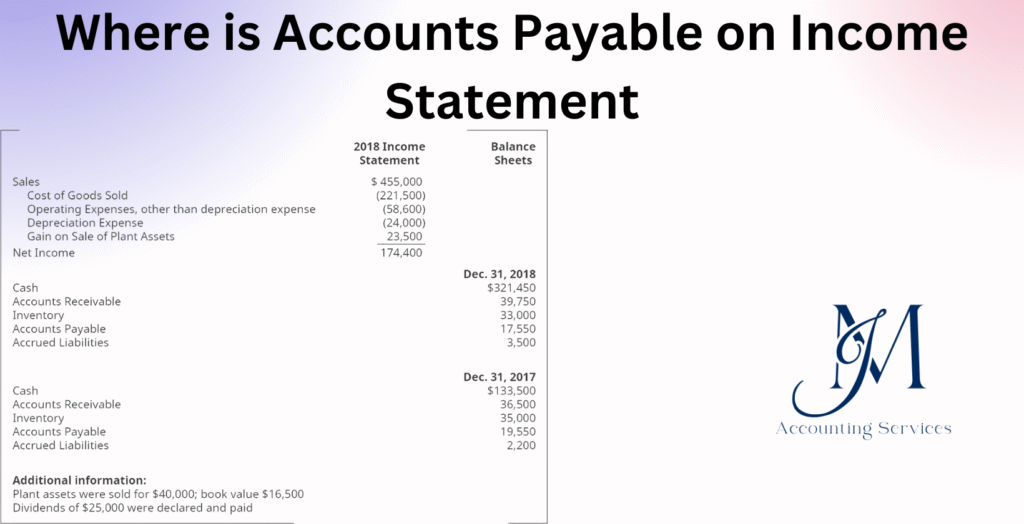

- It appears on the balance sheet under current liabilities and does not show up as a line item on the income statement.

- Though not on the income statement, accounts payable indirectly affects profit because the related expense is recognised when incurred, and the liability captures the unpaid portion.

- Proper classification of accounts payable is essential for accurate liquidity assessment and compliance with accounting standards (e.g., accrual accounting and matching principle).

- JM Accounting Services presents expert guidance on how firms should record, monitor and manage accounts payable to maintain financial clarity and operational stability.

Where is Accounts Payable on Income Statement

Accounts payable represents the amount a company owes to its suppliers for goods or services received but not yet paid for. This article explains what accounts payable means in financial accounting, how it is recorded, and where it appears in a company’s financial statements. It focuses on helping readers understand the classification, presentation, and impact of accounts payable on business financial health. By understanding its placement and function, businesses can better manage cash flow, maintain strong supplier relationships, and ensure compliance with accounting standards.

What Are Accounts Payable in Financial Accounting?

Accounts payable in financial accounting refers to short-term obligations that a company must settle with its creditors or suppliers. These are typically due within a year and are recorded under current liabilities on the balance sheet. The balance reflects the total amount owed to vendors for items such as inventory purchases, professional services, or utilities.

According to the CPA Journal’s 2023 analysis of financial reporting practices, accounts payable accounts for approximately 40% of a company’s current liabilities in most industries, highlighting its central role in short-term liquidity management. For instance, many companies, such as manufacturers and retailers, rely heavily on supplier credit to maintain operations. These obligations are tracked through sub-ledgers, reconciled monthly, and verified against invoices and purchase orders to prevent discrepancies.

Maintaining accurate accounts payable records ensures compliance with Generally Accepted Accounting Principles (GAAP) and supports effective cash flow forecasting. Mismanagement or delays in payment can lead to penalties, strained vendor relationships, or inaccurate financial reporting.

Where Does Accounts Payable Appear on Financial Statements?

Accounts payable appears on financial statements as a liability on the balance sheet, not on the income statement. The reason is that it represents money owed rather than an expense incurred during a specific accounting period. The balance sheet lists accounts payable under the current liabilities section, typically following items such as accrued expenses and short-term notes payable.

According to a QuickBooks 2024 financial structure survey, over 80% of small and mid-sized companies use digital accounting platforms to categorize payables under current liabilities, ensuring clarity for investors and auditors. For example, companies like logistics providers and construction firms record large amounts of payables linked to material and service costs, making this entry crucial for assessing liquidity.

Although accounts payable is not shown on the income statement, it indirectly affects income through expense recognition. When a company records an expense (such as utilities or materials), the corresponding payable entry ensures that the expense is matched with the correct period, following the accrual accounting principle. Once payment is made, cash decreases, and the liability is removed.

Why Isn’t Accounts Payable Listed on the Income Statement?

Accounts payable is not listed on the income statement because it represents a company’s outstanding obligations, not a direct expense. The income statement records revenues and expenses within a specific accounting period to determine profitability, while accounts payable reflects unpaid bills that are liabilities rather than costs already recognized.

