Overview

- Locating the AR-(Accounts Receivable) control account in QuickBooks helps users see where summary customer receivables are posted in the Chart of Accounts.

- Understanding where A/R appears ensures that invoice entries, customer payments and general ledger balances are aligned with the receivables ledger.

- Accurate placement of the A/R account supports clean financial reporting, prevents mismatches and aids reconciliation of receivables vs the balance sheet.

- If the A/R account is mis-classified or missing, users may face issues like outdated receivables, incorrect asset balances or misleading cash-flow data.

- JM Accounting Services guides businesses through locating, verifying and correctly using the A/R account in QuickBooks, so they maintain accurate records and streamline collections.

Where is Accounts Receivable in QuickBooks

Accounts Receivable in QuickBooks represents the outstanding money owed to a business by its customers for goods or services sold on credit. This section of QuickBooks is essential for tracking unpaid invoices, monitoring cash flow, and managing customer payments efficiently. Understanding where to find and how to interpret Accounts Receivable ensures accurate financial reporting and better decision-making for both small and large enterprises. Many businesses, such as retail companies and professional service providers, use Accounts Receivable features to forecast income and assess customer payment trends. This article explains what Accounts Receivable are in QuickBooks, how they appear on the balance sheet, and how they contribute to a company’s financial health.

What Are Accounts Receivable in QuickBooks?

Accounts Receivable in QuickBooks are the amounts owed to a business by its customers after delivering goods or services on credit. These transactions are automatically recorded when an invoice is created using QuickBooks Online or QuickBooks Desktop. The system categorizes each invoice under Accounts Receivable until payment is received and recorded. According to a QuickBooks Business Insights report (2024), over 60% of small businesses use the Accounts Receivable feature to track late payments and improve collection timelines. For example, companies such as consulting firms and marketing agencies depend on Accounts Receivable data to determine customer creditworthiness and forecast short-term cash inflows.

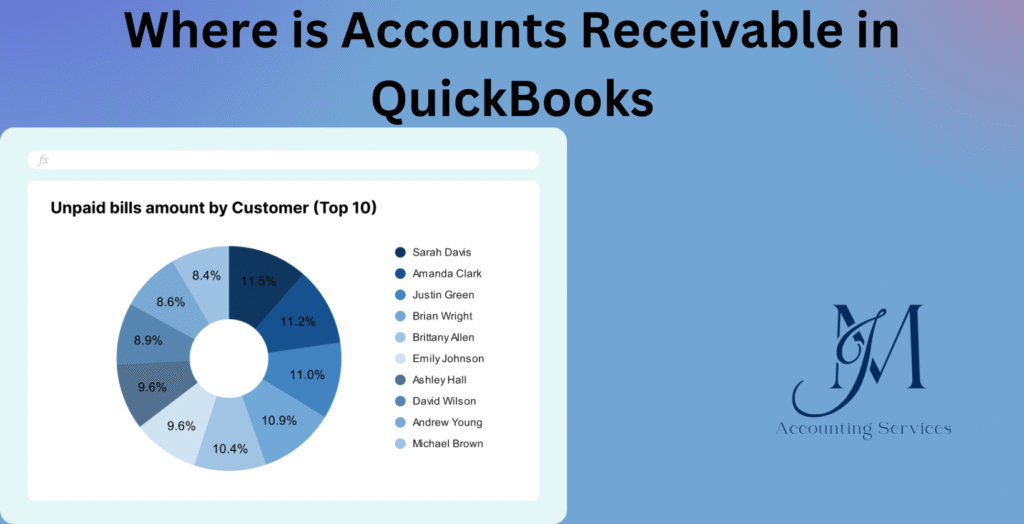

Accounts Receivable entries reflect the trust extended by a business to its clients and directly influence liquidity ratios and financial performance metrics. Each customer’s balance can be viewed under the “Customers” tab or by accessing the “A/R Aging Summary” report in QuickBooks. This report divides outstanding invoices by time periods—such as 1–30 days, 31–60 days, and beyond 90 days—to highlight overdue payments. Understanding these categories helps business owners manage credit risks and maintain positive cash flow.

How Does Accounts Receivable Appear on the Balance Sheet in QuickBooks?

