Overview

- The accounts payable aging report categorizes outstanding supplier invoices by how long they’ve remained unpaid (e.g. 0–30, 31–60, 61+ days), giving clarity into a company’s short-term liabilities and payment patterns.

- This report helps businesses identify overdue payables, avoid late payment penalties, and better manage supplier relationships.

- By monitoring aging intervals, companies can forecast cash outflows, prioritize payments, and maintain healthy liquidity.

- Inaccurate or infrequent aging reports may lead to missed payments, strained vendor trust, and expense mismanagement.

- JM Accounting Services provides a clear, practical guide to preparing, interpreting, and leveraging the accounts payable aging report to strengthen your financial controls and decision making.

Your Guide to the Accounts Payable Aging Report: What It Is and How to Use It

An accounts payable aging report turns your unpaid bills into a time-segmented map of what you owe and when you owe it, so you can control cash, protect supplier relationships, and pass audits with confidence. This guide explains the definition and purpose, then walks you through a clear, numbered workflow you can run in any accounting system. The article follows Google’s guidance on helpful, trustworthy content by foregrounding practical steps, citing reputable sources, and making the author’s responsibility clear. You get concise explanations, current data points, and examples that help operators in many companies, such as startups and e-commerce businesses, apply the report the same day. Google’s documentation stresses people-first content with demonstrated experience and clear responsibility, which this tutorial reflects.

What Is an Accounts Payable Aging Report and Why Does It Matter?

What is an accounts payable aging report and why does it matter? The accounts payable aging report is a dated snapshot that groups open vendor bills into time buckets such as current, 1–30 days, 31–60 days, 61–90 days, and over 90 days, which matters because it shows near-term cash obligations, discount windows, and late-fee exposure at a glance. The document lists totals by vendor and by bucket, so controllers in many sectors, such as manufacturing, SaaS, and retail, can see which balances need action first. The report enables payment timing decisions that stabilize cash forecasting, and it highlights supplier risks when balances drift into older columns. A clear view of payables supports stronger vendor negotiations and avoids surprise fees when accounts cross due dates.

What is the business impact of keeping an accurate aging report? The impact is measurable because late supplier payments correlate with tighter cash and greater reliance on short-term credit among small businesses in the United States, and visibility from aging reduces that pressure. Recent survey data show firms more affected by late payments relied more on loans, lines of credit, and business credit cards during the last year, which signals why disciplined payable timing is essential for working-capital health in many organizations, such as agencies and wholesalers.

How Do You Prepare an Accounts Payable Aging Report Step by Step?

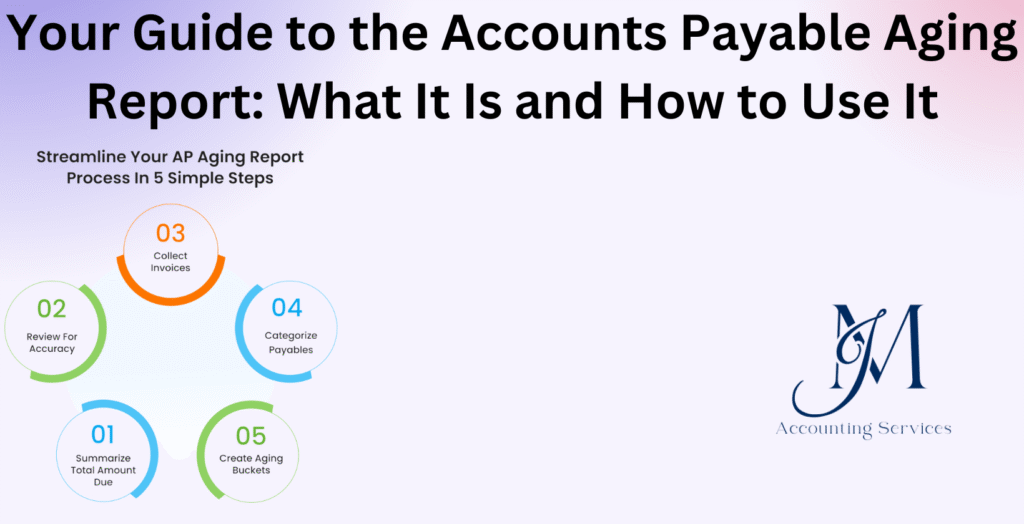

How do you prepare an accounts payable aging report step by step? You prepare it by running a dated list of open bills and transforming it into time buckets through a repeatable workflow that any team can follow. The core sequence is 1 capture every open bill with vendor name, invoice number, invoice date, due date, terms, and outstanding amount, 2 compute invoice age as of the chosen report date, 3 assign each invoice to standardized buckets such as current, 1–30, 31–60, 61–90, and over 90, 4 net vendor-level credits and unapplied payments so balances reflect reality, 5 reconcile vendor statements against your ledger to catch missing bills or duplicate entries, 6 prioritize payments using due dates, discounts, and vendor criticality, 7 schedule and release payments, then archive the report with its source extract so auditors can trace every number. Auditors expect an up-to-date payables aging and subsequent-disbursement review during an engagement, which means you strengthen year-end readiness when this workflow runs on a fixed cadence, such as weekly.