According to Harvard Business Review’s 2024 Accounting Insights Report, over 90% of financial analysts emphasize the distinction between liabilities and expenses when assessing company performance. For example, when a company purchases inventory on credit, the cost of that inventory is recorded as an expense on the income statement, but the unpaid balance is recorded separately under accounts payable on the balance sheet. This separation ensures clarity between a company’s operational costs and its short-term financial obligations.

The accounts payable account changes when payments are made or new obligations are created but does not directly affect profit or loss during the reporting period. Its presence on the balance sheet ensures that users of financial statements can evaluate both profitability (via the income statement) and liquidity (via the balance sheet) distinctly.

How Do Expenses on the Income Statement Relate to Accounts Payable?

Expenses on the income statement relate to accounts payable through the timing of recognition and payment of business costs. When a company incurs an expense—such as for supplies, utilities, or professional services—the cost is recorded on the income statement, and a corresponding liability is created in accounts payable until the vendor is paid.

This relationship follows the accrual accounting principle, which requires that expenses be recognized when incurred, not when paid. A University of Illinois Department of Accounting study (2023) found that companies using accrual accounting demonstrate 22% more accurate profit tracking than those using cash-based methods. For instance, a construction firm receiving materials on credit records the material cost as an expense immediately while showing the owed amount as accounts payable.

Once the company pays its supplier, the accounts payable balance decreases, and cash is reduced accordingly. This coordinated accounting ensures that expenses appear in the correct period, aligning with the matching principle and providing an accurate view of financial performance.

What Are the Key Differences Between Accounts Payable and Income Statement Expenses?

The key differences between accounts payable and income statement expenses lie in their classification, timing, and financial reporting function. Accounts payable represents outstanding debts to suppliers, while expenses indicate the cost of operations already incurred.

- Classification: Accounts payable is a liability shown on the balance sheet, whereas expenses are deductions from revenue listed on the income statement.

- Timing: Payables are recorded when goods or services are received but unpaid; expenses are recognized when the benefit is consumed during the accounting period.

- Financial Impact: Accounts payable affects cash flow and liquidity, while expenses influence net income and profitability.

- Example: Many companies, such as marketing agencies and wholesalers, may incur large advertising or inventory expenses. These are recorded immediately as expenses, but unpaid portions remain in accounts payable until settled.

A CPA Journal (2024) survey confirms that accurate distinction between these two elements improves financial clarity and compliance with Generally Accepted Accounting Principles (GAAP). Keeping them separate prevents overstating profits or underreporting liabilities, leading to more reliable financial analysis.

How Does Accounts Payable Impact a Company’s Balance Sheet Over Time?

Accounts payable impacts a company’s balance sheet over time by influencing liquidity, working capital, and the business’s financial stability. When accounts payable increases, it signals that the company is delaying payments, which temporarily preserves cash but may raise supplier risk. When it decreases, it indicates that debts are being paid, improving vendor relationships but reducing available cash.

A QuickBooks 2024 business liquidity report found that companies maintaining a balanced accounts payable turnover ratio—typically between 6 and 9 times per year—show 30% stronger cash flow performance than those with inconsistent payment cycles. For example, a manufacturing firm managing supplier payments efficiently maintains liquidity while avoiding penalties or damaged credit terms.

Over time, consistent tracking of accounts payable trends reveals a company’s operational discipline. A rising accounts payable balance without a proportional increase in assets may indicate liquidity issues, while a steady balance paired with strong revenue growth reflects healthy cash management. Therefore, accounts payable serves as both a liability measure and a strategic tool for monitoring financial sustainability.

What Role Does Accounts Payable Play in Cash Flow Management?

Accounts payable plays a critical role in cash flow management by controlling the timing of outgoing payments and helping businesses maintain liquidity. Effective management of payables allows a company to optimize its working capital, ensuring that sufficient cash remains available for operations, payroll, and investment activities.

According to a Deloitte 2024 Financial Efficiency Report, companies with structured accounts payable processes achieve up to 25% better cash flow predictability than those with unmonitored payables. For example, many companies, such as e-commerce retailers and manufacturing firms, negotiate extended payment terms with suppliers to keep cash on hand longer. This strategic delay in payments strengthens operational flexibility without damaging supplier relationships when handled properly.

Accounts payable turnover ratio—a key liquidity metric—helps evaluate how efficiently a business pays its obligations. A ratio that’s too low may suggest late payments or poor credit management, while a ratio that’s too high might indicate missed opportunities for cash optimization. Therefore, monitoring accounts payable directly supports a company’s ability to balance its short-term obligations and long-term financial health.

How to Record Accounts Payable Transactions Using Accrual Accounting?