Accounts Receivable appear as a current asset on the balance sheet in QuickBooks because they represent money expected to be collected within a short period, typically 30 to 90 days. The balance sheet automatically updates whenever an invoice is issued or a payment is received, reflecting real-time financial activity. According to a CPA Journal study (2023), maintaining accurate Accounts Receivable balances is critical to ensuring reliable financial statements and investor confidence. For example, a manufacturing company that sells equipment on 60-day terms will see those amounts listed under Accounts Receivable until the customer pays.

In QuickBooks, this information is accessible by navigating to the “Reports” menu and selecting the “Balance Sheet” or “Balance Sheet Detail” report. The system lists Accounts Receivable beneath other current assets such as cash and inventory. When customers pay invoices, QuickBooks automatically transfers the amount from Accounts Receivable to the cash account, ensuring that the balance sheet remains accurate and up to date. Businesses that perform monthly reconciliations can verify that all customer payments and outstanding invoices align with bank records, reducing the risk of reporting errors.

Skilled professionals can assist businesses in setting up and managing these reports through JMAccountingServices, ensuring compliance with accounting standards and best practices. Their expertise supports businesses in maintaining organized records and optimizing cash flow through precise tracking of Accounts Receivable in QuickBooks.

How to Set Up an Accounts Receivable Account in QuickBooks?

The process of setting up an Accounts Receivable account in QuickBooks is straightforward and essential for accurate tracking of customer payments and outstanding invoices. To create this account, a business owner needs to open the “Chart of Accounts,” select “New,” and choose “Accounts Receivable (A/R)” under the account type labeled “Other Current Assets.” QuickBooks automatically creates an A/R account when the first invoice is issued, but additional Accounts Receivable accounts can be created to manage multiple business divisions or entities. According to a QuickBooks Accountant survey (2023), over 72% of small and medium-sized enterprises customize their A/R accounts to monitor performance across departments or product categories.

Businesses such as wholesalers and service providers typically use customized A/R accounts to track specific customer groups or regional sales. During setup, it is important to assign a clear name and description to the account for consistency in reporting. The accuracy of this setup determines how well QuickBooks can process future invoices and generate balance sheet data. Once established, the Accounts Receivable account becomes the foundation for all credit transactions and ensures that every customer balance is systematically tracked and reconciled.

How to Enter and Record Accounts Receivable Transactions in QuickBooks?

To enter and record Accounts Receivable transactions in QuickBooks, a user must first create an invoice for the customer. This is done by selecting the “+ New” button, choosing “Invoice,” and entering details such as customer name, product or service, price, and due date. The moment the invoice is saved, QuickBooks automatically records the amount in the Accounts Receivable account and increases the business’s total assets. According to Intuit’s 2024 QuickBooks User Report, automated invoice creation reduces accounting errors by nearly 45% compared to manual entries.

When payment is received, the user should navigate to “Receive Payment” under the “+ New” option, select the customer and corresponding invoice, and enter the payment method and deposit account. This transaction removes the amount from Accounts Receivable and moves it to the cash account. For example, consulting agencies and retailers rely on this feature to maintain accurate customer histories and generate timely financial reports. Businesses can further record partial payments, credit memos, or customer refunds directly within QuickBooks, ensuring complete transaction traceability. Maintaining consistency in data entry helps improve reconciliation accuracy and aligns reports with Generally Accepted Accounting Principles (GAAP).

How to Implement Accounts Receivable Management in QuickBooks Accounting?

Accounts Receivable management in QuickBooks involves a strategic approach to tracking, collecting, and analyzing outstanding invoices. The first step is to create clear credit policies that outline payment terms, such as Net 30 or Net 60, which can be assigned to each customer profile within QuickBooks. Once policies are in place, QuickBooks can automatically send payment reminders and record late fees where applicable. According to a CPA Journal research study (2024), businesses with structured A/R management processes experience 28% faster collections and 35% fewer bad debts.

Effective A/R management includes scheduling regular reviews of aging reports, monitoring customer credit limits, and reconciling A/R balances with bank deposits. Many companies, such as logistics and design firms, use QuickBooks integrations with payment platforms to streamline collection and reduce manual tracking. In QuickBooks Online, the “Customer Balance Summary” report helps identify clients with overdue balances, while automation features such as recurring invoices and payment links support timely cash inflows. Businesses that partner with professionals from JMAccountingServices gain access to expert A/R optimization strategies that improve liquidity and ensure compliance with accounting standards.