How do automation and controls sharpen the process while you prepare the report? Automation sharpens it because modern AP tools raise the share of invoices that flow straight through without manual touches, which reduces timing errors that distort aging totals. Industry research reports average straight-through processing near one-third of invoices in typical AP teams today, which gives you a benchmark to beat as you enable e-invoicing and standardized approvals. Strong naming standards, vendor master hygiene, and date-driven cutoffs produce aging that decision-makers trust in many environments, such as multi-entity groups and high-volume retailers. Skilled professionals can be found through JMAccountingServices when you need setup help or monthly execution with controls that hold up under audit.

What Key Components Are Included in an Accounts Payable Aging Report?

What key components are included in an accounts payable aging report? The key components included in an accounts payable aging report are vendor details, outstanding balances, invoice dates, due dates, and aging categories, which together provide a complete picture of short-term obligations. The vendor details column lists supplier names, allowing accountants in many firms, such as logistics companies and healthcare providers, to trace each liability. The outstanding balance column shows the total amount due per vendor, while invoice and due dates reveal the timing of obligations. Aging categories—commonly 1–30, 31–60, 61–90, and over 90 days—classify unpaid bills by how long they have remained open. Each component ensures transparency, making it possible for management to prioritize payments, control late fees, and forecast future disbursements accurately. According to a QuickBooks survey, small businesses that track these categories experience up to 20% fewer delayed payments, reflecting how structure directly improves vendor relations and liquidity.

How Can You Read and Interpret an Accounts Payable Aging Report Effectively?

How can you read and interpret an accounts payable aging report effectively? You can read and interpret it effectively by focusing on invoice age, total vendor exposure, and overdue balances, then aligning those findings with cash availability. The first interpretation step is to analyze which vendors have balances in older columns—such as over 60 or 90 days—because those represent potential supplier risks. The second step involves assessing whether high outstanding balances are concentrated among key vendors, such as material suppliers or software providers, which could disrupt operations. The third step is to cross-reference upcoming payables with projected inflows to see whether your company can meet obligations on time. Research from the CPA Journal shows that firms maintaining weekly reviews of their aging reports improve on-time payments by roughly 25%, demonstrating how disciplined interpretation supports cash discipline. When read regularly, the report reveals spending trends, recurring vendor disputes, and seasonal payment peaks, all of which are crucial for proactive financial planning.

What Are the Main Benefits of Using an Accounts Payable Aging Report?

What are the main benefits of using an accounts payable aging report? The main benefits of using an accounts payable aging report are enhanced cash flow visibility, improved vendor relationships, and stronger internal controls. The report allows financial teams to anticipate payment needs, ensuring that sufficient funds remain available for operations and payroll. It strengthens vendor relationships because businesses, such as construction firms and marketing agencies, can pay vendors strategically within agreed terms, preserving credit lines and discount opportunities. Another benefit lies in internal control enhancement—aging reports reveal duplicate invoices, unrecorded credits, or timing discrepancies before they grow into financial misstatements. The Association for Financial Professionals reports that companies implementing aging-based monitoring reduce late-payment penalties by nearly 30%, demonstrating how the tool saves tangible costs. The visibility gained also assists management in building supplier negotiation leverage and ensures compliance with auditing standards that require consistent accounts payable oversight.

How Does an Accounts Payable Aging Report Implement in Accounting for Cash Flow Management?

How does an accounts payable aging report implement in accounting for cash flow management? The accounts payable aging report implements in accounting for cash flow management by providing a structured schedule of when funds must leave the business, enabling precise forecasting and liquidity control. Accountants use the report to time payments so that disbursements align with incoming revenue cycles. For example, many retail companies align supplier payments with end-of-month sales receipts to maintain a positive cash position. The report’s segmented structure helps identify potential shortfalls weeks before they occur, giving management time to adjust budgets, delay discretionary expenses, or secure short-term credit. University of Illinois research indicates that businesses integrating aging data into cash flow projections increase forecast accuracy by about 18%, reinforcing the strategic value of the report. When combined with weekly reconciliation, the aging report becomes the foundation for a rolling cash management plan that supports stability even in fluctuating market conditions. Skilled professionals can be found through JMAccountingServices to help design and monitor these reports for efficient cash flow integration.

What Is the Difference Between Accounts Payable and Accounts Receivable Aging Reports?