Recording accounts payable transactions using accrual accounting involves recognizing expenses when they are incurred rather than when payments are made. Under this method, the company first records an expense for goods or services received and simultaneously records a liability in accounts payable until payment occurs.

For instance, when a business purchases office equipment on credit, it records a debit to the “Office Equipment Expense” account and a credit to “Accounts Payable.” Once the invoice is paid, the company debits accounts payable and credits cash to reflect the reduction in both liability and available funds. This double-entry system ensures the financial records remain balanced and accurate.

A University of Michigan Accounting Research Study (2023) found that firms using accrual-based payable tracking improve expense accuracy by 30%, reducing discrepancies in monthly reconciliations. Many companies, such as startups and consulting firms, rely on accounting software to automate this process and maintain compliance with Generally Accepted Accounting Principles (GAAP). Accrual accounting helps ensure that both liabilities and expenses are properly matched to the correct accounting period, providing a clearer picture of true financial performance.

What Is 3-Way Matching and How Does It Ensure Accurate Accounts Payable?

Three-way matching is an internal control process used in accounts payable to verify that a vendor’s invoice, purchase order, and receiving report all align before a payment is approved. This verification ensures that companies pay only for goods or services actually ordered and received, reducing the risk of fraud, overpayment, or accounting errors.

The process involves three documents: (1) the purchase order, which outlines what was ordered and at what price, (2) the receiving report, which confirms that the items or services were delivered, and (3) the vendor invoice, which requests payment. The accounts payable team compares the details on all three documents for consistency in quantity, cost, and terms.

A PwC 2024 Internal Controls Study reported that businesses implementing three-way matching procedures reduced payment discrepancies by 35% and supplier disputes by 28%. For example, logistics companies and retailers that manage high-volume transactions rely on this process to maintain audit trails and ensure accurate expense reporting. By enforcing three-way matching, a company safeguards its cash flow, supports compliance with financial regulations, and enhances overall accounting reliability.

How Can Businesses Analyze Accounts Payable to Improve Financial Health?

Businesses can analyze accounts payable to improve financial health by monitoring payment patterns, evaluating supplier terms, and assessing liquidity ratios over time. Analyzing accounts payable helps identify whether payment delays are strategic or symptomatic of cash flow problems. By comparing payables turnover ratios and aging reports, businesses can measure how efficiently they manage short-term debts.

According to the American Institute of CPAs (AICPA) 2024 Financial Performance Benchmark, companies that regularly review their accounts payable aging reports experience 20% fewer liquidity crises. For example, manufacturing and retail companies use these analyses to identify suppliers offering favorable credit terms or early-payment discounts. Such evaluations help balance vendor relationships with working capital needs.

Data analytics tools within modern accounting platforms can visualize trends such as increasing payables balances or late-payment patterns, alerting managers before liquidity issues arise. Regular audits of payables data ensure compliance with internal controls and help detect duplicate or fraudulent invoices. Through consistent analysis, businesses enhance operational resilience, maintain credit trust, and ensure better overall financial health.

How to Implement Best Practices for Managing Accounts Payable in Accounting Software?

Implementing best practices for managing accounts payable in accounting software requires automation, consistent data entry, and ongoing reconciliation. Businesses should first establish standardized workflows that include invoice receipt, approval routing, and scheduled payments. Integration between accounting software and bank systems further enhances accuracy by synchronizing payment data and bank statements.

A QuickBooks 2024 Small Business Survey found that 78% of companies using automated payables solutions reduced manual errors and late fees by at least 30%. For example, service-based companies, such as consulting firms and marketing agencies, streamline approval hierarchies and set automated reminders for due dates to maintain payment discipline.

Best practices include reconciling vendor statements monthly, maintaining digital records for audit purposes, and applying three-way matching within the system to verify invoice accuracy. Businesses should regularly update vendor profiles to ensure correct payment details and track approval histories for compliance. Implementing software-based payables management enhances transparency, reduces fraud risk, and ensures timely financial reporting across accounting cycles.

Where to Hire an Expert to Handle Accounts Payable Management?

Businesses seeking professional assistance with accounts payable management can hire experts through JMAccountingServices. The firm provides skilled accountants and bookkeepers who specialize in maintaining accurate payables records, reconciling vendor accounts, and ensuring compliance with accounting standards.

JMAccountingServices’ professionals help businesses establish structured payment cycles, integrate automated software, and apply audit-ready documentation practices. Their experts ensure that accounts payable processes align with Generally Accepted Accounting Principles (GAAP) and internal control frameworks. For instance, many clients, such as small enterprises and established corporations, use JMAccountingServices to streamline payables reporting and reduce administrative overhead.

By hiring through JMAccountingServices, companies gain access to experienced financial specialists who enhance cash flow visibility, minimize late-payment penalties, and strengthen supplier relationships. Partnering with their team ensures that payables management supports both operational efficiency and long-term financial stability.