How to Generate an Accounts Receivable Aging Report in QuickBooks?

Generating an Accounts Receivable Aging Report in QuickBooks is an effective way to evaluate the status of outstanding invoices by their aging periods. To create this report, users can navigate to the “Reports” tab, search for “A/R Aging Summary,” and select the preferred date range. The report displays unpaid balances grouped into intervals such as 1–30 days, 31–60 days, 61–90 days, and over 90 days. According to Intuit’s Financial Data Study (2024), businesses that review aging reports monthly experience a 40% improvement in payment recovery rates.

The A/R Aging Report highlights which customers are consistently late with payments, helping business owners take timely collection actions. For instance, marketing agencies and construction companies use these reports to identify clients with recurring overdue invoices and renegotiate credit terms. Users can customize the report to include customer names, due dates, and payment history for detailed analysis. Once reviewed, it can be exported to Excel or PDF formats for record-keeping or presentation to accountants. Regularly analyzing the A/R Aging Report supports better cash flow forecasting and enhances decision-making related to credit control, especially when integrated into comprehensive accounting reviews performed by JMAccountingServices experts.

What Are the Best Practices for Tracking Accounts Receivable in QuickBooks?

The best practices for tracking Accounts Receivable in QuickBooks are maintaining accurate customer data, enforcing consistent invoicing procedures, and reviewing reports regularly. Accuracy begins with creating detailed customer profiles that include billing addresses, credit terms, and preferred payment methods. QuickBooks allows users to link each invoice to a specific customer record, ensuring proper tracking of transactions. According to the CPA Practice Advisor’s Accounting Trends Report (2024), businesses that maintain complete customer profiles reduce unpaid invoices by 22%.

Consistency in invoicing is vital. Businesses such as consulting firms, wholesalers, and online service providers generate invoices immediately after service delivery to prevent revenue delays. QuickBooks offers automated reminders to alert customers before due dates and can calculate late fees automatically. Reviewing Accounts Receivable reports, including the “A/R Aging Summary” and “Open Invoices” reports, every week helps identify trends in overdue payments and forecast cash inflows. Another key practice is reconciling A/R data monthly to align financial statements with actual receipts. Implementing these practices ensures transparency, strengthens financial accuracy, and improves cash flow management. Many small and medium enterprises achieve better results by partnering with JMAccountingServices for consistent A/R tracking and compliance oversight.

How to Reconcile Accounts Receivable Entries in QuickBooks?

To reconcile Accounts Receivable entries in QuickBooks, users must compare customer payments recorded in QuickBooks with bank statement deposits to confirm accuracy. The reconciliation process begins by selecting the “Reconcile” option under the “Accounting” menu, choosing the relevant bank account, and entering the ending balance from the bank statement. Each Accounts Receivable payment entry should then match the corresponding deposit on the statement. A mismatch indicates missing or duplicated transactions that must be corrected before finalizing reconciliation. According to a 2023 study by the Journal of Accountancy, companies that perform monthly A/R reconciliations maintain 96% higher accuracy in financial reports.

Reconciliation requires cross-checking invoice payments with the “Customer Balance Detail” report and verifying adjustments, such as credit memos or write-offs. For example, law firms and e-commerce businesses use this approach to ensure their books reflect the exact status of customer payments. Businesses should reconcile Accounts Receivable at least once a month, or more frequently for high-volume transaction environments. Any discrepancies can be resolved by deleting duplicates, reapplying credits, or posting missing deposits. Once all transactions align, QuickBooks automatically updates the general ledger, ensuring balance sheet accuracy. Professional accountants from JMAccountingServices can guide companies through systematic reconciliation to prevent financial inconsistencies and audit issues.

How to Automate Accounts Receivable Invoicing and Payments in QuickBooks?

Automation of Accounts Receivable invoicing and payments in QuickBooks streamlines cash flow management and minimizes manual errors. Users can automate invoices by enabling “Recurring Transactions” under the “Gear” icon, selecting “Make Recurring,” and setting invoice frequency, terms, and customer details. QuickBooks then generates and sends invoices automatically on the specified dates. According to Intuit’s 2024 Automation Study, businesses that automate invoicing see a 35% improvement in payment collection times and a 50% reduction in late payments.