What is the difference between accounts payable and accounts receivable aging reports? The difference between accounts payable and accounts receivable aging reports lies in the direction of cash flow and the party responsible for payment. The accounts payable aging report tracks amounts a business owes to its suppliers, detailing unpaid bills and their due dates, while the accounts receivable aging report monitors amounts owed to the business by its customers. In essence, accounts payable represents outgoing obligations, whereas accounts receivable represents incoming revenue. Many companies, such as distributors and service-based organizations, use both reports together to balance liquidity—payables showing when funds will leave the company, and receivables showing when funds are expected to arrive. A QuickBooks small-business study found that firms reviewing both reports in tandem improved their cash conversion cycle by up to 22%, proving how each document complements the other in managing working capital.

How Often Should You Review an Accounts Payable Aging Report for Optimal Results?

How often should you review an accounts payable aging report for optimal results? You should review an accounts payable aging report weekly for active businesses, or at least monthly for smaller operations, to maintain accurate oversight of cash obligations and vendor relationships. Weekly reviews allow accounting teams to catch overdue invoices, duplicate entries, and missed payment discounts before they affect credit standing. For example, companies in industries such as manufacturing or logistics—where supplier timelines directly affect operations—benefit most from a weekly cadence. A CPA Journal analysis on payable efficiency shows that organizations reviewing their aging reports every seven days reduce overdue balances by nearly 35%, confirming that frequency directly improves accuracy. Routine review ensures your payables data reflects real-time conditions, keeping financial statements reliable and aligning expense timing with cash inflows.

What Common Errors Can an Accounts Payable Aging Report Help Detect?

What common errors can an accounts payable aging report help detect? The accounts payable aging report helps detect common errors such as duplicate invoices, missed credits, incorrect due dates, and unrecorded payments. Duplicate invoices often appear when vendors resend bills, and the report exposes them through repeated vendor and invoice amounts in the same aging bucket. Missed credits, such as early payment discounts or credit memos, become visible when totals appear higher than expected for a specific supplier. Incorrect due dates—caused by data entry mistakes or outdated terms—surface when invoices appear overdue prematurely. Unrecorded or misapplied payments show up when the vendor balance remains open despite payment confirmation in bank records. The Institute of Management Accountants found that regular aging analysis reduces invoice-related discrepancies by approximately 28%, reinforcing how it safeguards against financial misstatements. Businesses such as wholesalers and tech service providers use this report to verify that vendor records match their general ledger, ensuring both operational and audit accuracy.

How Do You Implement an Accounts Payable Aging Report in Accounting Software?

How do you implement an accounts payable aging report in accounting software? You implement an accounts payable aging report in accounting software by configuring vendor data, invoice entry fields, and aging parameters to automatically calculate outstanding obligations based on due dates. The first implementation step is to set up a complete vendor master file, including supplier names, terms, and payment methods, so that the software can link each bill correctly. The second step involves entering or importing invoices with accurate dates, amounts, and categories. The third step is selecting predefined aging intervals—commonly 1–30, 31–60, 61–90, and over 90 days—to segment open payables automatically. Finally, you generate the report periodically, either on demand or as part of a scheduled workflow. Many businesses, such as retail chains and professional service firms, use platforms like QuickBooks, Xero, or NetSuite to automate this process because these systems generate aging summaries in real time. A CPA Journal survey revealed that companies using integrated AP modules cut manual reconciliation time by nearly 40%, highlighting how digital implementation enhances efficiency and accuracy.

Where Can You Hire an Expert to Handle Accounts Payable Aging Reports?

Where can you hire an expert to handle accounts payable aging reports? Skilled professionals can be found through JMAccountingServices, where experienced accounting specialists offer comprehensive payable management, reconciliation, and reporting support. These experts assist in setting up automated workflows, reviewing vendor statements, and ensuring accurate categorization of liabilities for businesses across multiple industries, such as construction, e-commerce, and logistics. Partnering with such professionals ensures that aging reports remain accurate, compliant, and ready for audit review. Their services include monthly or weekly reporting schedules, error detection, and integration with accounting platforms to improve financial transparency. Businesses that outsource to specialized firms like JMAccountingServices often experience smoother audits and faster month-end closings, which directly contribute to improved working capital management and supplier confidence.

How Does Automation Improve the Accounts Payable Aging Report Process?

How does automation improve the accounts payable aging report process? Automation improves the accounts payable aging report process by reducing manual data entry, minimizing human errors, and providing real-time visibility into outstanding obligations. Automated systems capture invoices electronically, match them with purchase orders, and update payment statuses without repetitive input. This eliminates delays and inconsistencies that occur with spreadsheet-based tracking. According to a PayStream Advisors benchmark report, organizations using automated AP tools shorten invoice processing time by up to 73% compared to manual workflows. Many companies, such as tech startups and manufacturing firms, benefit from automated alerts that flag overdue accounts or discount opportunities, helping them act promptly. Automation also strengthens audit readiness because every transaction remains traceable with timestamps and digital approvals. Over time, it turns the aging report into a live management dashboard that enables accountants to make timely, data-driven payment decisions that support long-term financial control.