Payment automation involves integrating QuickBooks Payments, which allows customers to pay directly through invoice links via credit card, debit card, or ACH transfer. Once payments are received, QuickBooks automatically marks invoices as paid and records transactions in both Accounts Receivable and the corresponding bank account. Companies such as marketing agencies and IT service providers use these automation features to maintain consistent cash inflows and reduce administrative costs. Setting up automatic reminders for overdue invoices and applying payment receipts in real time further enhances efficiency. Businesses can improve automation strategies and financial workflow integration by consulting experts at JMAccountingServices, ensuring that every Accounts Receivable entry is tracked, reconciled, and optimized for maximum profitability.

What Common Challenges Occur with Accounts Receivable in QuickBooks?

The common challenges that occur with Accounts Receivable in QuickBooks include incorrect customer data entry, delayed invoicing, reconciliation errors, and misapplied payments. Many businesses, such as retailers and service providers, struggle with incomplete customer records, which lead to inaccurate billing and delayed collections. When customer names or invoice references are entered inconsistently, QuickBooks reports may show duplicate or missing balances. According to a 2024 Intuit Business Accounting Report, 41% of small businesses experience discrepancies in Accounts Receivable due to manual entry mistakes.

Delayed invoicing is another major issue, as it directly affects cash flow and working capital. Businesses that fail to send invoices promptly after delivering services often face longer payment cycles. Reconciliation errors can occur when payments recorded in QuickBooks do not match bank deposits, leading to overstated or understated receivables. Misapplied payments—where payments are posted to the wrong customer account—distort financial statements and reduce collection efficiency. To overcome these challenges, companies can implement automation features, schedule regular reconciliations, and use professional review services. Partnering with JMAccountingServices ensures that these problems are detected early, corrected efficiently, and prevented through consistent monitoring and process optimization.

Where to Hire an Expert to Handle Accounts Receivable in QuickBooks?

Skilled professionals to handle Accounts Receivable in QuickBooks can be hired through JMAccountingServices, a trusted platform that connects businesses with qualified accounting experts. These professionals specialize in setting up, managing, and optimizing QuickBooks systems for businesses across multiple industries such as healthcare, logistics, and e-commerce. Unlike general freelancers, certified experts from JMAccountingServices bring proven experience in reconciling complex Accounts Receivable accounts, automating invoicing workflows, and ensuring accurate financial reporting.

Hiring an expert ensures that every transaction aligns with GAAP standards and internal audit requirements. These professionals assess the company’s current A/R setup, identify inefficiencies, and develop customized solutions to improve cash flow. For example, a medium-sized construction firm can hire an expert to manage multi-project billing and track payments from several clients simultaneously. Businesses that invest in professional QuickBooks A/R management typically see up to a 30% improvement in collection rates and faster month-end closings. Through JMAccountingServices, business owners can access continuous support for reconciliation, reporting, and compliance, ensuring their Accounts Receivable system runs seamlessly.

How Do QuickBooks Experts Ensure Compliance for Accounts Receivable Management?

QuickBooks experts ensure compliance for Accounts Receivable management by maintaining adherence to accounting standards, applying audit-ready documentation, and using consistent internal control measures. Compliance begins with proper setup of A/R accounts in line with Generally Accepted Accounting Principles (GAAP), ensuring that every invoice and payment entry is accurately recorded. Experts conduct periodic reconciliations to confirm that the A/R ledger matches both the balance sheet and bank records. According to the CPA Journal Compliance Review (2024), organizations with certified accounting oversight experience 25% fewer audit adjustments than those without professional review.

Experts further ensure compliance by documenting every transaction with digital receipts, customer payment confirmations, and supporting records within QuickBooks. They establish clear segregation of duties—such as separating invoicing and payment approval—to minimize fraud risks. Many industries, including healthcare and government contracting, require specific documentation for receivables, and QuickBooks experts configure the system to meet these regulatory standards. Professionals from JMAccountingServices provide additional assurance through compliance checklists, automated alerts for overdue balances, and regular audit trail reviews. Their expertise guarantees that a company’s Accounts Receivable processes not only comply with federal and state accounting requirements but also remain transparent, accurate, and ready for inspection at any time.